Remittances: A foreign exchange boost for emerging and frontier markets

Most emerging and frontier economies get a welcome boost from worker remittances. Such flows supplement foreign exchange earnings as much as foreign direct investment (FDI), and are many times greater than overseas development aid. Remittances have a key role to play in financing the sustainable development goals (SDG) and with efforts to maintain debt sustainability.

The emerging market exceptionalism story in early 2000s was in part premised on rapid FDI growth. Since the global financial crisis, however, FDI flows have paused their growth. Conversely, remittances have continued on an increasing path. In place of export-led growth there is an increasing number of talent-export stories.

Recent remittance trends

After a dip during the pandemic, remittances soared in 2021 and have continued their growth in 2022, albeit at slower clip. The World Bank estimates a 5% increase in the amount of money 285 million migrant workers are sending home to lower-and middle-income countries this year.

The $794 billion in global remittance flows is mostly driven by migration trends, but also by exchange rates and how the economies attracting migrants are faring.

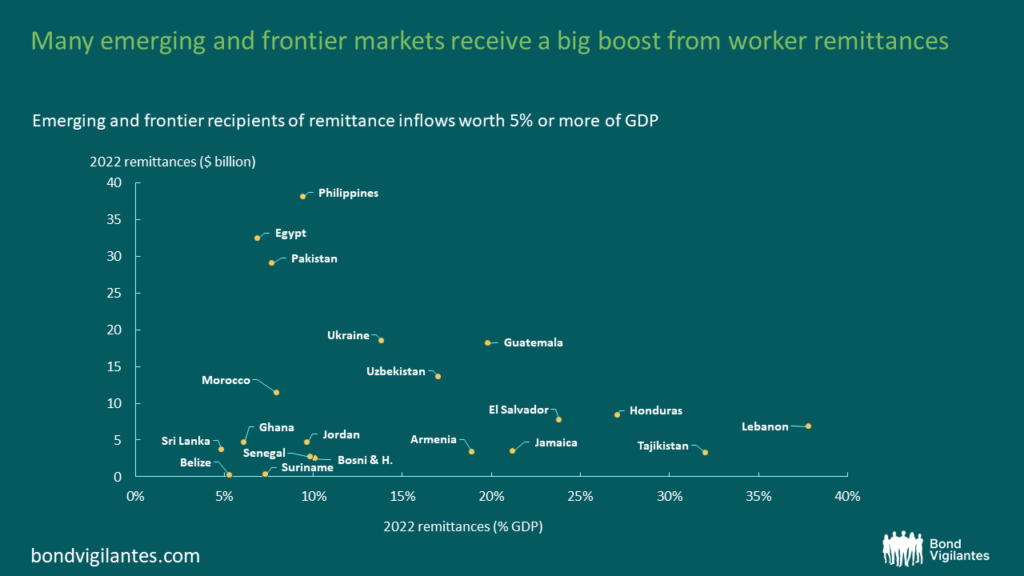

The biggest winners among emerging and frontier markets—measured by remittance inflows as a percentage of GDP—are spread across the globe. The top five recipients this year includes: Lebanon (38% of GDP); Tajikistan (32%); Honduras (27%); El Salvador (24%) and Jamaica (21%). Meanwhile, remittances account for over 5% of GDP in 20 emerging and frontier economies.

The biggest increases in the USD value of remittance flows in 2022, versus the average of the past five years, were experienced by Armenia, Azerbaijan, Guatemala, Mozambique and Suriname. The Caucasus economies have seen a spike in remittances as people have rushed to get money out of Russia following the sanctions linked to its invasion of Ukraine. The central American economies have benefited from a buoyant US labour market. Meanwhile the largest single drop, by a huge margin, was experienced by Sri Lanka. Remittances there plummeted in 2021 and 2022, a period in which the economy has suffered from a deep debt crisis.

A critical source of foreign exchange earnings

Remittances provide more foreign exchange earnings than exports in several economies, including Egypt, El Salvador, Guatemala Honduras, Pakistan, Uzbekistan, Jamaica and Lebanon – and almost two times more in Tajikistan. This export of talent is earning an important dividend, but it is also a signal that there is not sufficient opportunity to deploy skills at home and that there is a struggle to build a sufficient scale of competitive export sectors.

Remittances and debt sustainability

Large remittances can be supportive of debt sustainability where countries are borrowing in hard currency. While the inflows of foreign exchange are directed to households rather than government, they can still help plug a trade deficit and be supportive of the overall macroeconomy.

Hence an understanding of remittance flows is vital when carrying out debt sustainability assessments. Typically debt sustainability assessments utilise measures of external debt, or external debt service costs, versus exports. But in many countries, especially the ones listed above, there’s a need to fully integrate remittance data for comprehensive debt health check-up. Gauging upside and downside risk to such flows is essential.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.