The ECB, negative rates, and the Swiss experience

Ahead of tomorrow’s ECB monetary policy meeting, the market has high expectations of rates being cut further into negative territory (consensus is a cut in the deposit rate by 10 to 20 bps). However, a report this week from the Bank for International Settlements (BIS) suggests that cutting rates further could be counterproductive and damaging for the banking sector.

The BIS’s quarterly review, points out that negative policy rates either don’t work in lowering borrowing costs for households and businesses, in which case why bother cutting; or they are passed on in loan rates, which means they must be passed on to depositors too, otherwise bank profits will fall. And if they are passed on to depositors there will be a risk of cash fleeing the banking system, which is another undesirable outcome. The paper did acknowledge that there was one potential transmission mechanism of further rate cuts without such consequences for the Eurozone – euro depreciation might be desirable, although that comes with geopolitical (currency wars) implications.

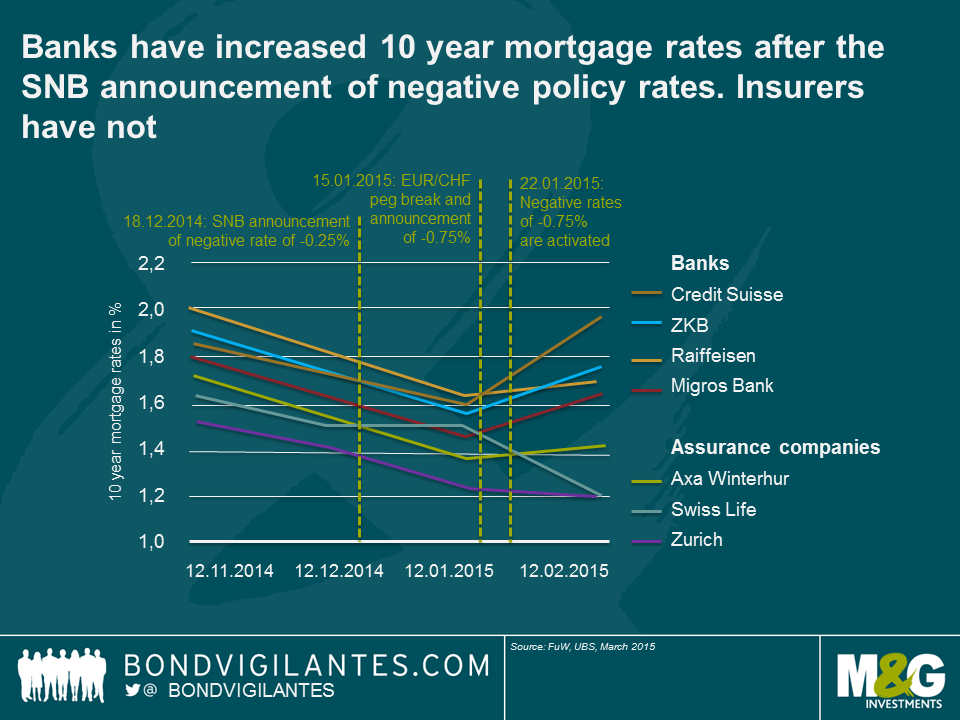

The Swiss experience with negative rates demonstrates clearly that negative rates have direct consequences for banks and can actually lead to tightening credit standards. A note published by UBS a year ago deserves attention as it shows that 10 year mortgage rates for bank clients have actually risen after the SNB has lowered its deposit rate into negative territory.

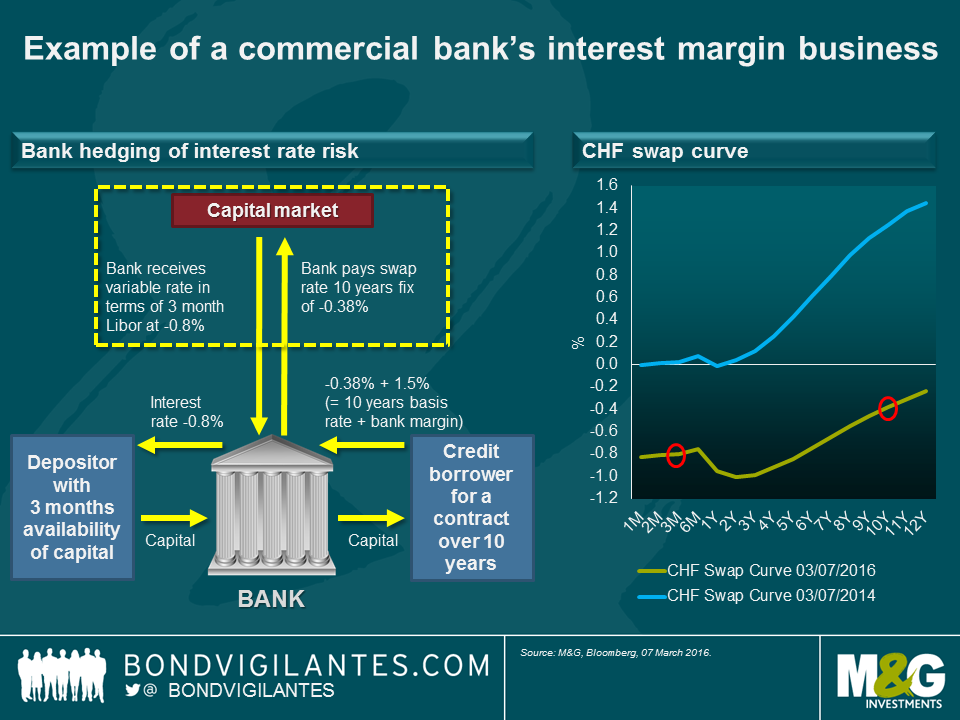

Let’s use a simplified example to illustrate a commercial bank’s interest margin business. A major task of a bank is to act as an intermediary of money. Depositors provide their money to the bank on a short term basis, for example, via savings accounts, whereas many investments require longer-term financial commitments. This process is called maturity transformation, which exposes banks to certain risks, one of which is interest rate risk. Imagine interest rates go up significantly. Savers will demand a higher rate on their savings account, but the bank has agreed a mortgage rate of 1.12% for the next 10 years, as illustrated in the example, which then would have a direct negative impact on the bank’s margin.

Fortunately, there is a capital market to hedge out the interest rate risk. Looking at the current Swiss swap curve, the bank in our example could hedge their interest rate risk by paying away the 10 year fixed part of the curve (-0.38%) to receive a variable rate, which is currently even more negative at -0.8%. In a negative interest rate environment however this process faces a problem. Banks cannot pass on the negative interest rate of -0.8% to their depositors as there is the immediate danger that savers withdraw their money and store it somewhere else, as I wrote in a recent blog.

So what can Banks do?

Either

- They accept a smaller margin, which affects their profitability

- They don’t hedge the mismatch between maturities of the assets and liabilities, which would expose them to even higher profitability risks if interest rates go up quickly

- They hedge the interest rate risk and at the same time try to increase their margin via other revenue streams

The latter point is what happened in Switzerland according to the 2015 UBS report. After the SNB’s announcement of negative rates of -0.75% in January 2015, the price for a 10 year mortgage offered by Swiss banks increased. So the banks have increased their margin on long term mortgages to offset the increasingly negative rates on deposits, which equals credit tightening. In other words, mortgage borrowers are subsidising depositors. Assuming banks have also increased their margin on corporate loans as a result of negative rates it would likely weaken economic growth instead of accelerating it.

Swiss assurance companies offer mortgages for clients too, which complicates the situation for banks even more. As UBS points out, insurers have not been forced to increase their margin like banks did, as their deposits are usually long term investments, e.g. a life insurance contract over 10 years. The chart above shows quite nicely that the relative competiveness of insurers’ mortgage offerings has improved compared to banks since the SNB introduced negative policy rates. However, the mortgage business is not a core business for assurance companies, so we can assume they have less information about their borrowers and less extensive credit assessments compared to banks, which according to UBS increases the risk of capital misallocation and higher credit defaults going forward.

Draghi faces a dilemma. Too big a cut of the already negative deposit rates could be perceived negatively by the market as damaging for bank profitability and thus the transmission mechanism to the real economy. He has to live up to his promise of bringing inflation back without breaking the very system that – in the absence of fiscal easing – is needed to spur European companies and households in to growth.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox