Inflation: Not always and everywhere a bad thing

One of the well-known effects of inflation, albeit seemingly rarely discussed in recent times, is its ability to erode the value of debt. The (fixed or nominal) amount of money one has borrowed begins to shrink in comparison to one’s income as prices, wages, and earnings rise. A rising nominal income increases a borrower’s ability to pay.

The same is true of governments. All else being equal, higher prices, wages and earnings all result in higher tax receipts, and therefore should improve their fiscal position. However, all else isn’t equal. For reasons we know all too well, over the last few years government borrowing in Europe has been on the rise too.

So, the interesting question is where has that combination of higher borrowing and elevated inflation left government finances? I found some of the answers surprising.

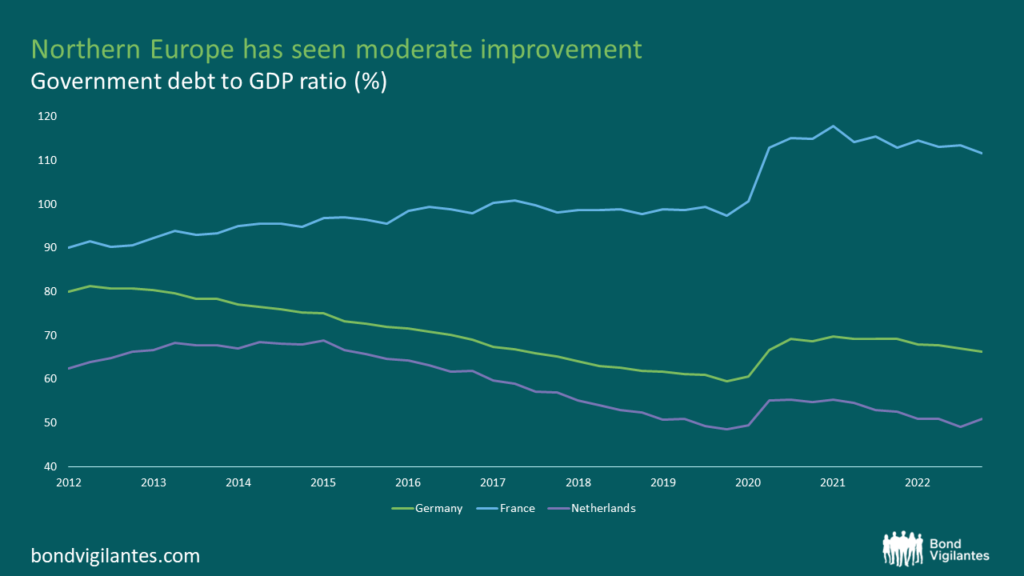

Let’s start with Northern Europe. Since the peak of debt/GDP in early 2021, the average improvement in this measure for Germany, France and The Netherlands has been 4.67%.

Source: Bloomberg (July 2023)

