Tourism recovery across emerging markets – on track, but still some way to go

The main festive season of the year is rapidly approaching, with people across the world preparing to depart on well-deserved holidays. It’s been almost three years since the emergence of COVID-19, when almost all global travel was suspended or dramatically reduced for many months as the pandemic spread across the globe. For some emerging market countries, this meant the vital lifeline of their income stream from foreign visitors was almost severed – which contributed to a much deeper GDP contraction in those countries, compared to those in which tourism is not so important. Many months and lockdowns later, it seems a good time now to take a look at the state of tourism recovery in emerging markets.

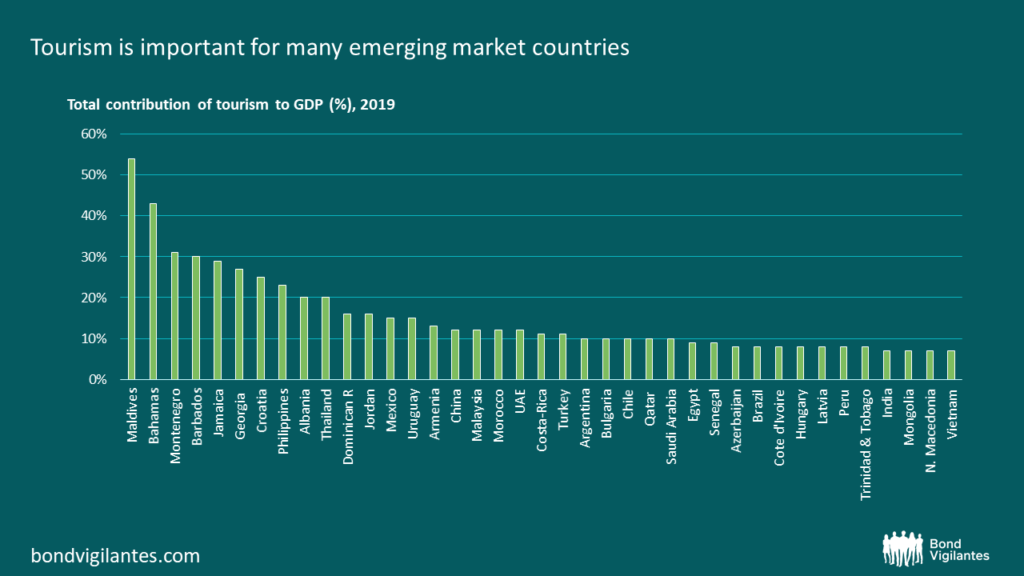

The contribution of tourism to GDP naturally varies significantly across emerging markets. As one would expect, tourism is most important for small island states. Among Eurobond issuers, the highest importance is that for the Maldives (54% of GDP) and for the Bahamas (43% of GDP). However, one should note that its significance extends to many other countries as well – for example, tourism’s contribution to GDP exceeds 20% in Croatia and Thailand.

Across emerging markets, the tourism industry naturally collapsed much more than any other sectors of the economy in 2020. The degree of collapse across different countries varied greatly though and depended on many factors, including the severity of COVID-related restrictions in destination countries, as well as tourism source countries (i.e. where most visitors tend to come from). Geographical location and related flight availability mattered too. The availability of fiscal space and skilfulness of government measures to support the industry was yet another differentiating factor.

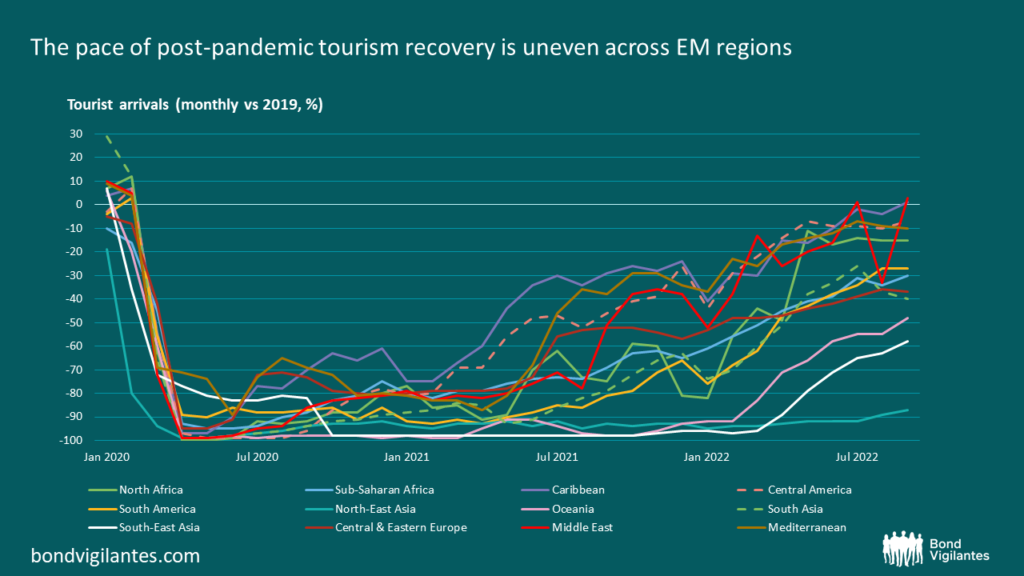

The total decline in global tourist arrivals exceeded 70% y/y in 2020. Interestingly, overall there was only a small recovery in 2021 as a whole – while some regions (e.g. the Mediterranean and the Caribbean) indeed did better, the decline deepened to 80-95% vs 2019 in others (Asia and South America).

As usual, the aggregated figures mask significant differences across individual countries due to various country-specific factors. For example, the decline of tourism arrivals in Croatia was 68% in 2020, despite the majority of tourists tending to come from Germany, Austria and Slovenia (where restrictions were among the harshest and longest globally at the time). However, the fact that Croatia is easily reachable by land from those countries turned out to be more important for tourism flows. This travel flexibility also meant that tourists likely stayed in the country for longer than usual, so the decline in tourism receipts (a more accurate, but not always available for emerging market countries, measure of tourism) was actually even softer at 55% in 2020. Meanwhile, the neighbouring Montenegro offers similar points of attraction for tourists, but it had harsher COVID-related restrictions and flights are the only travel option for a larger share of its tourist market, compared to Croatia. This likely meant that many visitors simply didn’t reach it, with both tourist arrivals and tourist receipts having collapsed by about 87% in 2020.

In another example, the decline of tourist arrivals in Turkey was relatively contained at 69% in 2020 and improved to 42% in 2021 (vs 2019), much quicker than the emerging market average. Not having a land border with its main tourist sources (Germany, UK and Russia) was partly compensated by the fact that travel restrictions in one of them (Russia) were much lighter and short-lived than elsewhere.

So where do we stand on the tourism flows now, three years since COVID-19 emerged and two years after the first vaccines were developed? It is fair to say that we are making solid progress back towards normality, with the pace being somewhat faster than expected. According to the United Nations World Tourism Organization, the tourism sector has recovered to about 65% of its pre-pandemic levels in 2022. The worst concerns regarding long-lasting (or even permanent) damage to the tourism industry seem not to have materialized, helped by the relatively quick invention and distribution of efficient vaccines.

The number of countries without any COVID-related restrictions reached 120 in December, up from just 8 in March. Even though the vaccination rates in most emerging market countries still significantly lag those in developed markets, the very high rates in the latter do matter much more – because those high-income countries are the main source of tourism for emerging markets. Having been vaccinated, people are no longer much concerned by the state of the COVID-19 situation in the countries which they plan to visit. Moreover, there is still significant pent-up demand and hunger for travel after many months of having to spend the holidays closer to home.

As was the case during the tourism collapse in 2020, the pace of recovery is also very uneven across regions and countries. The Mediterranean region has shown the most significant tourism recovery, with tourist arrivals in the first three quarters of this year already being at around 85% of pre-pandemic levels. Moreover, the situation continues gradually to improve on a monthly basis. And in some countries, tourism receipts already significantly exceed the 2019 levels. For example, on a year-to-date basis those receipts are up 13% in Croatia and 36% in Turkey.

Tourism recovery has also been rapid in the Caribbean, where tourist arrivals have almost reached 2019 levels in summer months (though still about 20% below on a year-to-date basis). The Dominican Republic stands out with arrivals 7% higher on a year-to-date basis (and almost 30% higher in Q3) already. South America has shown the quickest recovery pace in 2022, but started the year at a very low levels, with tourist arrivals there still around 30% lower in recent months vs the same period in 2019.

Overall, it is clear that many people have become more open to spending their holidays further away from home this year, having been denied this opportunity in the previous two years. In this context, it may seem a bit puzzling that tourism recovery in South-East Asia is significantly lagging, with year-to-date tourist arrivals still around 80% down in most countries compared to 2019. Longer-lasting COVID-related restrictions, particularly in China (which is the main tourism source for the region), are the main reason behind this. On the positive side, the situation in this region continues to improve as well, with the most recent months showing about 60% decline vs 2019, compared to 95% in the first quarter of this year.

Positive tourism developments this year have significantly helped those countries in which tourism is most important, lifting their GDP growth and easing pressure on the budgets at a time of challenging global financial conditions. While it is often difficult to isolate the contribution of tourism from other factors, it’s not a coincidence that bonds of many of those countries from various regions (e.g. Barbados, Jamaica, Albania, Georgia) have significantly outperformed the market this year. That said, the outlook for tourism recovery looks somewhat more uncertain going forward.

Overall, there is certainly more room to recover at least towards the 5% average annual growth rate observed in 2015-19. However, as the impact from pent-up demand gradually dissipates, other factors start coming to the fore in the near term. In particular, higher fuel prices make any means of transport much more expensive. A general income squeeze and recession fears in developed countries (the main source of tourism) also incentivize people to save more. In addition, the evolution of some country/region-specific factors remains difficult to predict, like the zero-COVID policy in China and the conflict between Russia and Ukraine (which has led to an abnormal increase in tourism for the Caucasus and Central Asia region). Nevertheless, one thing is clear – the pandemic is largely behind us, meaning that people have the willingness and confidence to travel again.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.