EM debt in 2022: what investors really think

I recently attended an Emerging Markets debt conference, which provided some time away from the daily headlines on the terrible Russia/Ukraine situation to see how companies elsewhere are faring and how investors view the outlook for 2022. With the trauma of the war in Ukraine rightly in everyone’s minds, we must also be aware of events in the rest of the world which could prove to be key drivers of investment performance this year.

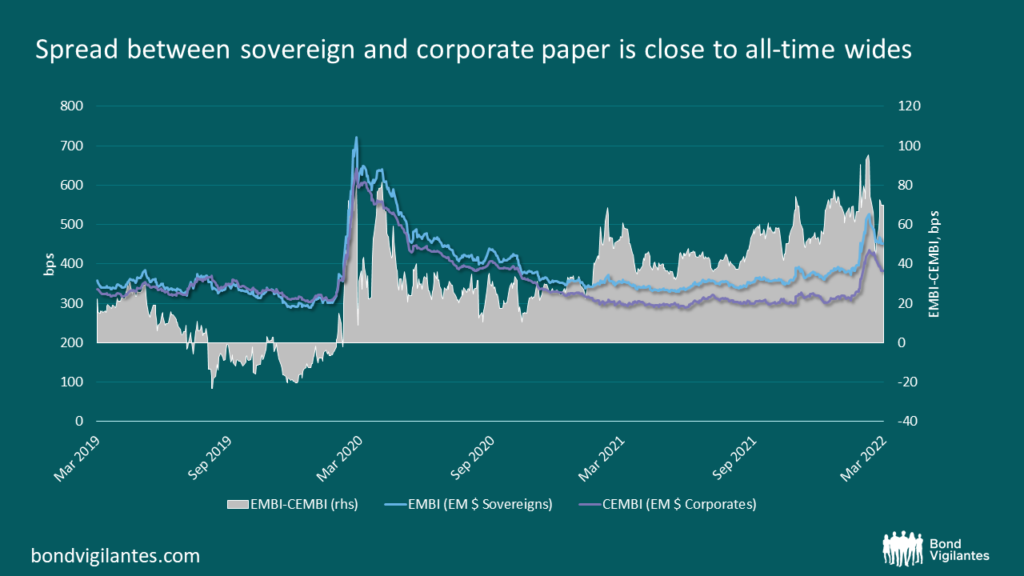

Before delving into the key conclusions, it’s worth taking stock of where we are. Russia’s invasion of Ukraine has caused asset prices to fall sharply and, despite a modest recovery over the past fortnight, valuations remain stretched. The chart below shows this, and also reveals that the spread between sovereign and corporate paper is close to all-time wides. This is partly due to index composition, in that the EMBI (sovereign index) has a higher duration component, which has been hit by rising rates, as well as a larger High Yield bucket. However, it also reflects strong corporate balance sheets – leverage is at its lowest point since 2011 – versus the efforts made by sovereigns to cushion their economies from the effects of the Covid pandemic through fiscal and/or monetary expansion.

With this backdrop in mind, here are some key conclusions from the conference:

- Sovereign/macro considerations are key investment drivers. Unsurprisingly, the Russia/Ukraine conflict was the centre of discussion and the biggest risk factor identified by investors. The other two topics discussed with concern were global monetary tightening (higher rates) and inflationary pressure getting out of control. Clearly these three are linked, with the Ukraine conflict adding to the supply crunch, driving inflation (especially in food and energy) and thereby forcing central banks to raise rates. Equally clearly, they are having an effect on the whole world, which goes some way to explaining why outflows from EM funds have been lighter than initially feared – at least EM debt offers some downside buffer in terms of carry that is much less substantial in developed markets. We would question whether aggressive rate hikes make sense in EM, given that substantial moves were already made last year and higher rates will not have much impact on a supply shock; however, there was a firm view that central banks have inflation targets to hit, so will be forced to act, which will in turn lower growth expectations for 2022. Finally, it is clear that sovereign stories are driving sentiment around corporates. A majority of investors thought that corporate ratings would improve or deteriorate driven by the sovereign (or by a mixture of sovereign and standalone considerations).

- LatAm is the place to be. In the second half of last year, there was a clear flow of funds out of Asia (specifically China) and Emerging Europe (specifically Turkey) into LatAm. Both countries made up a significant portion of the EM indices. Concerns in China centred on the Education, Tech and Property sectors, while the outflow from Turkey was driven by worries around its unorthodox economic policies. The Ukraine conflict has added momentum to these flows. Russia, formerly another significant index constituent, is now uninvestable following sanctions, while geopolitical concerns have now been added to the list of concerns around China as the country weighs offering support to its Russian ally. It comes as no surprise, then, that a clear majority of investors felt that they were most likely to add LatAm risk in 2022, while Eastern Europe was the most likely area to reduce. We would be cautious in following the crowd here. The issues in Russia, Turkey and China are well known and largely priced in. While election risks in LatAm may not seem as threatening as what is going on elsewhere in the world, their lack of profile may be lulling investors into a false sense of security. A majority felt that current pricing in LatAm does not reflect the risks. As asset prices in the rest of the world hopefully start to recover, we may find LatAm moving in the opposite direction later this year.

- Corporates are still in vogue. Given the disparity in pricing between the EMBI and the CEMBI, perhaps the biggest surprise was the ongoing level of support for corporates over sovereigns. Almost half of investors felt that allocation to corporates would increase, with very few moving in the opposite direction. Moreover, a large majority of investors even felt that there was better value in EM corporates than in the DM counterparts, a feeling that can only have grown following the last fortnight’s price action. The two factors go some way to explaining the relatively benign flows that EM funds have experienced so far; investors reporting inflows significantly outnumber those experiencing outflows.

We agree that corporate fundamentals generally remain strong and that the past month’s volatility has led to significant investment opportunities in areas less directly linked to Russia/Ukraine (Thai banks being one good example), though we feel that the same could be said of certain sovereign issuers (e.g. Mexico) which remain attractive due to the superior liquidity and value on offer. But to us the key risk/opportunity for 2022 lies in the flow of funds into LatAm. There is a clear sense that risks are not priced in here, whereas the risks in the rest of the world are more clearly understood and the market reaction to them is behind us. This leaves money in LatAm exposed to volatility later this year, at a time when asset prices elsewhere should hopefully be recovering. Perhaps the best time to seek opportunities outside LatAm is now.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.