Emerging market growth: the largest frontier economies need to grow like Indo

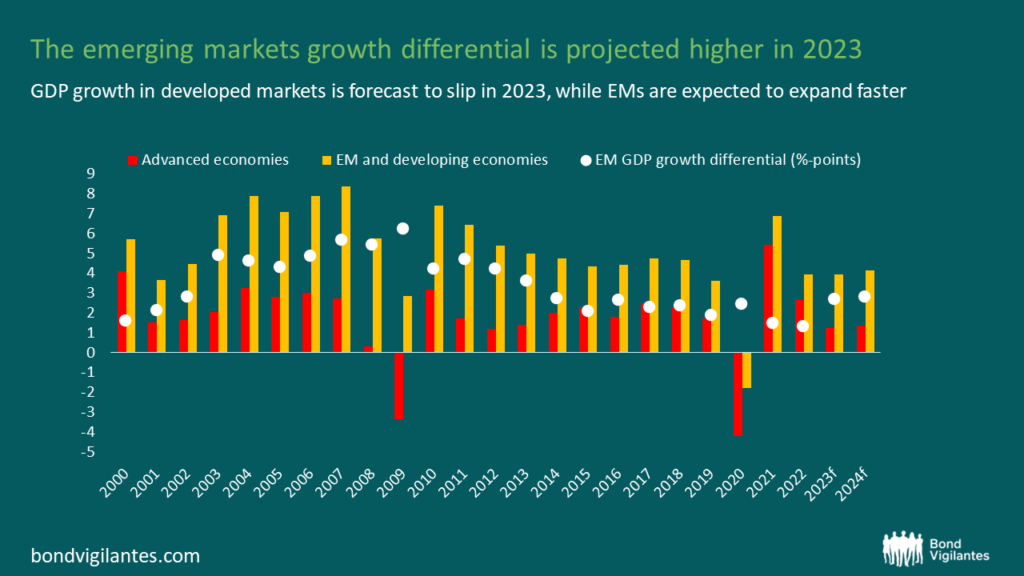

One of the key motivations for investing in emerging markets is their economic dynamism. This is evidenced by any pick-up in emerging markets’ growth over advanced economies.

There is good news. The IMF forecast that the global economy will grow, this year, and over the next few years – even if a couple of advanced economies slip into recession. Best in class are emerging markets, with their GDP growth differential (versus advanced economies) forecast is to pick-up in 2023 and 2024 to around 3 percentage points per year.

The biggest emerging markets global growth pulls tend to come from the very large countries, although not all are pulling their weight.

Source: IMF WEO (April 2023)

Emerging market giants

There are seven giant countries with populations over 200 million. Leaving the USA aside, the remaining six are emerging markets, that together make up 47% of the global population. This assumes Nigeria’s population is actually that big (noting this year’s census will be the first in ages).

India and China are the giants with the largest populations (India’s is now measured slightly larger than China’s) and have growing economies that are driving the emerging market growth differential. Indonesia’s growth size also makes an impressive contribution. Conversely, the remaining three giants–Pakistan, Brazil and Nigeria–are struggling to grow at a decent clip. And with that growth struggle comes challenges with stabilising public debt.

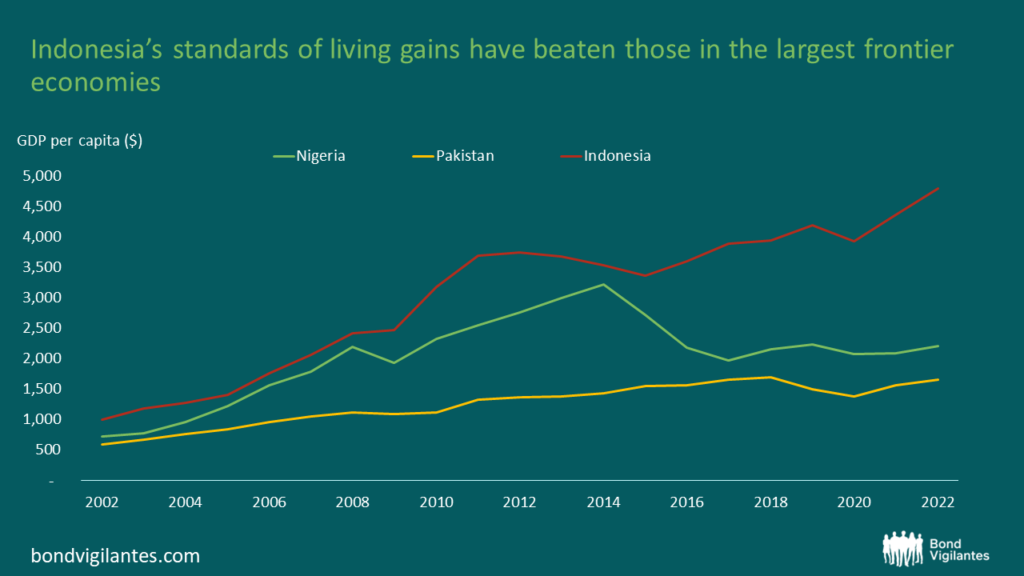

Brazil saw some robust economic growth for a decade before the global financial crisis, but it has since fallen from grace. An average GDP growth of 0.6% over the past decade leaves it outpaced by advanced economies. While its income level per person was far higher than China’s in 2010, it has since fallen a long way behind. Meanwhile the most disappointing performance is observed in Pakistan and Nigeria, where their starting point (that is lower-income levels) and population growth should be supportive of income levels catching up.

Source: IMF WEO (April 2023)

Grow like Indo(nesia)

Standards of living have improved in Indonesia with a growth engine that has relied extensively on its services and manufacturing sectors. Resource exports have played a crucial role, but have not dominated the development. Indonesia’s GDP per capita was the same as Nigeria’s in the early 1980s. Since then, and an Asian miracle growth later, Nigeria’s income per capita is just 36% of the Indonesia’s. Meanwhile, Pakistan’s income per capita is 29% of Indonesia’s.

Source: IMF WEO (April 2023).

Nigeria’s new President

Bola Tinabu was elected as Nigeria’s head of state in February. After his inauguration he’ll need to announce his team and get going with much needed reform. The bar is low following little progress over the past two political terms, but implementing policy in Africa’s largest economy is really hard. Nigeria produces oil, but not much when measured per person, leaving the country oil dependent rather than resource rich.

The recent oil price increase did little for Nigeria as production declined and fuel subsidies soared. So something new is needed for growth to pick-up from an average of 1.4% per year (less than population growth) that Nigeria recorded between 2015 and 2022.

First up is some macro-stability via tighter monetary policy to tame inflation, a revamp of the exchange rate policy and a reduction in subsidy to ease fiscal pressures. Beyond that, efforts to boost competitiveness and diversify the economy away from oil remain essential, but have long been elusive.

Pakistan’s pivot

It has already been an eventful election year in Pakistan. While the political cycle has been reaching its peak, economic activity has slumped after two years of post-pandemic rebound growth. The foreign exchange shortages and inflationary pressures have motivated import controls while investor confidence has evaporated. The country is also still enduring the impacts of devastating floods in 2022.

A debt crisis could push growth further from potential if Pakistan is unable to rekindle its IMF program and find the foreign financing it needs to meet its trade and debt refinancing needs. Whoever is in power in 2024 will need to embark on a series of reforms if they want to improve standards of living.

To pivot to better progress, the World Bank suggest productivity improvements (mainly a lack of competitiveness in its export sector), while identifying macroeconomic instability as a culprit for lacklustre investment. They also highlight how talent needs to be leveraged by investing in education and increasing female participation in the labour market (that is lower than in peers).

Summary

Indonesia has been able to push through many reforms. No story is perfect, and there are blemishes, but there are plenty of lessons from Indonesia’s success. If a better progress path can be found in large countries like Brazil, Nigeria, and Pakistan then the emerging market engine for global growth can get stronger and get the differential back to the elevated levels of the early 2000s.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.