Anticipating the ECB’s next steps in greening the CSPP

As outlined in a recent blog, bond investors have likely witnessed the final hike by the European Central Bank (ECB) of this economic cycle. With this in mind, investor focus might well shift to the ECB’s Asset Purchasing Programme. Bond investors should pay particular attention to the Corporate Sector Purchasing Programme (CSPP) following the ECB’s commitment to help managing and mitigating the financial risks of climate change by tilting or directing the ECB’s corporate bond purchases towards issuers with a better climate performance.

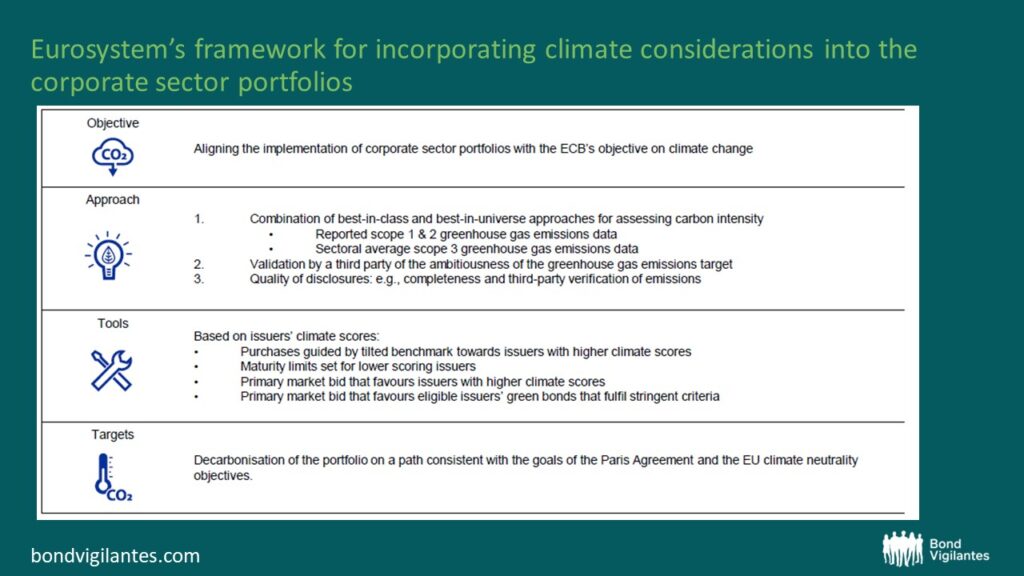

In March this year, the ECB disclosed details of their Climate Tilting Framework. As shown in the chart below, the climate approach focuses on a combination of backward-looking factors such as issuers’ carbon intensity, forward-looking metrics in the form of emission reduction targets, as well as disclosure quality standards. The climate score will then, among other risk factors, inform the ECB’s risk limits for their CSPP purchases.

Source: https://www.ecb.europa.eu March 2023.

The ECB has committed to decarbonise CSPP consistent with the goals of the Paris Agreement, which aims to keep the global temperature rise this century well below 2 degrees Celsius. The strategy so far was to tilt holdings towards issuers with better climate performance through the reinvestment of sizable redemptions. The ECB did acknowledge as part of the Climate Framework Disclosure that the large stock of existing holdings vis-à-vis reinvestments implies that it will take time for the tilting to have a substantial impact on the overall carbon metrics. So far so good, but here is where it gets interesting. The ECB halted their CSPP reinvestment in July 2023 as part of the run down strategy. Since CSPP represents 90% of the (circa €380bn) ECB holdings of corporate bonds, the process of decarbonising their portfolio via tilting the reinvestments essentially came to a halt. ECB President Lagarde acknowledged this in a July press conference by saying:

“…we stopped any asset purchases under the Asset Purchase Programme, because we are no longer reinvesting. So as a result of that under the CSPP, we are not reinvesting. We are letting that portfolio into run-off mode. What we have decided is that we will stick to our commitment to be Paris Agreement-aligned, and we will in the course of 2023 elaborate the means and the ways by which we will be Paris-aligned.”

ECB President Lagarde, 27th July 2023

This leaves the ECB with only a few options:

- Passive approach: Accept a misalignment with their climate commitment for the time being until their holdings with a low climate score mature or until market conditions warrant reinstating either a reinvesting approach or expanding the CSPP programme.

- Active approach: Coordinated selling of holdings with a low climate score, and, depending on market technical, replacement of sold bonds by buying securities with a better climate score, also known as a stock-based tilting approach.

The ECB has a role model function to play: therefore my view is that the ECB feels obliged to pursue an active approach to ensure they stay in control and make further progress in mitigating the climate risks of their corporate holdings and achieving a Paris-aligned portfolio. Given the importance of the ECB as one of the largest buyers and sellers of corporate bonds, as well as setting the blueprint for other market participants, it is paramount for fixed income investors to anticipate the ECB’s next move and to reflect this important market technical in the pricing of affected bonds. With that in mind, the M&G Fixed Income Team have worked with M&G’s Climate Team to approximate the ECB methodology using the disclosed information.

