Aussie banks: regulatory guidance on calls creates opportunities for investors

Recently, the Australian Prudential Regulation Authority (APRA) made waves by publishing guidance regarding the Aussie banks’ calls on capital instruments including Tier 2 instruments, as we touched on in yesterday’s blog on Asian financials. For background, banks’ capital instruments, which include Tier 2 and Additional Tier 1 (AT1) instruments, are forms of loss absorbing capital that count towards meeting banks’ overall capital requirements. They contain a call option, which allows the issuer to call the bonds: as an investor, predicting when an issuer will call the instruments is therefore important in pricing them. Traditionally, most banks will call these bonds at the first opportunity, and so the bonds are typically priced “to first call”. For the issuer, they must weigh up (among other factors) the cost of calling and refinancing the bond, versus the reputational effect of not calling the bonds at the time investors expect, even if calling is uneconomical.

In short, the guidance shows that the APRA expects banks to call their outstanding capital instruments only if they can satisfy both economic and prudential criteria for the call decision. The economic criteria is met if the cost of issuing a replacement bond is equal to or less than the cost of keeping the existing instrument outstanding.

The analysis required from the bank is quite prescriptive: for Tier 2 instruments, the bank is required to present an analysis for various scenarios which would consider the loss of regulatory capital treatment, which usually amortizes down linearly to maturity, offset by the funding benefit. Maintaining access to capital markets or limiting reputational damage are specifically ruled out as “sole” reasons for potential uneconomic calls of capital instruments. The prudential criteria requires the bank to satisfy APRA that the call does not create an expectation that other instruments will be called in similar circumstances.

While this is a reiteration of an existing standard (APS111), we find the publication significant, as this puts the explicit burden on the banks to justify any potentially uneconomic calls. This is particularly surprising given that Aussie banks are in the process of building their Tier 2 buckets to at least 6.5% of risk weighted assets by January 2026, much higher than the Basel 3 requirement of only 2%. This APRA requirement means the banks must increase their Tier 2 outstanding by 50-100% of their existing stack, creating a meaningful negative technical dynamic.

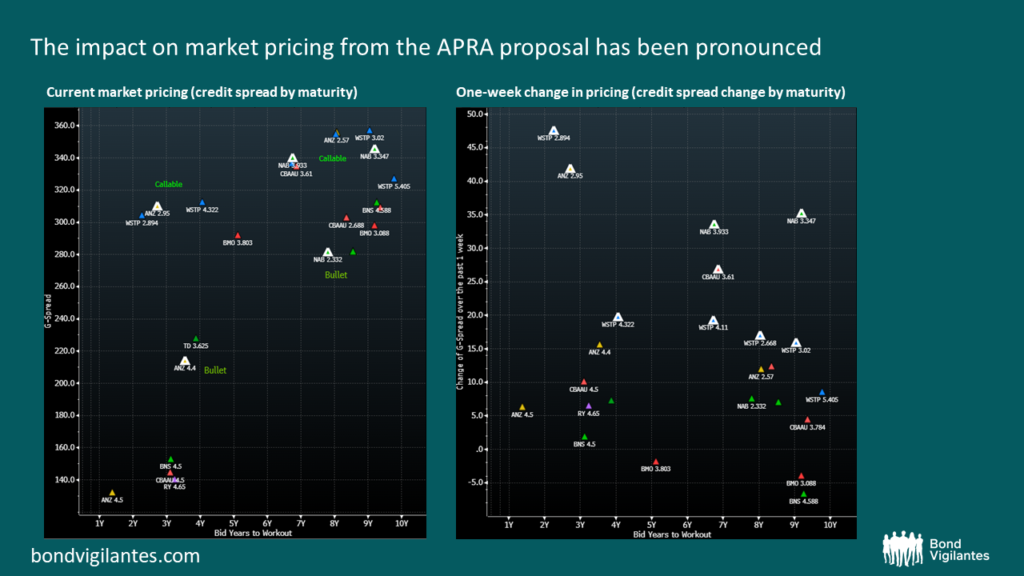

The preferred issue structure for Aussie Tier 2s was the 10-year Non-Call 5 (“10NC5”, which means the bond has a maturity of 10 years but is not callable for the first 5) given it allowed banks to call on the first call date to maximize the regulatory value of the instrument. This in turn allowed investors to price the bonds to call. Given that historically the major Aussie banks have called their Tier 2 instruments on their first call dates and therefore most of their Tier 2 bonds were priced to call, the impact on market pricing from the APRA proposal has been pronounced, as shown in the two charts below.

Source: M&G, Bloomberg (November 2022)

The USD callable bonds of the four major Aussie banks widened by 25bps across the curve in the days following the announcement, with ANZ and NAB most impacted. At the short end, the callable bonds now trade 95-100bps wider than their equivalent bullets (ANZ 2.95% ’30 vs. ANZ 4.4% ’26).

The shorter dated callable bonds now appear to almost fully price a non-call, which we believe could offer some asymmetric upside and therefore creates potential opportunities for investors.

What about the read-across from Australia to European banks’ calls on their Tier 2 instruments? In the Eurozone, we note the recent October 2022 agreement between the Single Resolution Board and the ECB which stipulates that in order to redeem eligible liabilities (which includes Tier 2 instruments), banks need to meet a formulaic capital threshold consisting of their combined MREL, Combined Buffer requirement, and an additional undisclosed bank-specific margin. Importantly, the agreement does not require banks to demonstrate or pass any economic calculations for their redemptions. There is a more philosophical argument to be made regarding regulator’s views on enforcing the hierarchy of capital: with many banks actively engaging in share buybacks, thus reducing their highest quality capital (equity) – should the regulator at the same time be able to limit the redemption of a Tier 2 instrument?

In conclusion, the APRA regulatory guidance on calls still leaves significant wiggle room for the banks while creating opportunities for investors.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.