Emerging market debt: 2021 review and 2022 outlook

Emerging market debt faced a difficult year in 2021. Will 2022 be any better?

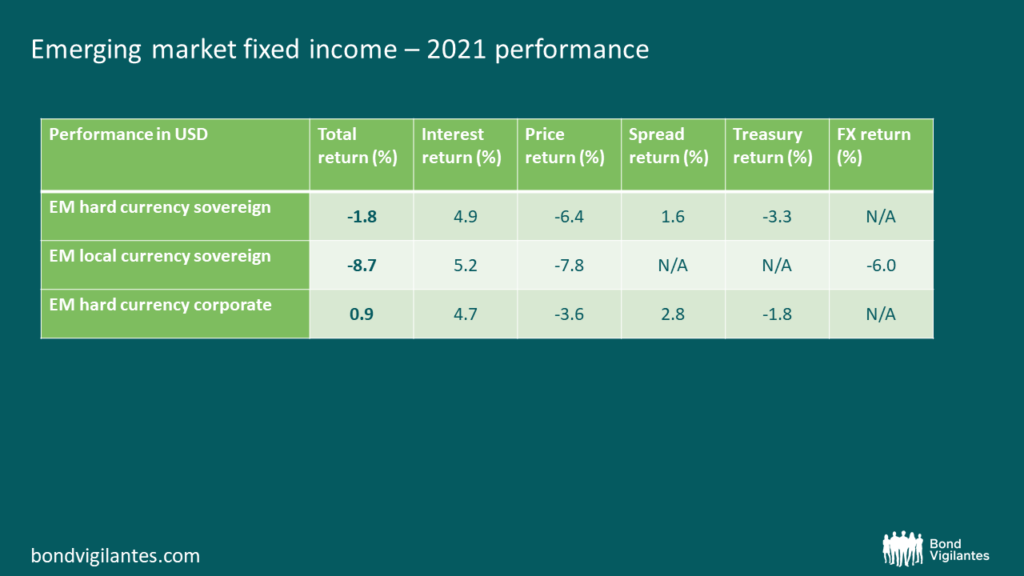

The sovereign debt asset class delivered negative returns in 2021 – particularly local markets, which suffered from a double whammy of both currency depreciation and higher rates. Corporates fared better as the credit quality of the index is higher than the sovereign index, notwithstanding specific sectorial problems (e.g. China real estate).

Several factors that led to the poor performance of EM in 2021 may not be repeated in 2022, but there are still several drivers to be mindful of:

Source: M&G, Bloomberg (31 December 2021).

1) Inflation

A big surprise for 2021. A combination of demand-side recovery, fiscal stimulus, supply-side bottlenecks, labour shortages, currency depreciation in some cases and the very easy monetary stance of most central banks in the earlier part of the year led to inflationary pressures. Within emerging markets, Asia fared all right but most other countries did not. While the debate over how permanent this shock is rages on in developed markets (DM), we believe that it is more transitory in EM for the following reasons:

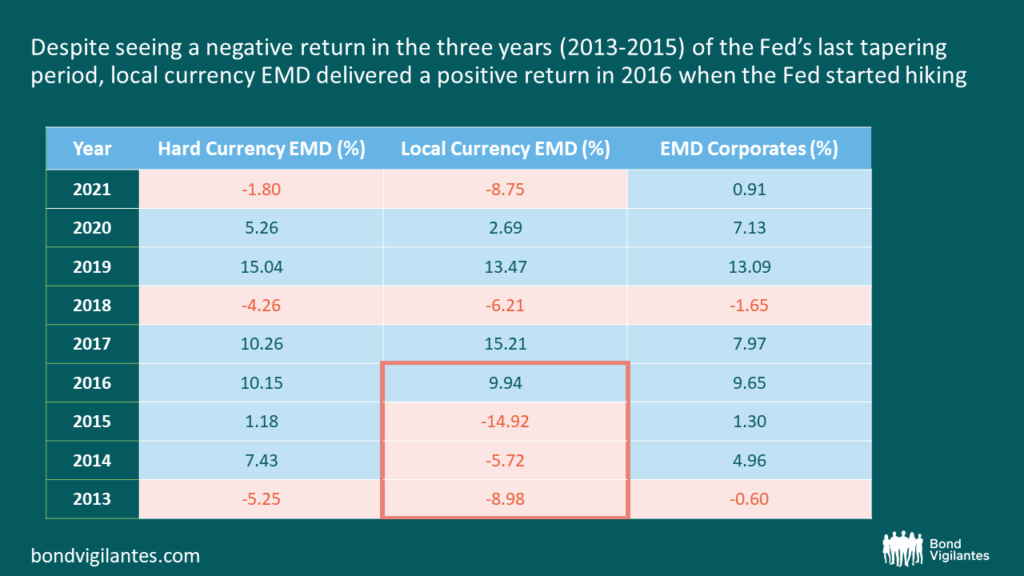

Expectations of tighter Fed policy have contributed to the outperformance of the dollar vs EM currencies and other major currencies in 2021. The better growth differential between DM and EM, as well as lacklustre capital flows into EM fixed income and broader EM assets were also drivers. In fact, many EM currencies depreciated vs the USD despite their central bank’s tightening and improved current account receipts (driven for example by higher commodity prices). This happened too before the Fed’s most recent tightening cycle. During that cycle, the EM local currency index posted negative returns for three years (2013-2015) during the taper period, but actually delivered a positive return in 2016 when the Fed started raising rates. It is a common misperception that EM FX fares poorly when the Fed tightens. In fact, they tend to depreciate in advance so that, by the time the Fed starts moving, they actually tend to perform relatively well.

Source: JP Morgan, 31 December 2021.

Additionally, most EM FX are fundamentally cheaper now than they were in that period (many were overvalued back then) and EM current account imbalances are far smaller – in many cases, they are actually in a surplus. For this reason we believe that, unless the Fed needs to hike by more than that which is reflected by the Fed’s recent dot plot estimates (three hikes for 2022, with hikes continuing into 2024), EM local markets should fare better in 2022. This is likely to be driven more by the currency side than by rates, as there is still very limited scope for rate cuts given the Fed’s tightening stance.

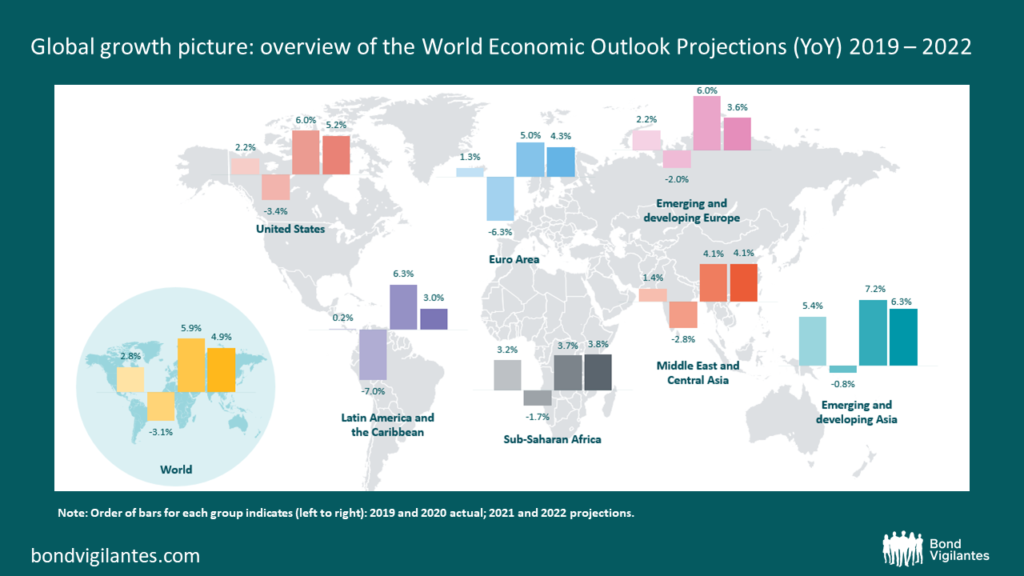

With less fiscal and monetary stimulus, inflation eroding purchasing power and the world still battling Covid-19 (Omicron now and possible other variants next), global growth is poised to slow in 2022. If anything, the projections below will probably be revised down in the coming months, once we have more information on the impact of Omicron. While a small headwind, we are far from a 2020-style recession. China will see a decline, but has started easing policy though RRR (reserve requirement ratio) cuts and – should it decide to do so – has scope to provide selective support to the real estate sector.

Source: M&G, IMF World Economic Outlook , October 2021 (latest data available).

The perennial wildcard. Potential flare-ups include Russia vs the West and Ukraine and more US-China tensions. These are low probability but high impact events which are not priced in. In terms of elections and scheduled events, Q4 will be particularly noteworthy. The China Party congress will take place in Q4, as will the midterm US elections. The most important EM election from a market standpoint will be Brazil in Q4, where there is scope to cater to a large centrist electorate that is not happy with the alternatives so far (Bolsonaro vs Lula). Latin America remains deeply divided in many countries and the administrations in Chile and Peru will need to navigate a delicate balance. In Turkey, it is unclear if Erdogan will call for early elections before 2023. The country’s ongoing departure from orthodox policies remains concerning, but fortunately it is not causing significant contagion across asset prices outside Turkey itself.

While sentiment towards EM debt was too bullish a year ago, it has now moved to the bearish camp, which could be a bullish sign in itself. Valuations have improved, particularly in EM local debt (FX and, to a lesser extent, rates) and select high yielders. Investment grade spreads, on the other hand, remain expensive and provide no cushion against higher US yields. Outside China HY, corporate defaults are expected to remain in their typical range as some deleveraging and/or liability management has taken place in 2021, commodity prices are higher and growth, even if it disappoints, is unlikely to cause a recession in 2022. Even within China real estate (which has seen a few defaults already with more to come) the contagion was rather small. If anything, China local markets were among the top performers in 2021 (CNY even appreciated vs the USD) on the back of strong current account and capital account restrictions. Local rates behaved as safe-assets as the bulk of holders are still domestic investors and so, with a backdrop of low inflation, they managed to outperform too. It is also quite remarkable that, despite the severe sell-off of the sector, the CEMBI corporate index posted a positive return in 2021, reflecting its well-diversified composition in terms of countries and sectors, and with an investment grade average credit rating. Sovereign debt restructurings could include Sri Lanka, El Salvador and Ethiopia, but none is systemic enough to cause contagion.

Conclusion Overall we are less worried about EM inflation in 2022, and selectively bullish on EM currencies with strong external accounts or where inflation may soon be peaking. Despite being more cautious on growth, we favour HY vs IG but recognize the tail risks within this segment – as always, differentiation is key. In 2021 for example, we saw -30% returns for El Salvador and Ethiopia and even worse within the China property space, but distressed credits may also surprise on the upside, like Zambia (+50%). Our bias is to add local exposure and tactically manage the HY component by bottom-up country and credit selection and position sizing.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.