Beware of the debt binge

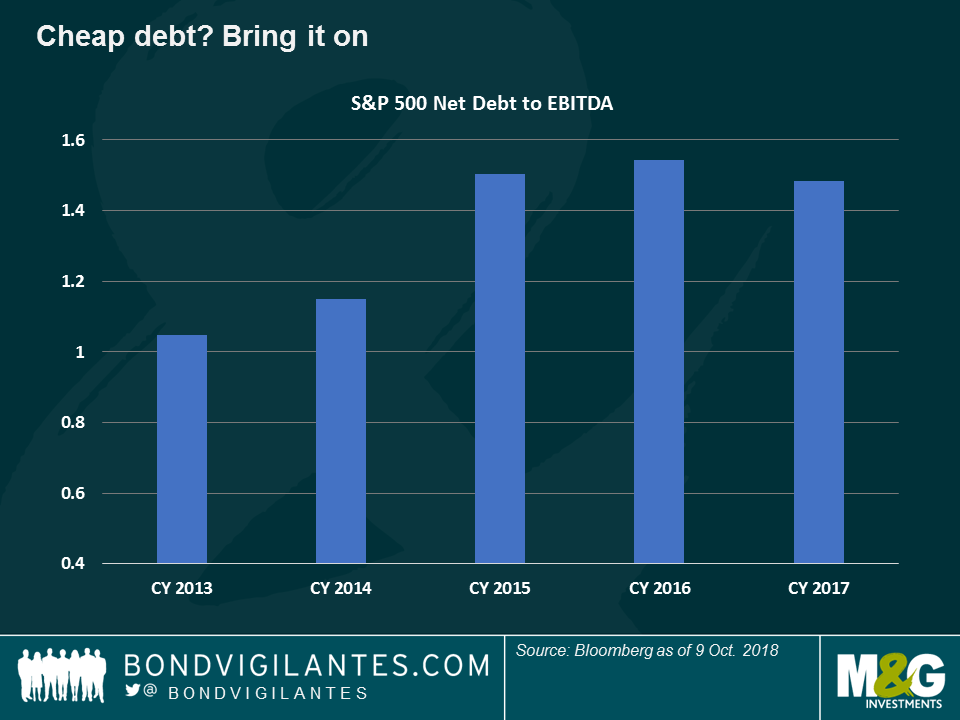

A decade of low interest rates has given companies, governments and households an excellent opportunity to cheerfully load up debt – until now. As interest rates rise and are projected to continue to do so in most major economies over the next three years, higher interest costs may soon send a stark reminder that there is no such thing as a free lunch.

Highly indebted companies are most at risk and investors should therefore expect less onerous dividend policies as well as fewer share buy-backs going ahead. As a telling example, let’s look at Iqvia Holdings Inc., a US Information and Technology service provider to the Pharmaceutical and Healthcare industries: it has returned $5.4bn to shareholders via share buy-backs from 2014 to 2017, and it has plans to do another $1.25bn buy-back in 2018; this has happened while gross debt has substantially increased from $6.3bn in 2013 (full year) to $10.7bn just in the first half of 2018. Will the company be able to continue its generous buy-back programme once debt becomes more expensive?

Fewer buy-backs may not be the only concern ahead: equity holders may also see share prices negatively affected as fewer buy-back action erodes demand. Cheap debt has helped companies go on such a buy-back spree that any reduction may leave companies without one of their biggest and most recent buyers: themselves.

The end of the low-rate decade could also challenge credit quality. Let’s look at UK pharmaceutical giant AstraZeneca Plc, recently downgraded by Fitch to BBB+ from A-. The move followed a similar rating action by S&P in July 2017. No wonder why: as seen on the chart, the company’s leverage ratio has increased and Free Cash Flows have remained negative, but the company hasn’t changed its generous dividend pay-out. This has been welcomed by investors, as seen on the share price line (green).

Investors may start paying more attention to Free Cash Flows (FCF) from now on, as higher rates start eating into one of the most truthful measures of corporate performance. US telecom giant AT&T, for instance, has $190bn of gross debt on its balance sheet: if borrowing rates increase by 50 basis points (bps), its present $10bn FCF would decrease by 10%. And if rates rise by 100 bps, about $2bn would be wiped off from its cash flows.

In Europe, borrowing costs are expected to increase as the European Central Bank (ECB) plans to end its asset purchase programme by the end of this year. This could hurt businesses whose debt has been included in the scheme as those bonds have benefited greatly from it. For example, Spain’s Telefonica has euro-denominated debt maturing in 2027 currently yielding 1.8%, far less than its US dollar denominated bonds, which have the same maturity but yield a much higher 4.8%. As the ECB starts tapering its programme, European rates may start rising, narrowing the difference with the dollar-denominated debt.

The so-called “Potential Fallen Angels” – or companies with a BBB / Baa rating, the lowest Investment Grade rank – could be particularly sensitive to higher rates, as any downgrade might send them to the Non-Investment Grade universe, where borrowing costs are significantly higher. This is especially worrisome, as this specific rating bracket has grown over the past few years: in the US, Baa-rated companies accounted for about one third of the Investment Grade universe one decade ago – they are almost half now, as seen on the chart:

Equity investors should beware, especially because they often overlook Non-IG (or High Yield) companies’ restrictions on shareholder returns: for example, German cable operator TeleColumbus is not allowed to pay dividends or buy back shares unless its leverage ratio is less than 4.5 times EBITDA. Similarly, UK telecoms firm TalkTalk will have to stop its dividend because its covenants require a maximum leverage level of 2.75 times (EBITDA), less that the present expected level of 3.1 times next year.

Where does this all leave us?

With the US Federal Reserve signalling more rate hikes and the ECB on pre-tightening mode, it is paramount to look at balance sheets in detail, and reasonable to favour companies with a low debt profile as they should be more resilient in a rate rising environment. Financials, for instance, have not only strengthened their balance sheets and reduced their risk profiles, but they should also benefit from rising rates, as they can usually charge higher interest to clients. Click here for a short video on the prospects of US and European banks – and beware of the debt binge!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.