Emerging Market High Yield: is there value after the sell-off?

The ongoing financial meltdown in Turkey, increasing risks of more US sanctions on Russia and a repricing of China High Yield (HY) bonds – on the back of higher defaults and increased trade war tensions -, have all resulted in a significant widening of Emerging Market (EM) HY corporate credit spreads. Investors are now getting paid 525 basis points (bps) over US Treasuries for investing in EM “junk” bonds, that is 170 bps more than at the end of April 2018. Are these levels attractive enough for global and EM- bond investors?

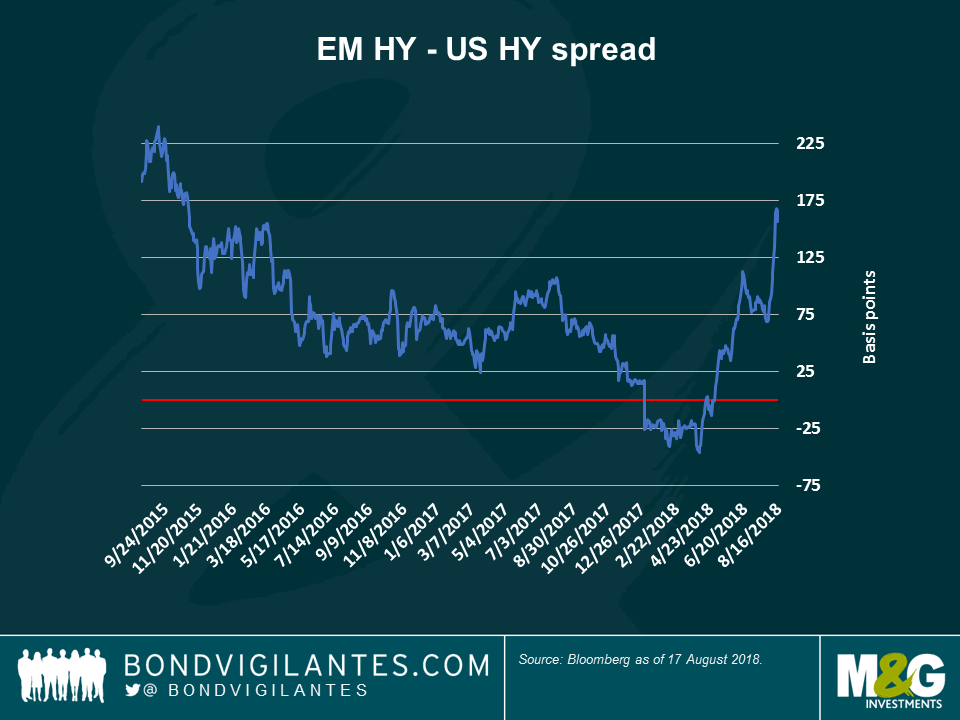

On a relative basis the premium over US HY seems attractive: the widening of EM HY spreads in recent weeks has been significant, especially relative to the resilience of US HY: EM now offers a premium of more than 160 bps over US HY (Figure 1), when it was trading below its US counterpart only earlier this year – such levels, however, may not have reflected the true fundamentals. Now, if we look over the past three years, current EM spreads relative to US HY, of 167 bps, look attractive as they are substantially above a three-year average of 75 bps.