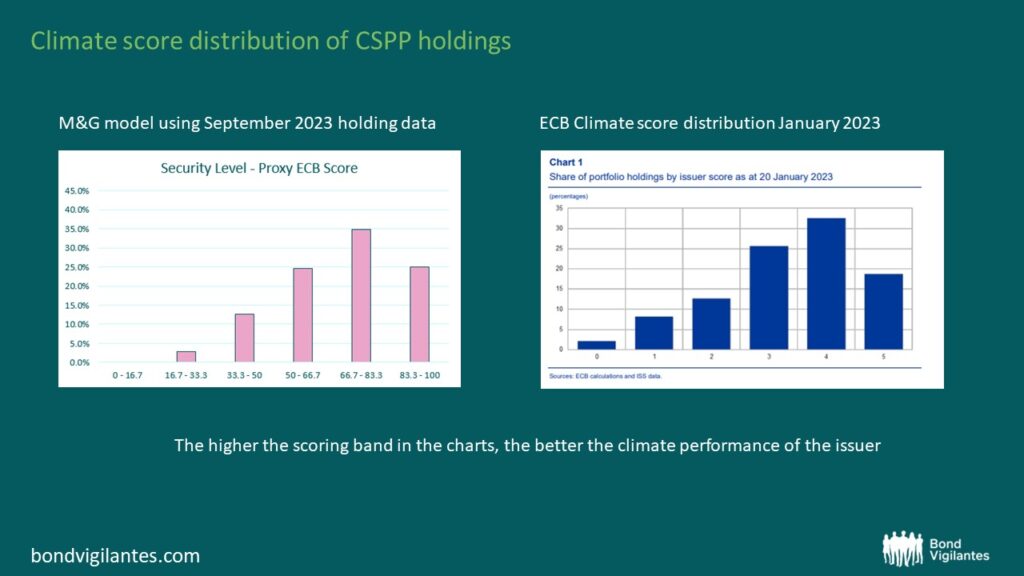

Source: ECB, M&G 2023. M&G model assumes equal security weighting. Green bonds and utilities receive scoring uplift.

While the distribution of the M&G model looks similar to the official ECB chart, it is important to note that various information gaps remain. While the ECB releases the held securities, no effective weightings are published. In the absence of any better information, our model assumes equal weighting of securities. Furthermore, preferential treatment is given to green bonds and utilities following ECB board member comments advising not to divest initially from those companies whose actions are particularly important in managing the green transition. It should also be noted that the ECB’s climate-related financial disclosures of corporate sector holdings dates back to January 2023, while our model used the latest available holding data published in September 2023.

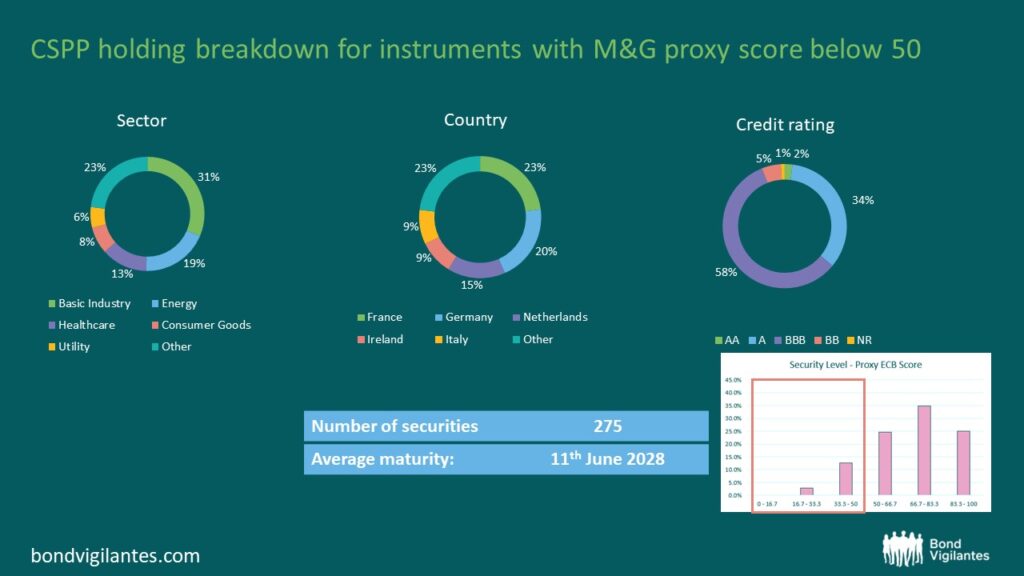

We are most interested in securities that fall within the three lowest rated buckets, equivalent to the ECB bands 0 to 2, as we anticipate that those securities are more likely exposed to selling pressure should the ECB decide to move to a stock-based tilting approach. The chart below highlights our findings.

Source: M&G, October 2023. M&G proxy score of 50 equivalent to ECB bands 0-2. M&G model assumes equal security weighting. Green bonds and utilities receive scoring uplift.

In terms of CSPP holdings, our model suggests that basic industry, energy and healthcare are the sectors most prone to ECB selling pressure. French and German issuers seem to be most affected which is unsurprising given those two countries are home to the largest corporate bond issuers in Europe. Irish issuers seem disproportionally highly exposed at 9% considering their smaller share of overall ECB eligible bond issuance. In terms of credit ratings, it looks like BBB rated issuers are overly exposed. They make up 58% of the lower climate bands while BBB companies account for 48% of Euro Corporate Bond index. We estimate the average maturity of the three lowest rated climate buckets to be just below 5 years. My hunch is that, should the ECB decide to start stock-based tilting, the initial focus would be on shorter-dated bonds to avoid realising capital losses on longer maturities with a low climate score.

We will continue to update and re-calibrate our model as more information comes to light about the central bank’s climate approach. Even in the absence of further interest rate action, upcoming ECB communication will require close monitoring from corporate bond managers for various reasons, one of which is further hints on the ECB climate strategy.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.