Sterling High Yield Bonds – Drying Up?

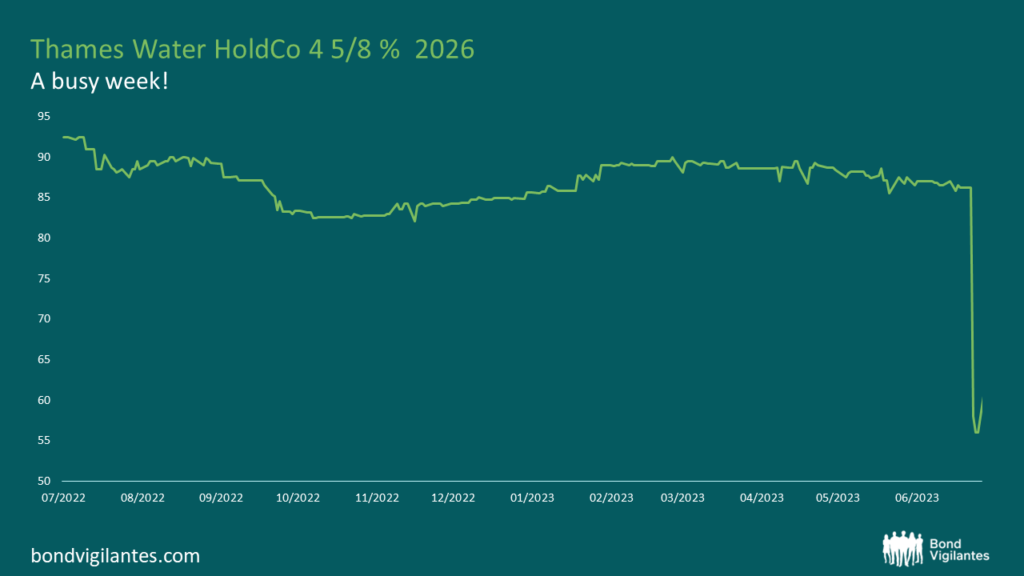

What a week for Thames Water. The indebted British utility company desperately needs a capital injection, has lost its CEO and remains in the spotlight as the regulator and government work on plans to deal with any potential failure. The fear that the HoldCo debt might be impaired in a nationalisation event triggered the bond losing more than 30 points over two days.

This is a high yield bond issued in Sterling. Recently, there seems to be a few troubled Sterling high yield issuers. I’ve heard complaints about Sterling high yield bonds having less trading liquidity compared to Euro or Dollar denominated bonds, and we have not seen many primary deals in this currency lately. Is the Sterling High Yield bond market drying up?

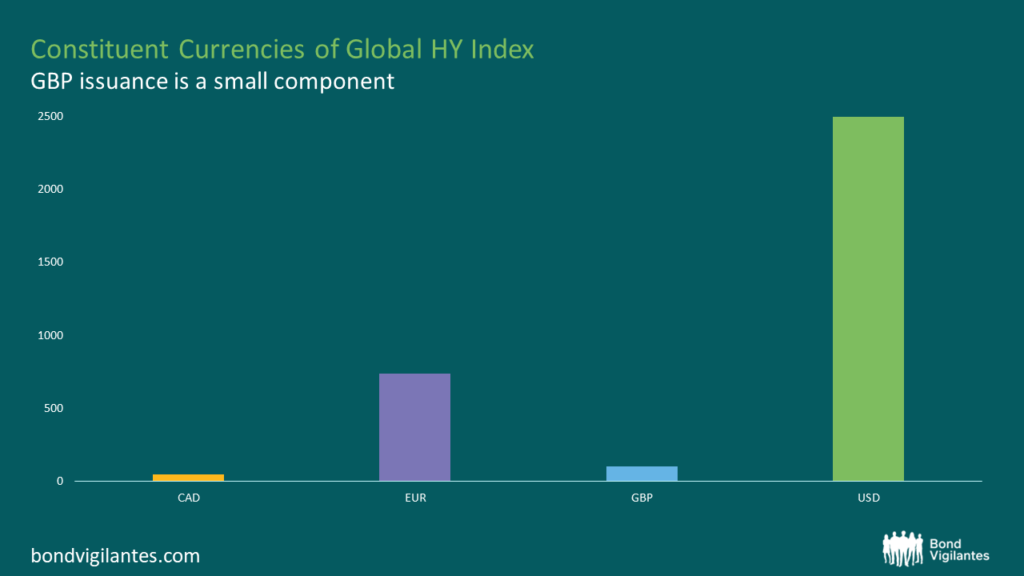

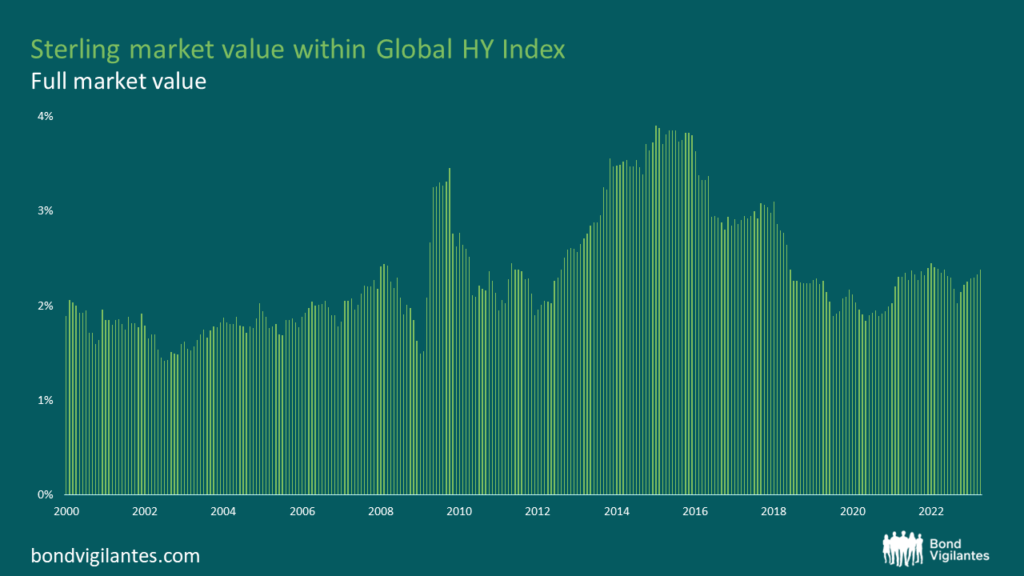

The number of Sterling bonds in the Global High Yield Index is very small, and in market value terms, Sterling bonds are also a very small component – only 2-3% of the index. The first question is – is it shrinking and disappearing?

To answer this question, we looked back more than 20 years, and found that it is not true: the Sterling HY bond market value has been ranging from 1.5% – 4% of the Global HY market over this period. It is now is lower than the pre-Brexit high, but definitely not lower than historic average, and it even enjoyed some growth since Covid.

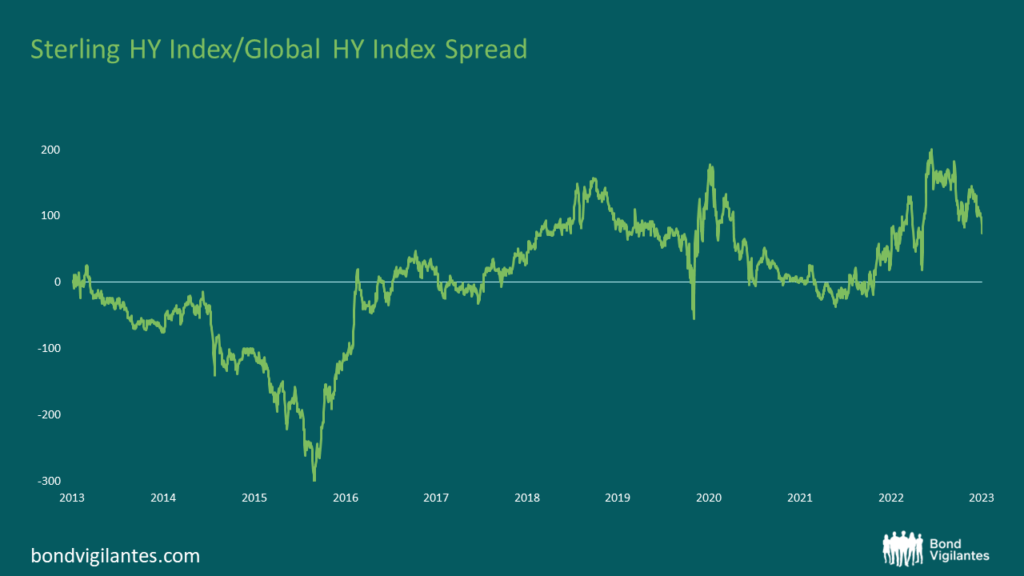

The second question – is the Sterling High Yield Market filled with riskier issuers/bonds?

If we believe spread is a true reflection of default risk, then yes. According to the chart above which compares Sterling and global HY spread level, Sterling HY bonds are trading at higher spreads and therefore have higher credit risk in recent years.

However, we can’t talk about the HY market without talking about the idiosyncratic risk of the issuers. Looking at Sterling HY issuers trading at distressed levels, there are troubled issuers like Boparan, the poultry supplier suffering from high leverage and high inflation; Garfunkel, the debt collector which still needs to prove its business model to the market; TalkTalk, the telecom company whose fundamental business model faces challenge and doesn’t generate free cash flow, and of course, Thames Water (Holdco). All these bonds are trading at alarming levels, indicating a high probability of default and/or low recovery value in a restructure. However, there are also many strong credits, such as B&M, the discount retailer who has a strong balance sheet and is benefiting from the current consumer environment; Pinewood, the production facilities provider for the film and TV industry with strong and unique market position and solid performance; Ford, the global auto manufacturer with the potential to become a rising star; and Rolls-Royce, the large Aerospace & Defence business currently benefiting from the air travel recovering post Covid and aiming to go back to IG in the medium term. All these bonds are trading at low spread level reflecting their credit strength.

So where is the Sterling HY market heading to? Just like in any market, I expect to see some default among Sterling issuers, but I can’t see the market being abandoned by issuers or investors. From an issuer’s perspective, they issue in the currency of the country where their assets/liabilities are. Issuers with an international presence might have the capacity to access other markets to issue more easily and cheaply, but they must consider the cost of swapping the currency and matching the liabilities, which could be expensive – especially when rates are volatile – therefore, most issuers choose to issue in the natural currency they need to borrow.

So as long as there are still assets based in the UK and future investments to be made here, Sterling HY bonds will hang in here – although remain small.

As for investors, when a bond’s spread/price is “punished” for being in Sterling, there are always attractive opportunities, especially for active HY fund managers.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.