Short dated credit – reassuringly exciting

The short end of the investment grade credit universe is generally a rather dull place. Lending to good quality companies for a relatively short amount of time rarely provides much excitement. From time to time, however, the benefits of the asset class shine through. Now is one of those moments.

Most investors view bonds as the low risk portion of their overall portfolio but, as many have found this year, not all bonds are created equal. Higher government bond yields, over which corporate credit is priced, have resulted in some heavy losses for bond investors so far this year. As a general rule of thumb the longer a bond has until it matures, the more capital value it will lose if interest rates rise (and the more it will gain if they fall). In the UK, the investment grade corporate bond index is down by about 15% YTD. The comparable short dated index (bonds with 1-3 years until maturity) has lost about 5%. Not ideal, but there are few assets out there that would have done a better job at limiting the losses that higher yields have brought to financial markets this year.

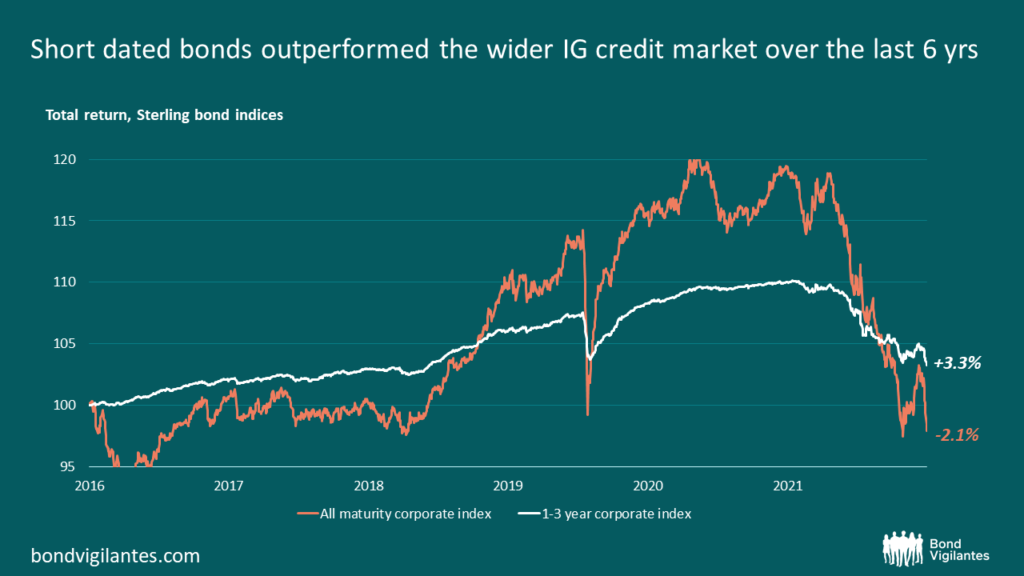

And no, this isn’t just a UK phenomenon. The same dynamics are at work in both the Euro and Dollar credit markets too. In fact, the global move higher in yields has been so brutal that lower risk, short dated bonds have outperformed the wider Investment Grade credit market over the last six years.

Below is a chart showing exactly that in the Sterling market. Again, this is true in Euros and Dollars (just), as is the lower volatility of short dated credit over the period – as one would expect from a lower risk asset class.

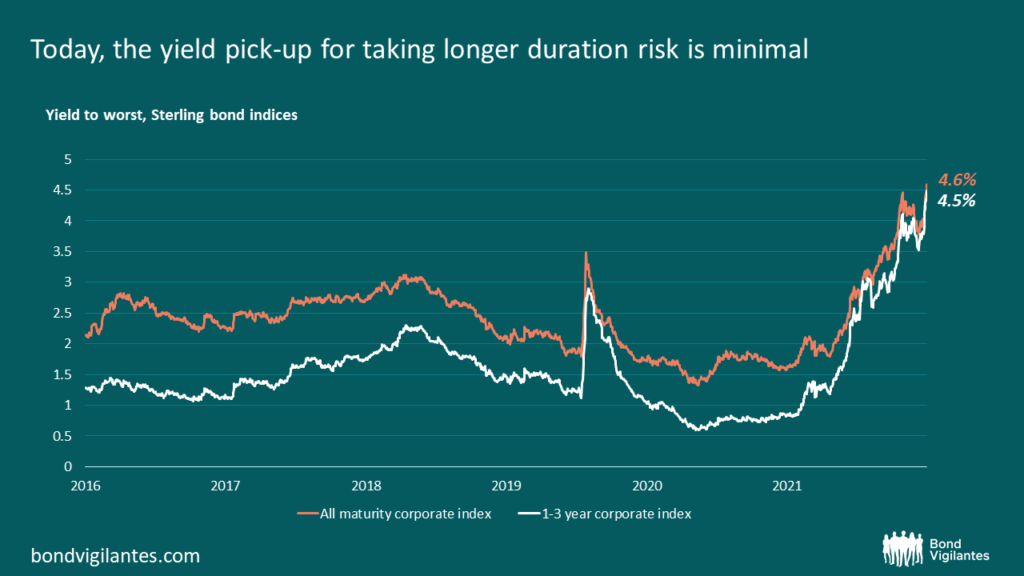

Higher returns with lower risk? What’s not to like? Well traditionally the argument would be that longer dated credit pays you a higher yield to compensate you for that extra risk. However, yield curves have not only moved higher – they have flattened and (in the UK & US) inverted too. This means that governments and firms are paying more to borrow over the next couple of years than they are over the next, say, 10 or 30. As the chart below shows, today the yield you receive from the longer duration UK Investment Grade corporate bond index is only 10bps more than you get from the equivalent 1-3 year index.

Foregoing that extra 10bps for a lower risk, lower volatility portfolio, that outperforms in a rising rate environment seems, to me, like a very good relative value trade.

See, I told you short dated credit wasn’t always boring!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.