To call or not to call: why EM banks should honour bond calls

Garanti, the Turkish subsidiary of Spanish bank BBVA, recently made waves by electing not to call its Tier 2 bond (GARAN 6.125% 2027). This came as a big surprise following the decision of fellow Turkish lender Akbank’s decision in March to call a similar bond and has precipitated a discussion among EM bank investors as to whether wider spreads could lead to a spate of non-calls. We think that this is unlikely as most banks are well aware of the reputational and financial damage that such a decision could make.

Bank sub debt falls into two groups: Additional Tier 1 (AT1) bonds, which are perpetual instruments with a call option, often after five years; and Tier 2 (T2) bonds, which have a fixed maturity (usually ten years) and a call option five years before the maturity date. T2 bonds’ capital credit amortises over the last five years of their life, which explains the timing of the call option. There is a strong expectation among investors that banks will call (i.e. redeem) their bonds at the first opportunity, which has indeed generally been the case. Consequently, at new issue they are priced to the first call date. Should the bond not be called, its coupon resets to the relevant risk-free rate plus the original premium. AT1 bonds are then typically callable every six months at the issuer’s discretion, while most T2s are no longer callable until maturity.

In theory, banks are supposed to call subordinated bonds on an “economic basis”. This is often taken to mean simply that the bond should only be called if a new instrument could be issued at a similar or better spread. However, there are several reasons why we believe that bonds should always be called, both on economic grounds and for reasons of financial stability:

- We fear that bank Treasury teams are focused narrowly on the cost of funds rather than the big picture. In a rising rate environment such as the one we are currently experiencing, funding costs rise but loan yields also improve. Most banks have said that they will be more profitable in Q4 2022 than in the previous year. Sub debt represents a very small part of any bank’s funding stack, the majority of which tends to consist of cheap deposits. Why would a bank destroy its market reputation for the sake of a tiny “saving”, the relative impact of which is dwarfed by increased asset yields?

- The consequence of such a hit to market reputation is that investors will require a greater premium when the bank needs to issue sub debt again. Given the choice between paying up due to wider spreads (which are likely to be temporary) or due to reputational damage (likely to be long-lasting), surely the former is preferable?

- Some EM banks argue that “investors forget”, and cite continued support in Europe for the likes of Deutsche Bank and Santander, which have missed calls in the past. This is simply wrong, and the markets are very different. European bank sub debt is a much greater part of its index than is true in EM, where the asset class is still developing. Combined with financial repression, this left European investors with little choice but to have at least some exposure to the larger names. In EM, we face no such constraint. As long as non-calls remain rare, we would not invest in the sub debt of any bank with a history of not honouring calls.

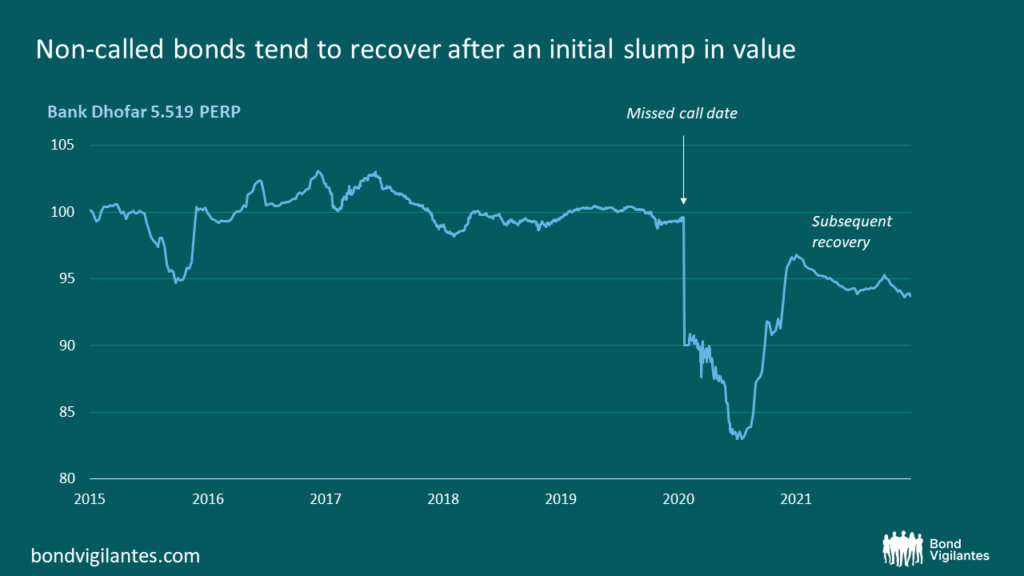

- Finally, there is the financial stability argument. Regulatory capital (sub debt) is a growing asset class in EM. Regulators are keen to continue to attract ongoing investment into this part of the market. Widespread non-calls would hinder that process. The only EM banks to miss calls to date have been weak banks in troubled jurisdictions, such as Bank Dhofar in Oman, which now has no chance of issuing more sub debt until it has redeemed its perp.

After many conversations with management, we are confident that most banks are aware of these points and will continue to call on time. This is particularly true in the GCC (Gulf Cooperation Council) and Asia, where there is a strong local investor base. Calls are also more likely to be observed for Tier 2 instruments, whose capital value amortises if not called, than on AT1s where this is not the case. The Garanti situation was forced on it by its owner, BBVA, so does not necessarily reflect the bank’s own wishes.

Finally, what are the consequences for investors whose bonds are not called? The evidence suggests that the bond’s reprice to the next call date meaning that, after an initially significant slump in value, non-called AT1 bonds tend to recover back towards the high 90s. This is because the six-monthly call option, which is the standard structure, creates the risk that the bond could be called at par at any time, supporting the price (see chart below). Tier 2 bonds tend to reprice to maturity. To date, there has been no skipped coupon on AT1s due partly to the dividend stoppers (clauses that prevent the issuer releasing dividends while the bond coupon is unpaid) that are standard in EM, so investors should continue to enjoy an income stream until such a time as the bonds become tradeable again or are tendered by the issuer.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.