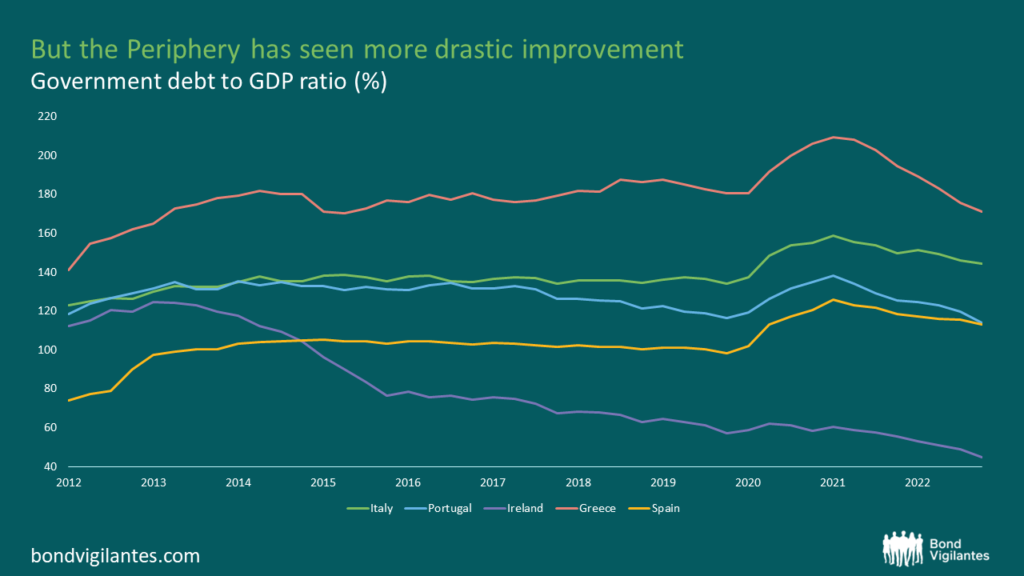

In the periphery, the average improvement has been a much more impressive 21.36%. A special mention to Greece, whose debt/GDP ratio has fallen by nearly 40% over the same period.

Source: Bloomberg (July 2023)

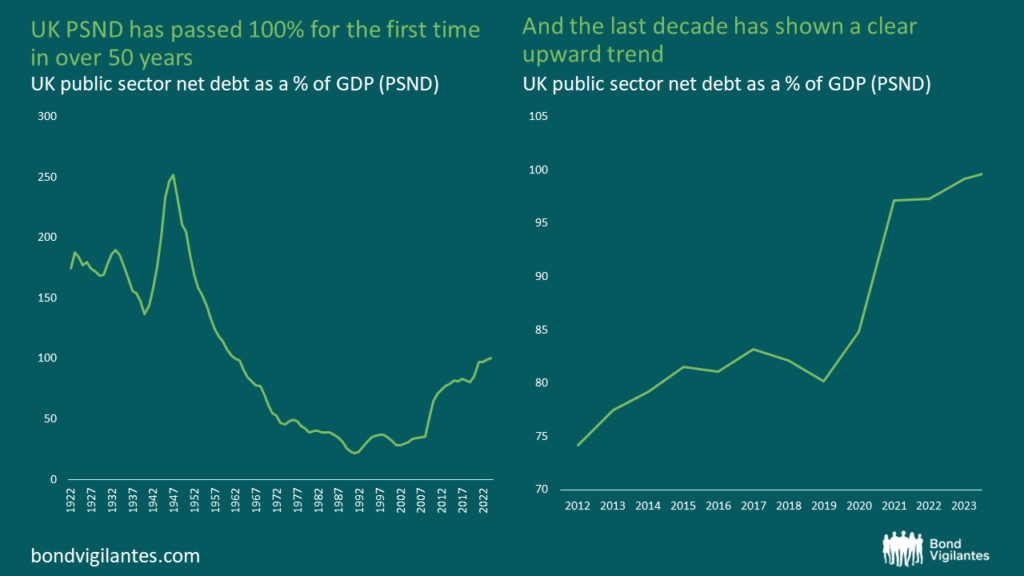

Sadly for our UK readers, there has been no improvement here. The situation has, in fact, worsened. The ONS recently announced that the debt/GDP ratio has (just) gone through 100% for the first time since the early 1960s. This despite the persistently higher levels of inflation we’ve been experiencing here compared to the rest of Europe.

Source: Office for Budget Responsibility (June 2023)

Taking the analysis a step further, what are the implications for asset prices?

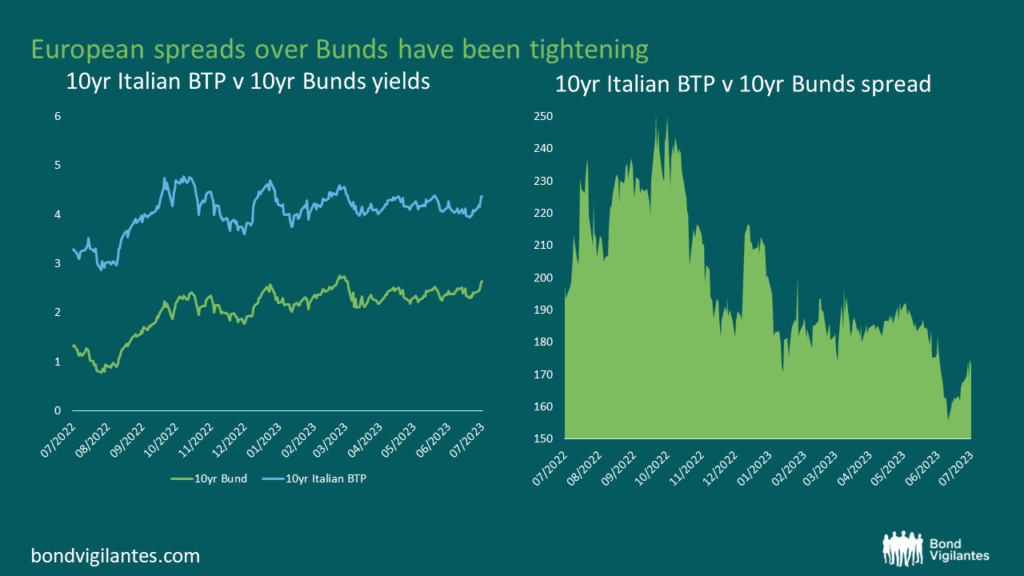

Well, if these trends continue (and we’ll hopefully be getting some new EU data soon) you’d have to expect the faster improving government finances in the periphery vs the core to result in spreads over Bunds to continue their recent tightening. Here’s Italy’s 10yr BTP vs 10yr Bunds as an example:

Source: Bloomberg (July 2023)

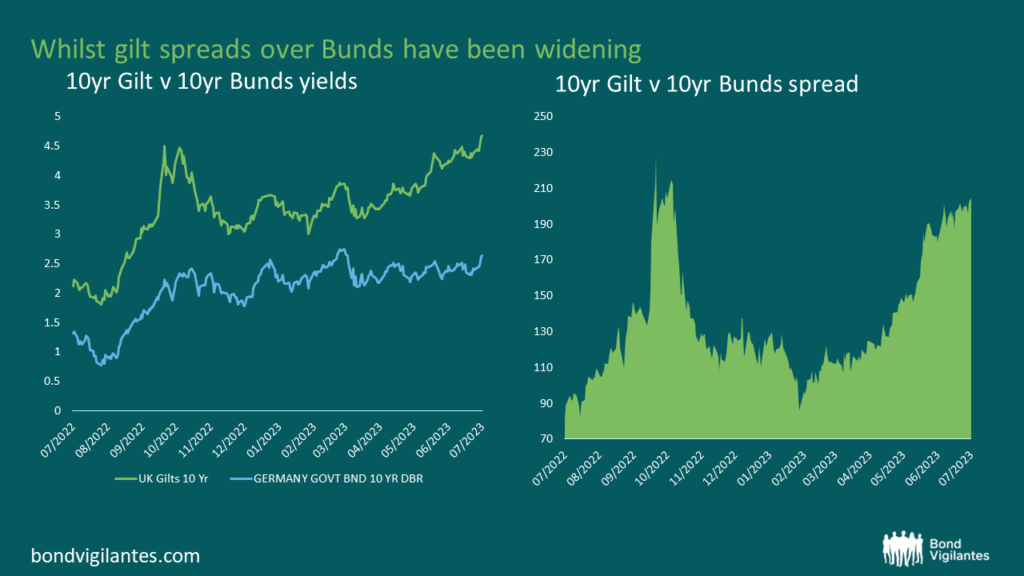

If the UK’s situation doesn’t improve, we’ll likely keep seeing our borrowing costs widen further vs Germany’s.

Source: Bloomberg (July 2023)

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.