The euro and the dollar: rates not driving performance. So what is?

Despite US rate hikes in December, March and another last week, the US dollar has depreciated back to pre-election levels. All of the Trumpflation dollar premium has disappeared. As the Trump dollar trade appears to have run out of steam, the Euro has however been climbing. Optimism around the Euro area growth comeback grew leading up to the ECB meeting earlier this month, with EUR/USD hitting an 8-month high at 1.13, despite Draghi delivering a decidedly dovish statement (with many now questioning their assumed timelines for policy normalisation via tapering and eventual rate hikes).

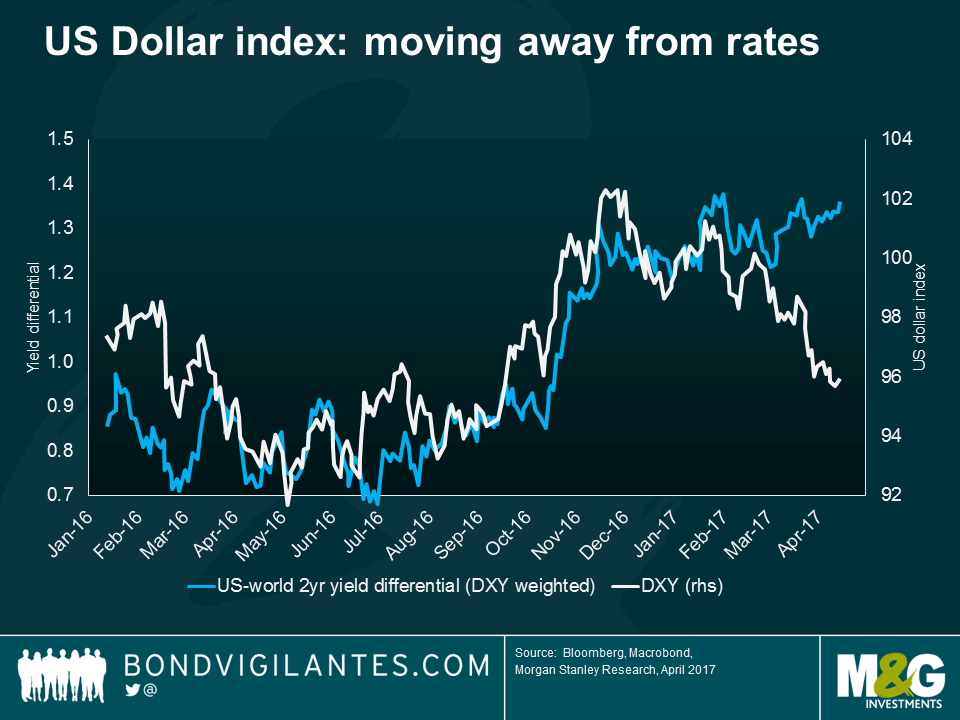

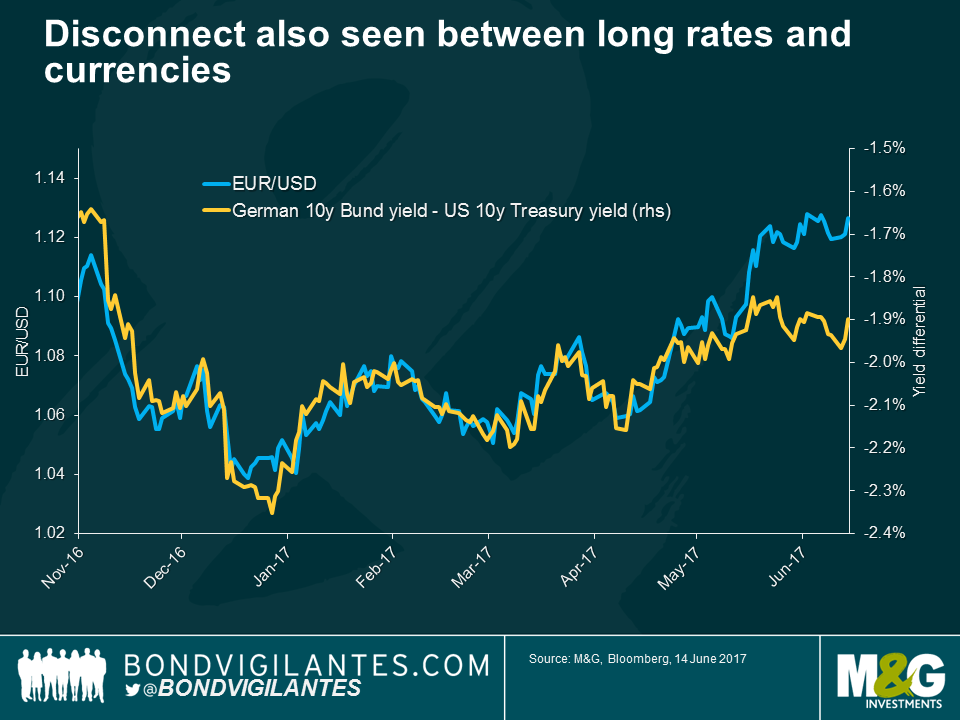

What’s been interesting about these recent currency moves is that the relative outperformance of the euro has not been driven by rising interest rate expectations for the euro zone’s currency bloc relative to rates in the US. In fact the opposite has been happening. The two charts below show that the recent trend has been for US rate expectations to be stable or rising compared with its major trading partners, and yet the dollar has underperformed sharply despite this rate divergence.

So if rate differentials aren’t driving the dollar and the euro at the moment, what is? Firstly the Citi FX positioning survey suggests that whilst investors had been heavily overweight the US dollar and underweight the euro in 2016, there has been a reversal in this positioning. A large short position amongst investors and speculators can cause significant upwards price corrections on relatively small changes in fundamental outlook, as short covering takes place.

Perhaps most importantly, the fundamental valuation of the euro has also supported its rally. Looking at Purchasing Power Parity (PPP), the euro looks to be almost 20% “cheap” to its fundamental value against the US dollar. Now that the economic data has started to come in stronger, and ahead of expectations in the euro area, and the political uncertainty surrounding elections in France, the Netherlands and elsewhere has diminished substantially, this big undervaluation has suddenly been noticed.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox