IMF/World Bank Autumn meeting notes

Recently Claudia and I were in Lima for the annual meetings of the IMF and World Bank. Unsurprisingly (given the host nation and history of the meetings) the majority of sessions were on the developing world, in particular Latin America. Claudia will shortly be posting a series of more detailed blogs on the LATAM countries she visited, so I’ll focus more globally.

In aggregate, the IMF is predicting global growth this year to be slightly lower (at 3.1%) than last, and then strengthen to 3.6% in 2016. Within this, they are expecting a pickup in developed world growth while the developing world will slow. The IMF give a number of factors as to why the developing world is slowing, but by far the most discussed was the impact of what is happening in China.

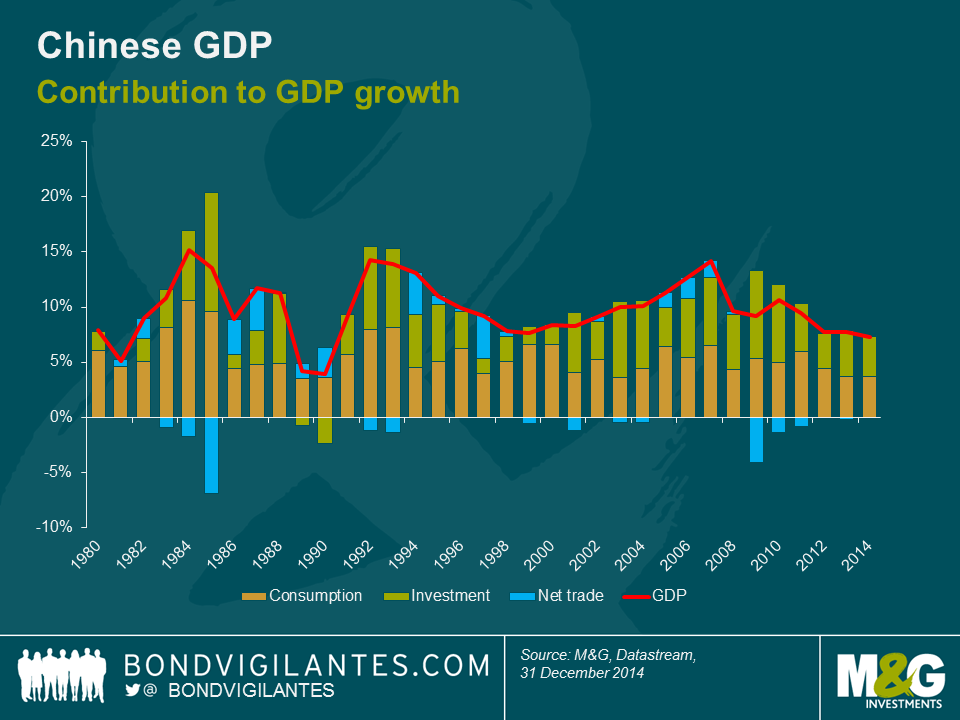

Chinese growth is slowing, but the growth projections for this year and next are still 6.8% and 6.3% respectively. Other than India, you would be hard pushed to find a large country with higher predicted growth rates anywhere in the rest of the world. The real story is how that growth will be achieved. China appears to be moving from an investment/construction led economy (which needs a lot of imported raw materials to continue to grow) to one in which domestic demand and consumption play a larger role in economic growth (something we have highlighted in the past here and here).

It was highly likely that this shift was going to happen at some point – the growing middle class were bound to start enjoying the increased wealth they have accumulated sooner or later. Anyone who has visited a shopping mall in Beijing in the past couple of years couldn’t fail to notice the proliferation of high end boutiques – I struggled to find a tie that cost less than £100 when I was there last year.

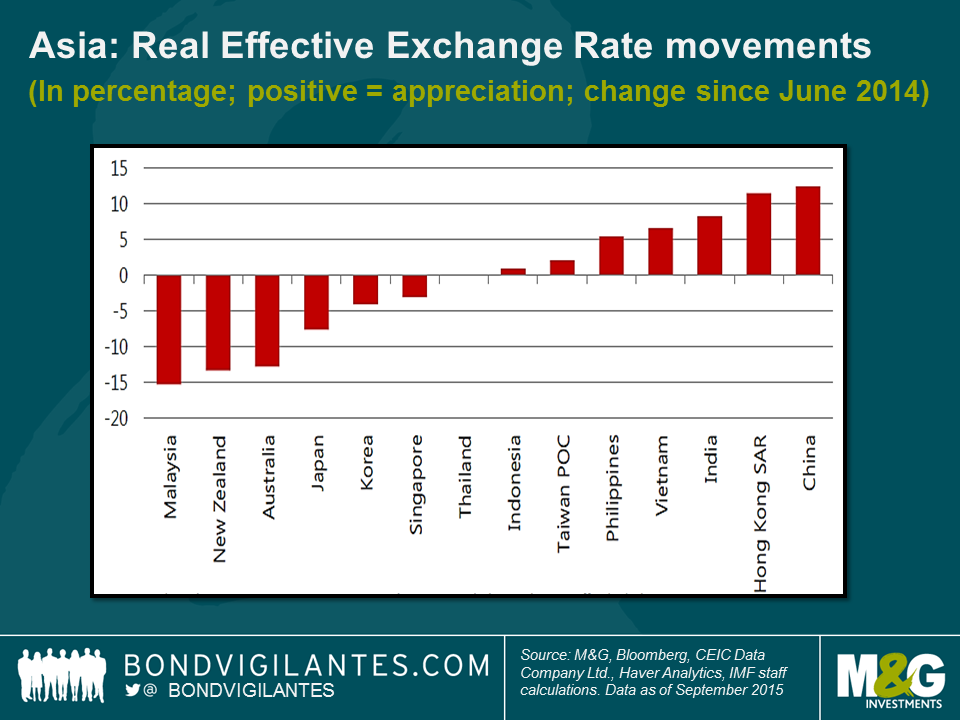

The effects of lower Chinese import demand have been felt most acutely in other parts of Asia and in South America countries which rely on commodity exports for a large part of their revenues.

The IMF acknowledged that these “spill over” effects on Asia were larger than they had expected, and since the old export led growth strategies had run out of steam, Asia would need to find new engines of economic growth. Whilst the depreciation of some of the region’s currencies has been “appropriate and helpful”, more needs to be done. They recommend that governments in the region work hard to improve infrastructure, increase labour market flexibility and strengthen the rule of law.

Regarding Latin America, my main takeaway was that weaker global commodity demand and the spectre of higher inflation could lead some previously well performing countries into a period of stagflation. Left unaddressed current account deficits, political populism and poor productivity could lead to problems for more countries in the region than just those where they are already sadly apparent.

Sessions on the US and Europe were few and far between which I take to be rather positive. I should point out that these meetings have traditionally been EM focussed so maybe one shouldn’t expect too much time devoted to developed market issues. However, if there are major problems in the developed world they tend to elbow their way into the discussions – I was told that Greece was the main topic of conversation at the spring round of meetings, for example.

All the sessions I attended on the US were dominated by the upcoming presidential election and the various candidates currently vying for the support of their respective parties. The general sense that I got was that the economy is ticking along nicely, most people were bored of predicting the timing of a Fed hike and therefore there wasn’t really very much to talk about.

Over in Europe, the feeling was that a lot of the recent drivers of volatility have receded for the time being – the situations in Greece and Russia/Ukraine are less of a risk now than they were before. I’m not sure I necessarily agree that the risk of something bad happening has decreased, but I think it’s certainly true that the market seems to be less focussed on the risks than it was.

The risks the IMF did highlight for Europe were (again) slowing demand from China and the relatively high levels of non-performing loans (NPL’s) that are still on banks’ balance sheets. They went as far to say that the recent economic recovery is unlikely to last more than 18 months if the NPL issue isn’t resolved. They believe that we are likely to see more QE from the ECB, and that European QE has been more effective than the US or Japanese versions as the term premium there fell a lot more. On a slightly brighter note; the increased participation rate in the labour market means that the 10% unemployment rate isn’t as gloomy as it may first appear. They also suggested that there is a need for structural reform in the Eurozone as potential growth is too low.

I appreciate I have painted some pretty broad strokes and that within each economic area there are countries that face totally different challenges and opportunities. There were some common themes that ran through my entire trip, however. Structural reform and improved productivity are pretty much universally necessary across the globe, and that the changes that are happening in China are here to stay. That said, I agreed with Christine Lagarde – the Managing Director of the IMF – when she said that the changes in the Chinese economy are healthy, and in the longer run will prove to be positive for the rest of the world too.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox