Deflation Tsunami

Inflation is one of the great economic debates and often leaves big economic thinkers at loggerheads. I am not a financial titan, but looking at the world from 100,000 feet, the conditions are in place for the world to see inflation heading meaningfully lower.

Source: Getty Images

For years, inflation has been too low for comfort for the world’s major central banks. Inflation remained elusive despite ultra-accommodative policy through negative interest rates and an eye-watering amount of quantitative easing (QE). It wasn’t until a pandemic that shuttered economies and ground supply chains to a halt, a war that raised geopolitical tensions and damaged global food and energy security, and a further increase in money supply in response ,that inflation moved meaningfully higher. The question is, is it here to stay?

Inflation is the measurement of the price change for goods and services. As prices start to find a level and stop increasing, the year on year (YoY) change will eventually trend to zero. We will begin seeing these ‘base effects’ drop out, and inflation will start behaving.

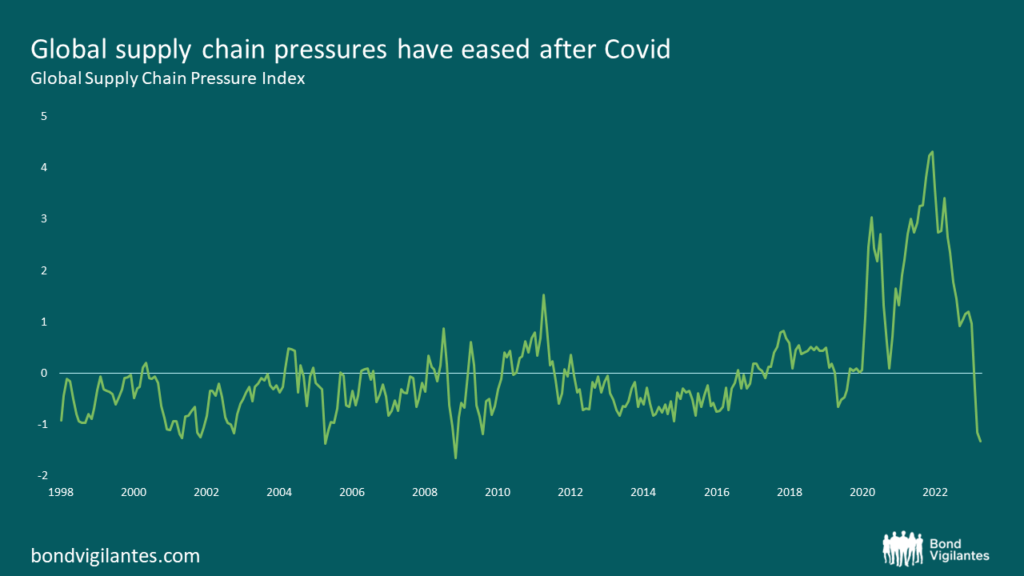

Covid is now thankfully a distant memory, and supply chains have eased and are now back to ‘normal’ – a disinflationary impulse.

Source: Bloomberg (May 2023)

The energy-induced spike from Putin’s invasion of Ukraine has eased and is another disinflationary impulse.

Source: Bloomberg (May 2023)

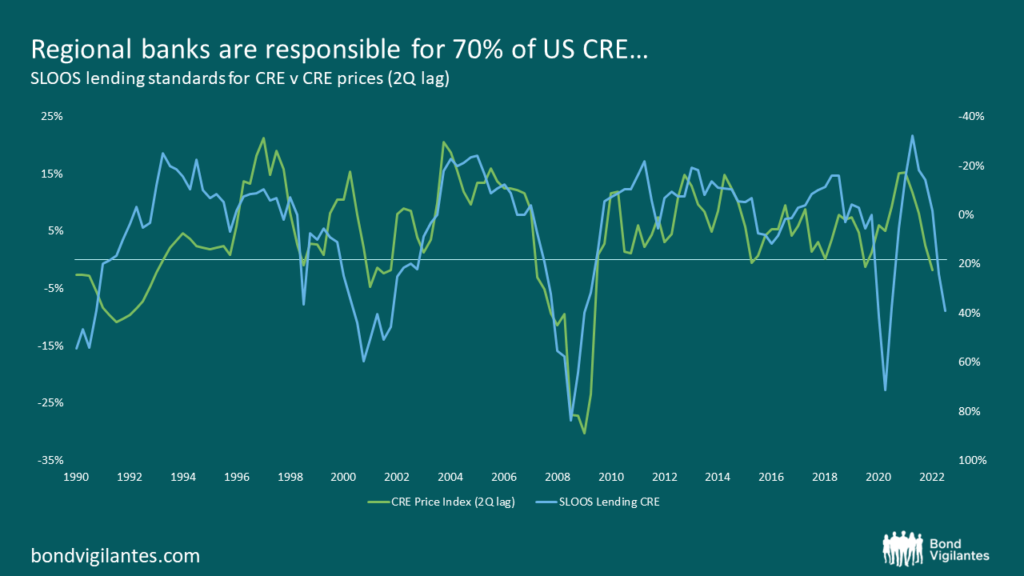

The aggressive rate hiking cycle the Bank has embarked on should bring about a slowdown in growth. This is particularly acute for economies with housing exposure linked to floating-rate mortgage products, less of a concern for the US, as most will have 30yr fixed mortgages. With house prices at unaffordable levels across most of the developed world and the cost of borrowing moving sharply higher, house prices will undoubtedly be pressured downwards, another disinflationary impulse. Alongside the housing market, the commercial real estate (CRE) sector is particularly vulnerable as it grapples with tighter monetary policy and a cascade of debt maturities. Rolling the debt over will hurt profitability as the cost of funding is now higher, but also potentially very difficult to do in the current environment. Regional banks in the US are going through their own crisis and are responsible for circa 70% of US CRE lending. Look out below.

Source: St Louis Federal Reserve (March 2023)

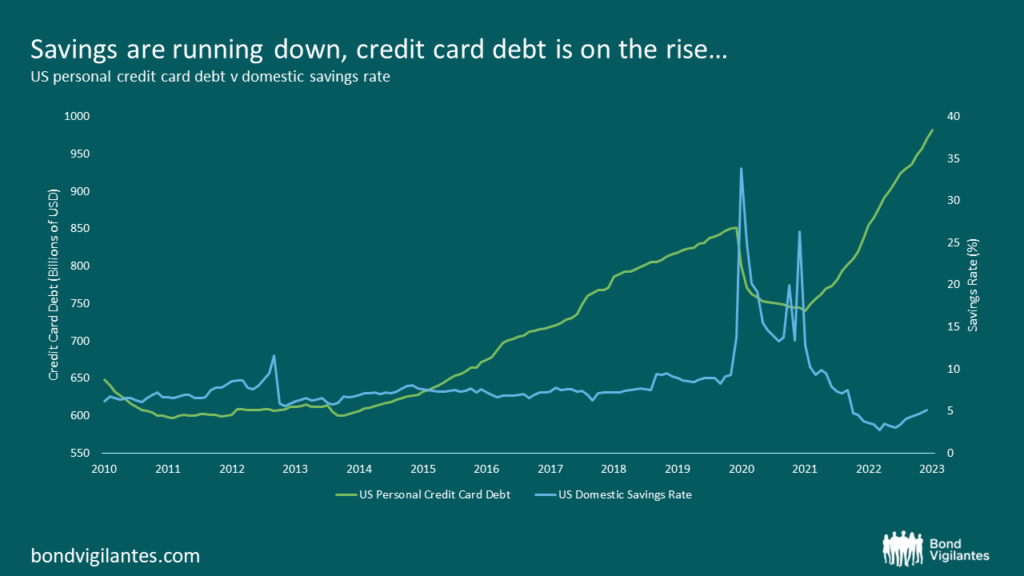

Perhaps the market has avoided a nasty recession to date as the consumer has remained defiant and run down their savings and significantly increased credit card debt over the past few years. The ability to do so going forward seems limited given savings rates are at or near the lows and credit card debt is at record highs with increasing annual percentage rates (APRs).

Source: Bloomberg (May 2023)

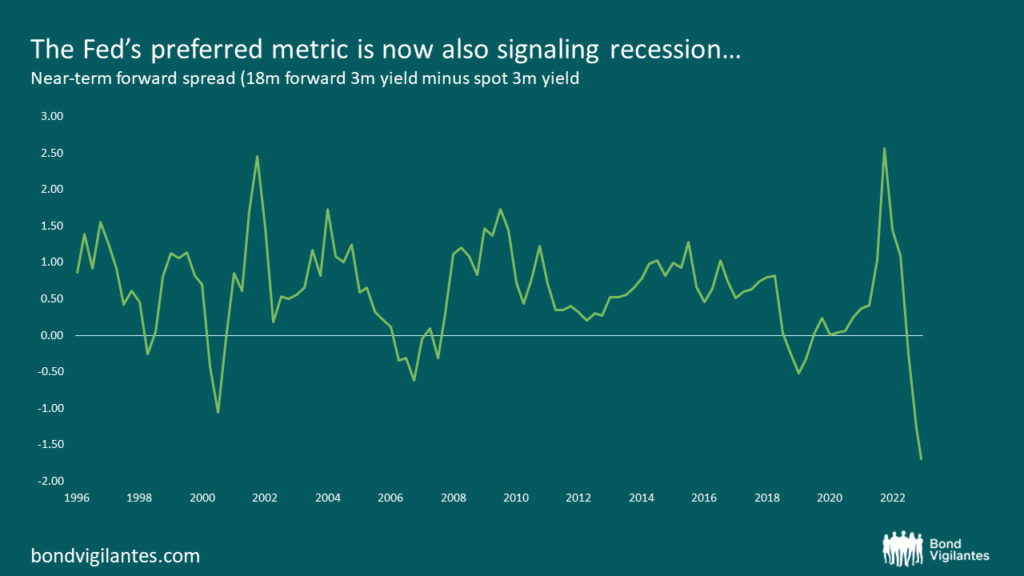

What is the market pricing? The ‘market’ has a particularly gloomy outlook and suspects recession is all but assured. The 2s/10s yield curve has been an accurate predictor of recession in the past and is currently highly inverted, signalling recession risk.

Source: Bloomberg (May 2023)

On the other hand, the Fed needs to engender confidence; they have said that the spread between 18m forward 3m and spot 3m yield is a better indicator and inferred that recession was less likely. I’m not here to say which measure is better, but… the Fed’s measure has rolled over in spectacular fashion and now suggests the same. That was quick.

Perhaps the biggest threat to inflation is artificial intelligence (AI)

AI has been predicted to destroy up to 300 million jobs in the coming years. Possibly a doomsday scenario, perhaps not. Mo Gawdat’s bestselling business book of the year, ‘Scary Smart’ gives a splendid and balanced view of this new technology and its impact on humanity. Gawdat was the former chief engineer at Google X, so we can be confident that he has a deep understanding of the sector. Worryingly, this was published in 2021, and things have moved on since then. Several takeaways from the book which struck a chord with me are:

- It is happening and cannot be stopped

- AI can already communicate better, observe visuals better and create as well as humans

- In 2019, Google’s supercomputer, Sycamore, outperformed the previous supercomputer by solving a problem which was considered impossible for normal machines and would have taken the then super compute 10,000 years to complete. Sycamore did this in 200 seconds. It is 1.5 trillion times faster.

Read the book, it really is terrifying.

Is this all scaremongering? Well, there must be something to this. Influential voices worldwide are pleading for regulation around the sector, but this is unlikely to meet its intended purpose. AI is simply progressing too quickly.

During the internet revolution, we witnessed Schumpeter’s creative destruction whereby the destruction of existing economic structures such as industries, firms and jobs were replaced by new ones via innovation and technological change. It always felt like a few industries were at risk, and if you weren’t in that industry, you could breathe a sigh of relief and move on happily with your life. This time it feels different. The breadth and scale of jobs now at risk are frightening.

A few examples are always helpful to help drive home the idea. Least at risk was always the Arts; this is no longer the case.

- Imagery/Art can be created in seconds – all that is required is a good description. Below is fully AI-generated image which I created/generated myself in 5 mins. This included downloading the app and fumbling around trying to figure out how it was done.

Source: Rob Burrows’ original creation

- Modelling – now take the above image and think about the modelling world. We no longer need models. Imagine advertising a pair of jeans. The advertising can be done globally and in seconds by simply picking your market and generating the image of an ‘attractive’ person wearing the said item of clothing for that demographic. Selecting male/female/young/old/small/big will be a simple button click.

- Music – AI is now creating music and is trending. Drake’s (I personally don’t know who this is) ‘wear my heart on my sleeve’ is currently trending. Musicians are now offering up the use of their vocals for a share in any future profits. It won’t be long until we no longer need human vocals. Hatsune Miku in Japan is an example of entirely generated AI music with a hologram presence and is extremely popular.

- The written word – Books and research papers can be written in seconds and across multiple languages. In fact, Hollywood screenwriters are going on strike to try and protect their industry and livelihoods.

An employment earthquake could be on the near horizon. Mass unemployment is certainly not a recipe for rampant inflation. There may, however, be unchecked profits for those companies that benefit from AI and a cost-cutting drive. Not a bright outlook for the man on the street. How will we all survive while on the unemployment scrap heap?

If such drastic change is upon us, we must rethink everything we know about economics and how society functions—no wonder the topic of universal basic income has reared its head again.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.