Corporate fundamentals continue to stabilise

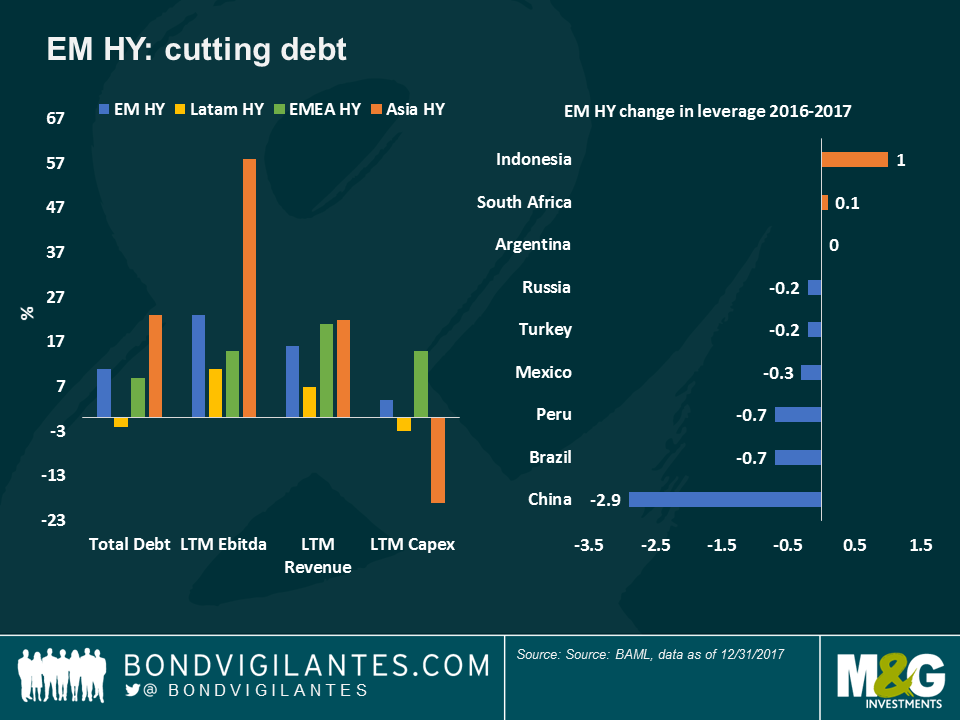

These levels could be a good entry point also because fundamentals have stabilised or improved: between 2008 and 2016, global EM HY debt levels sharply rose, fuelled by global monetary stimulus and the availability of cheap US dollar funding. In 2016, companies’ leverage had risen to 5 times EBITDA, up from 2 times just before the 2007-08 financial crisis. However, EM corporate debt levels stabilised about two years ago, due to better, synchronised global growth, a rebound in commodity prices and forced financial discipline, which led to lower capital investment. The return to higher earnings in the past 18 months, together with low default rates of 2-3% in EM HY, eventually helped corporate bond issuers reduce leverage, to 4.3x by the end of 2017 (Figure 2). In China, for instance, leverage levels fell 2.9x last year, although it still remains considerable at 7.7x.

Trade war risks are on the rise…

M&G fund manager Claudia Calich has recently written about EM vulnerability to trade wars. While trade tensions or geopolitical risks rarely disrupt businesses’ operations overnight, the first and most common channel of contagion of macro risk to corporates is via foreign exchange (FX). By their very nature, HY companies run more debt/earnings FX mismatch than Investment Grade issuers. This makes them more vulnerable to a falling local currency, as this increases the cost of servicing foreign-denominated debt. For example, following the recent Turkish lira collapse, some Turkish borrowers may be unable to meet their foreign-denominated obligations, which account for over a third of the country’s banking sector lending.

The increased geopolitical risks over the past 12 months therefore have real implications for corporate bond fundamentals. In addition, the end of monetary easing by leading central banks, combined with higher US and Libor rates is likely to add some more pressure on the weakest credits with short-term US dollar refinancing needs.

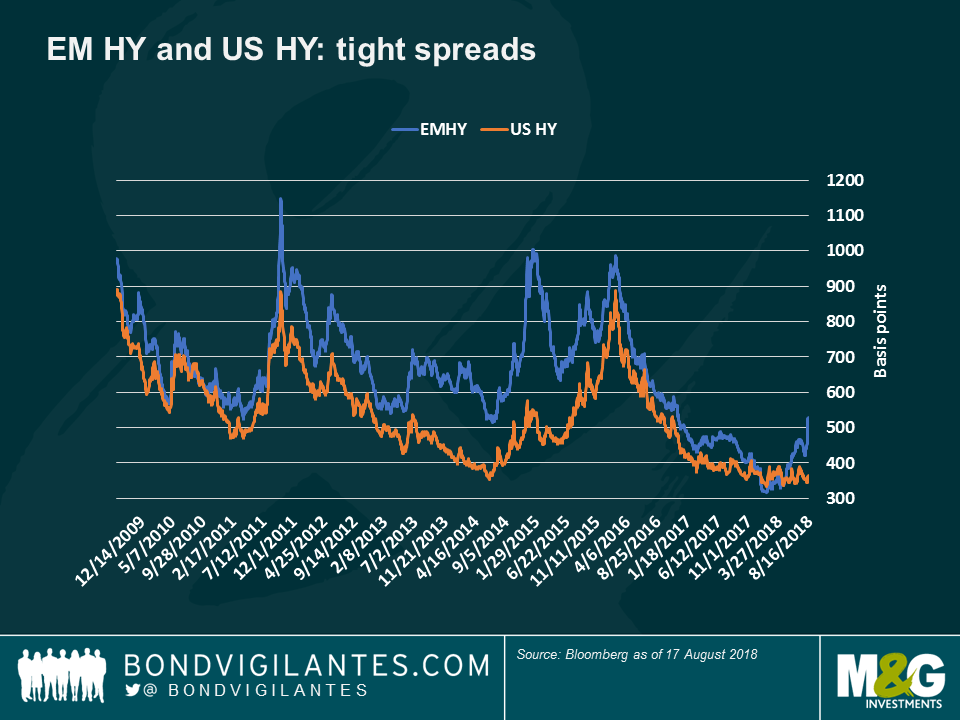

Whilst EM HY looks more attractive versus US HY than six months ago, credit spread valuations of both asset classes arguably look extremely tight since the Global Financial Crisis (Figure 3), and this is particularly true for US HY: the current 358 bps spread above US Treasury yields is substantially below a 9-year average of 532 bps. Because of the correlation between the two asset classes, I believe that if US HY spreads were to widen, EM HY should also widen to maintain a minimum premium over the US. More importantly, EM HY could also have idiosyncratic reasons to widen on its own, given the present historically tight spreads, macro noise contagion risk and vulnerability to rising US interest rates. EM HY credit spreads look even tighter if we exclude Turkey (average spreads of about 700 bps), which accounts for over 8% of the BAML EM HY index: without Turkey, EM HY spreads would be closer to 500 bps, less than the current 525 bps.

Pockets of value

Despite the recent repricing, and given the still tight market levels, I think that there could be better entry points in EM HY. Fortunately, the universe continues to offer many opportunities through either credit-specific stories or unduly punished areas of the market. For instance, we identified good opportunities in China HY, for the first time in four years, following the significant repricing of Asia HY credit: the imbalance between decent corporate fundamentals and macro concerns about the US-China trade war have made Chinese HY more attractive. Elsewhere, we also favour quasi-sovereign issuers whose stronger fundamentals are still not fully reflected by public credit ratings, especially in the Oil & Gas segment. Given this environment, I expect credit selection to be increasingly critical in EM HY.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox