Three things to watch as the Czech National Bank removes its FX floor later this year

For over 3 years, the Czech National Bank (CNB) has maintained the Czech Koruna (CZK) exchange rate close to 27 CZK to the Euro (EUR), essentially using its currency – as opposed to interest rates – as the policy tool to achieve its inflation target. Earlier this month however, the CNB advised that this strategy would be exited “around the middle of 2017”. Though the timing remains ambiguous (they previously stated that the cap would be exited “in mid-2017”), the message is clear: the removal of the FX floor is looming and how the market responds will be of interest.

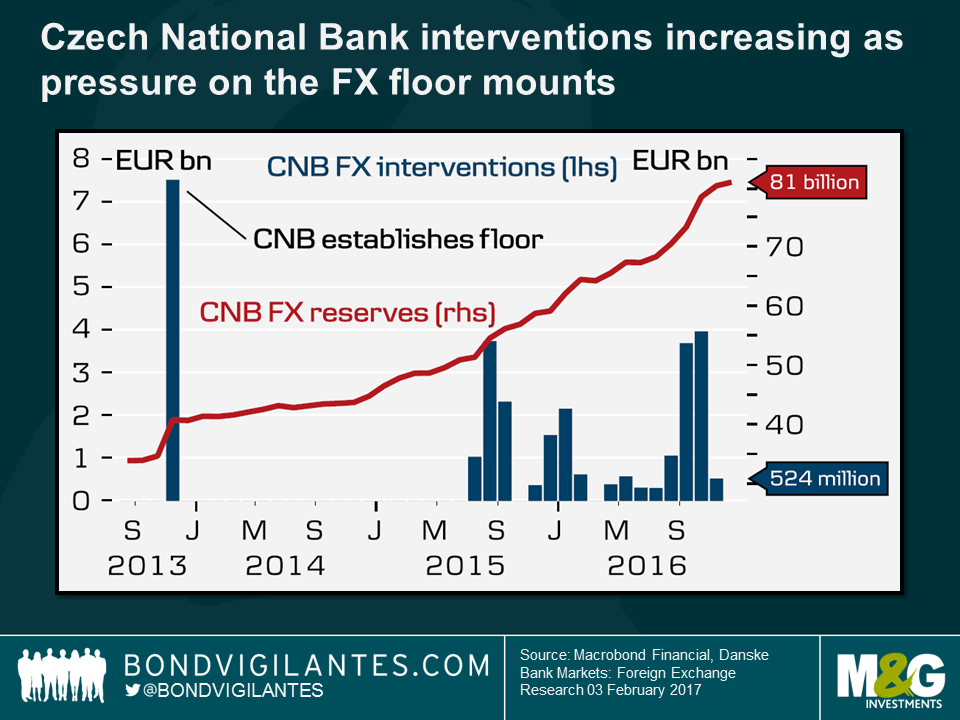

The EURCZK cap was first introduced in November 2013 after a short period of CZK appreciation. Since the Czech Republic is an export driven economy which is highly dependent on trade with countries in Europe (particularly Germany), the policy subsequently served as an effective way to weaken the currency, ensuring its competitiveness with its main trading partners whilst easing monetary conditions domestically. It’s regarded as a floor as the target is asymmetric; the CNB will not allow the currency to appreciate markedly from the aforementioned level, obliging them to intervene (i.e. by selling CZK and buying EUR) in the currency markets in order to maintain the strategy. Given this, CNB EUR reserves have more than doubled over the duration of the programme, with the size and frequency of interventions increasing in recent months as currency speculators have entered the market, upping the pressure on this managed floor.

The floor was introduced to ease monetary policy; the removal will be used to tighten it.

With an inflation target of 2% (plus or minus 1%), CPI had been outside of this range since early 2014. The October reading garnered attention however when it fell within the CNB’s tolerance band, which was sustained through November. What was particularly surprising was that the 2% target was reached in December – something that the CNB wasn’t expecting to achieve until Q3 2017. On Friday CPI surprised to the upside once again, this time hitting 2.2%. The rise was largely due to higher food prices as well as base effects kicking in from the unwinding of the year-on-year fall in fuel prices. Encouragingly, core inflation (which excludes oil) also increased, while wages are expected to continue to remain on an upward trajectory. This rise in domestically driven inflation, alongside an expectation of some externally imported inflation (the economic development of the Eurozone is significant, due to the trading links and thus the potential for spillovers from the growth in industrial producer prices) feels as though the previously high hurdle for the removal of the FX floor has been lowered. Cue the currency speculators.

Given the FX floor, the CZK has perhaps been kept artificially low, leading many to surmise that the removal of the floor will lead to significant currency appreciation. Speculators should however be mindful of three key points.

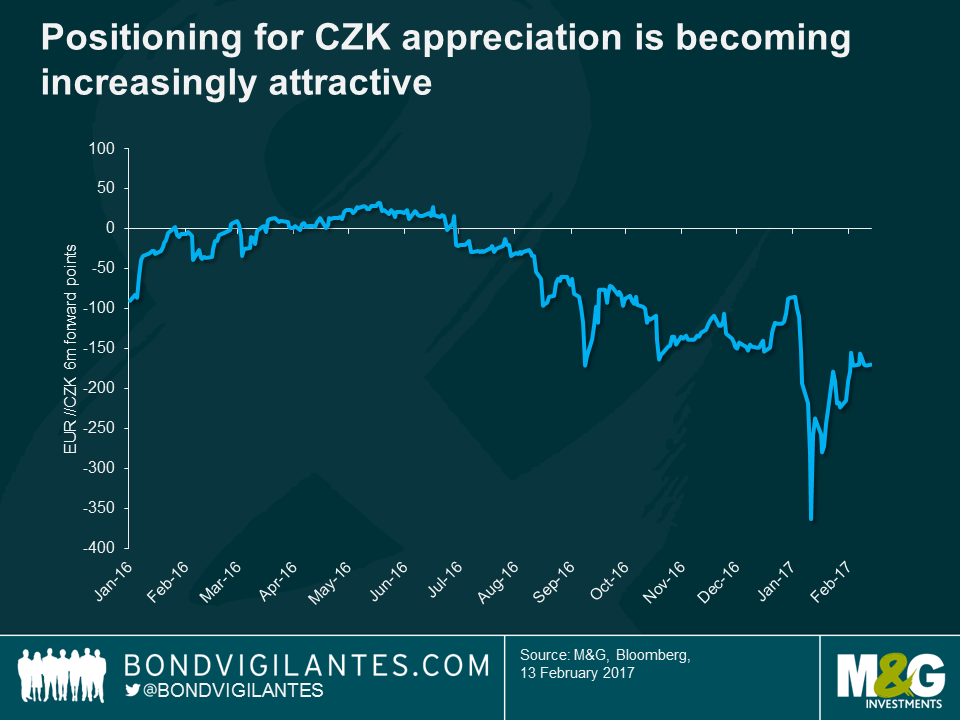

- Negative rates. Given that interest rates are negative in the Czech Republic, this is a negative carry trade, which could potentially make holding the position quite painful – particularly if the CNB decide to extend the removal date. Nevertheless, the 6m forward points have moved significantly since January, indicating that positioning for CZK appreciation is becoming increasingly attractive.

- The CNB’s reaction. This will be of considerable interest. Given that the Czech Republic is an economy dependent on its exports, the CNB would not want to damage its competitiveness and would surely intervene against any sustained appreciation. At the moment, the current CNB strategy states that they would not permit appreciation beyond the level at which they intervened (approx. EURCZK 25.7). If we assume this approach is upheld after the removal of the peg – which I think is credible – this represents a 4.8% appreciation from the current FX floor at EURCZK 27, so there is definitely some potential upside in the trade.

- Speculators may all rush for the door. The last point highlighted the potential appreciation from the removal of the FX floor, but what happens if lots of investors are positioned similarly and they all rush for the door, in order to lock in the profit? Those speculators long CKZ would want to sell and buy EUR to close the position. Lots of trades in the same direction however would cause the CZK to depreciate which would erode the gain on the trade (alongside the negative rates).

The inflation numbers from Friday exceeded expectation, which may further encourage buying of CZK, as investors anticipate the removal of the FX floor. However, I have struggled to find a forecast which predicts appreciation significantly in excess of the EURCZK 25.7 level discussed; which is perhaps testament to the credibility of the CNB. What will happen when they remove the floor? Time will tell.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox