EM vs DM convergence: the battle of the low yielders

2022 has been a notoriously bad year for government bonds globally, as central banks embarked upon (or continued) interest rate hiking cycles to fight rocketing levels of inflation. This was caused by unprecedented easy monetary policy through a pandemic, persistent supply-side bottle-necks, strong labour markets and the disruption of commodity markets due to Russia’s invasion of Ukraine. However, what is clear is that different central banks are tackling these growth and inflation woes in different ways and at different paces.

A key factor in this hiking cycle is that many emerging market (EM) central banks have been ahead of their developed market (DM) counterparts in starting to hike rates, whereas historically they have lagged behind. This means that it is the likes of the Fed, ECB and BoE that have been in catch-up mode in tackling inflation, rather than the EM policy makers. This also means, however, that central banks like the Fed have had to be more aggressive in their approach in order to compensate for the time they spent treating inflation as ‘transitory.’ The result? After a year of catching up, you can now earn a much better yield for lending to the US, a supposedly ‘risk free’ investment, than to the lower-yielding EM issuers, with the latter struggling to offer enough extra compensation for a riskier credit profile.

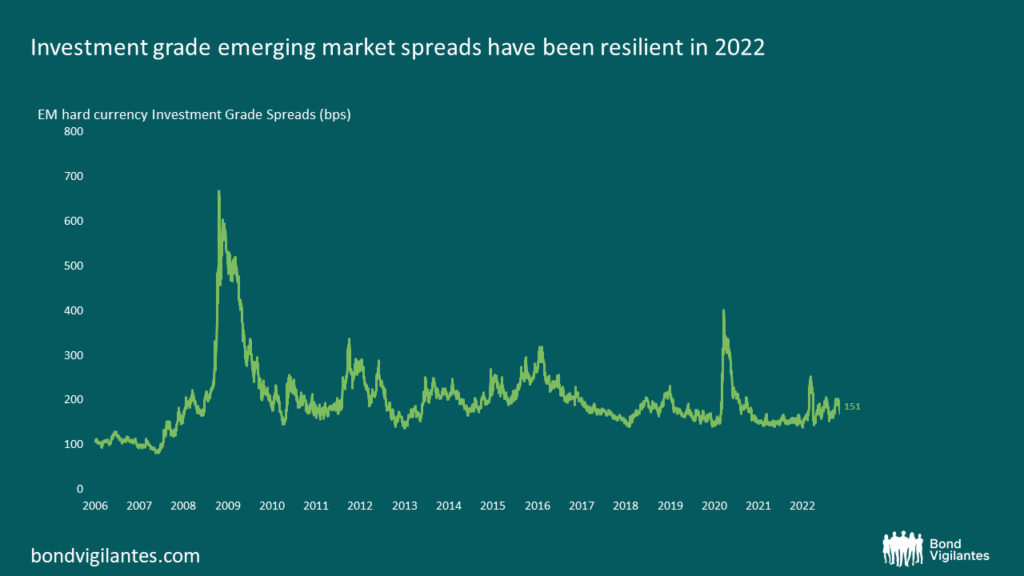

One area where the EM vs DM convergence seems particularly to be taking place is in the IG space of the external EMD market. Naturally, hard currency debt is a credit instrument in which return is expected from earning a spread above a developed market benchmark. Looking at the below chart, it is clear that despite the market turmoil of 2022, particularly in EM markets, IG spreads have stayed contained.

Source: JP Morgan Indices, 30 November 2022

Why have IG spreads been resilient?

Composition is important here. In the IG sovereign space, the index largely comprises issuers from Asia and the Middle East, which have generally been better insulated from the global shocks that have driven DM yields relatively higher. Many credits in the Middle East are currently enjoying a positive terms of trade impact from being commodity exporters throughout 2022, meaning that they are sitting on strong balance sheets flushed with petrodollars and have little need to come to market. In IG Asia, we find multiple issuers which simply have not needed to issue much debt in hard currency – economies with more stable currencies and inflation, as well as deeper domestic capital markets, tend to issue more in local rather than hard currency. This keeps supply low and spreads compressed. Let’s look at Indonesia as an example.

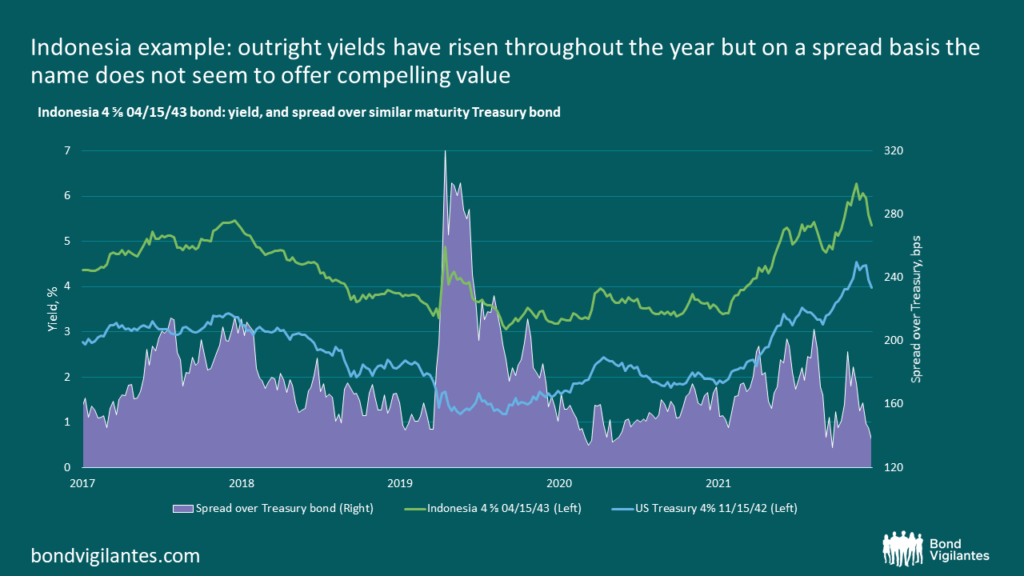

Source: Bloomberg, 30 November 2022

Indonesia is a BBB credit, so a higher yielder within the IG space and a large constituent of the IG market. Looking at a 20 year USD-denominated bond, we can see that outright yields have risen throughout the year in line with the market, but Indonesia credit has pretty solid fundamentals and on a spread basis does not seem to be offering compelling value.

So where is the value?

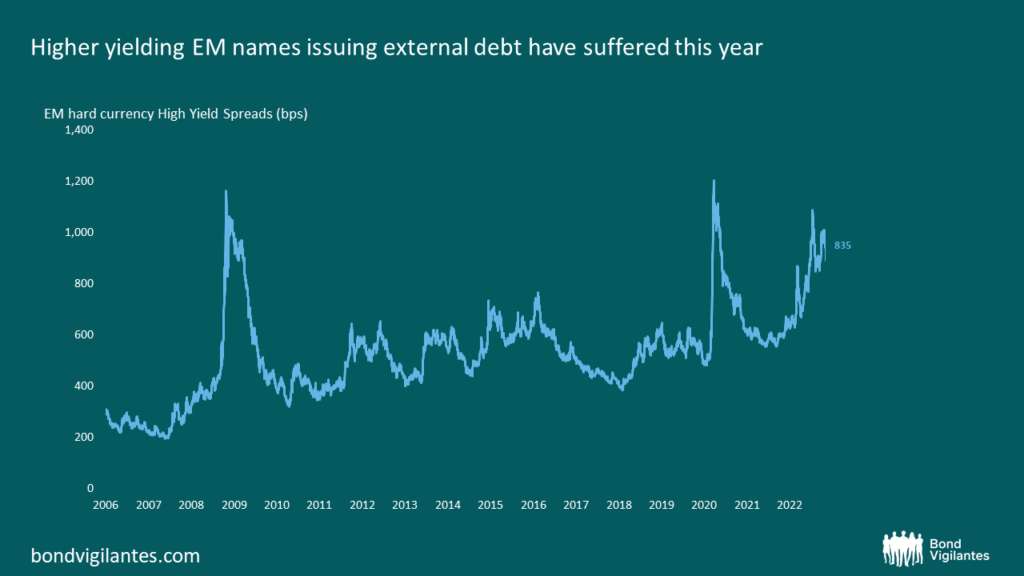

Most of the weakness in hard currency spreads has been driven by the high yield market, where lower quality/speculative credits issue a greater proportion of their debt in USD in order to attract external financing. Compositionally, this means hard currency EM debt typically has a weaker credit profile and higher default probabilities. Furthermore, USD-denominated EM debt will typically see spreads widen during times of USD strength (a resounding theme of 2022) – this is because their credit quality decreases as their ability to repay their debt deteriorates. Higher yielding EM names and frontier economies issuing external debt have undoubtedly suffered from the brutally bearish market as a whole this year, with a number of issuers having defaulted or tottering on the brink as debt surged and fiscal buffers shrank amid the pandemic and Russia’s invasion of Ukraine.

Source: JP Morgan Indices, 30 November 2022

However, the investor panic that sent spreads to wides rivalling the pandemic or the GFC seems to have eased recently, amid a flurry of IMF deals, bilateral funding commitments and hopes for a less hawkish Fed going into 2023. This easing in risk sentiment has opened up a window of opportunity, as witnessed by November’s rally in spreads, particularly in those names that have sold off more than fundamentals would warrant.

What about local markets?

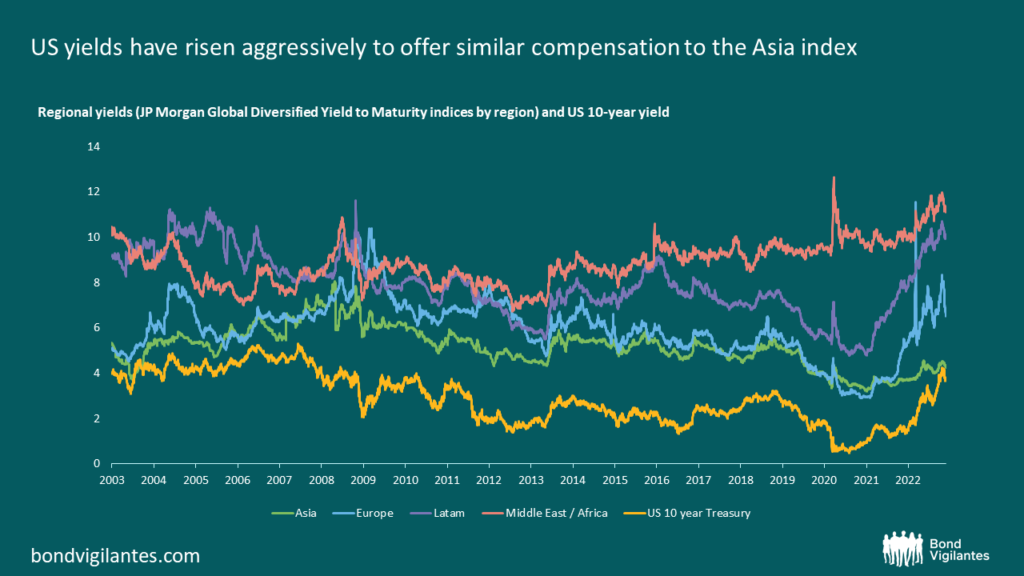

Again, it feels like the battle is between the lower-yielding Asia issuers and USTs, in which nominal US yields have risen aggressively to offer similar compensation to the Asia index.

Source: Bloomberg, 30 November 2022

Unlike EM sovereign credit, local EM bonds carry FX risk, are more liquid and are more driven by local inflation and interest rates. Asia in this case looks less attractive as an investment region, firstly due to China – a large constituent of the index, with the PBOC having retained an accommodative stance to monetary policy given plunging domestic demand in light of the country’s zero-Covid policy. We have also seen a weak CNY, driven by declining terms of trade, weak rate differentials (especially vs USD) and geopolitical risk.

South East Asia as a whole has seen relatively moderate inflation vs the rest of the world, driven by a number of factors including: China’s weak growth; geographically being further away from the conflict in Europe (and thus less reliant on its supply chains); many Asian countries managing the pandemic in a way that avoided major supply disruptions; and a rice-based diet reducing the need to import grain. This has afforded central banks room to keep interest rates lower for longer and support economic recovery. Hiking cycles have now commenced in many economies, but the lag vs the Fed has meant yield differentials have narrowed.

However, the big differentiator in local markets is real yields. If we return to our Indonesia example, given inflation has been lower in the region, the real yield pick-up vs USTs becomes much more attractive. In line with its peers, the BI (Bank Indonesia) central bank has been relatively late to the hiking cycle (they began in the summer), but have since caught up somewhat and have hiked rates from 3.5% to 5.25%. The currency also looks attractive, trading at cheap valuations but underpinned by strong growth forecasts and a healthy current account position.

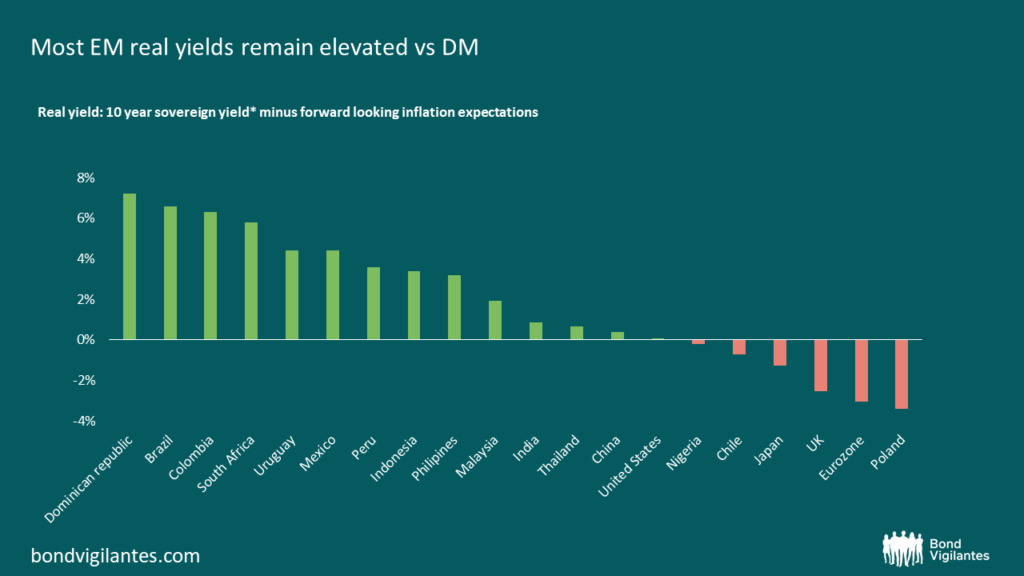

Regionally, it seems like the standout in local markets is Latin America, with a large move in both nominal and real yields as they have been more proactive in fighting inflation. US real yields could still catch up somewhat, especially if the Fed holds at a high terminal rate for a while and inflation expectations come back down. But, given EM is full of idiosyncrasies and volatility (especially in high yield), this will remain a battle of the low yielders here.

Source: Bloomberg, 30 November 2022 *10 year bonds or closest available maturity

In conclusion

In USD EM sovereign markets, much relies on the Fed. A slower pace of hikes could reverse the shunning of dollar-denominated debt as a whole, but clearly HY credit offers a much greater spread pick-up going forward vs IG that is struggling to compete with US Treasuries. In local markets, monetary policy remains divergent, politics and geopolitics dominate headlines, and FX remains volatile. However, looking at valuations, it is clear that local sovereign bonds are offering compelling real yields compared to developed markets, across both IG and HY issuers.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.