Is Initial Price Talk a genuine price discovery tool?

Arranging banks (on behalf of bond issuers) typically release the initial price talk (IPT) at the same time as the announcement of a bond deal. It is seen as a crucial tool for new bond price formation and is traditionally stated in yield terms for high yield (HY) and spread over benchmark (or swap curve) for investment grade (IG) bonds. From an investor’s perspective, spreads are the better way to analyse value in a bond because the benchmark rate can change over the course of the new issue process (we have seen some significant moves in the past couple of months) and diligent investors will transpose yield into spread terms.

Once the book building process has started, banks release updates on pricing (e.g. price guidance) and it is almost exclusively one way: tightening. This stage allows banks to test the order book with an improved pricing for their client (the bond issuer). After the guidance is released, if investors pull their orders below the targeted issue size, then the tightening has been too aggressive. Conversely, if investors stay in the deal and the order book is still multiple times the targeted size of the new issue, then there is room for further tightening. In reality, this process is more of an art than a science and there are many other factors that influence pricing, such as market conditions, quality of the book, issue size, flows, secondary trading success, and obviously the issuer’s view. Taking all of these factors into consideration, banks release final pricing.

I’ve always hit a wall when I have asked a few banks if they had any statistics on initial price talks vs final pricing of newly issued bonds. I therefore decided to crunch some numbers looking at emerging market (EM) sovereign and corporate USD-denominated bonds issued in 2023. In the IG space, results were a bit of a shock, so I also ran statistics on developed markets (DM) to see if this was EM-specific. In total, I have reviewed over 1,100 bonds, denominated in US dollar and issued in 2023: c. 900 IG bonds issued by developed market corporate bond issuers and c. 250 EM sovereign and corporate bonds (165 in IG and 77 in HY). Here are a number of observations:

- Not a single deal priced wider than IPT. Only ten deals (<1%) priced at the initial price talk.

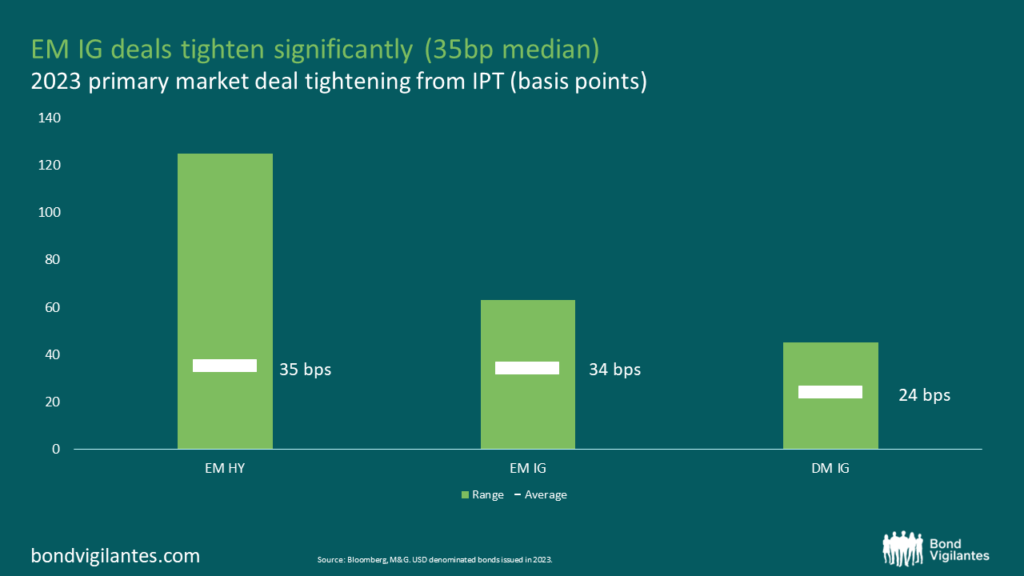

- EM IG deals tighten significantly in absolute terms. Within the sample, spreads tightened by a median of 35bps (average of 34bps) with a range of 0 to 62bps. This is rather counterintuitive: 30 basis points can mean a lot in the IG world, where issuers generally have a bond curve which should make pricing of new bond fairly simple; however, HY issuers may only have one (or even no) bonds outstanding, which means that price discovery is genuinely needed… We discuss below why IG IPTs are often set at somewhat ridiculous levels.

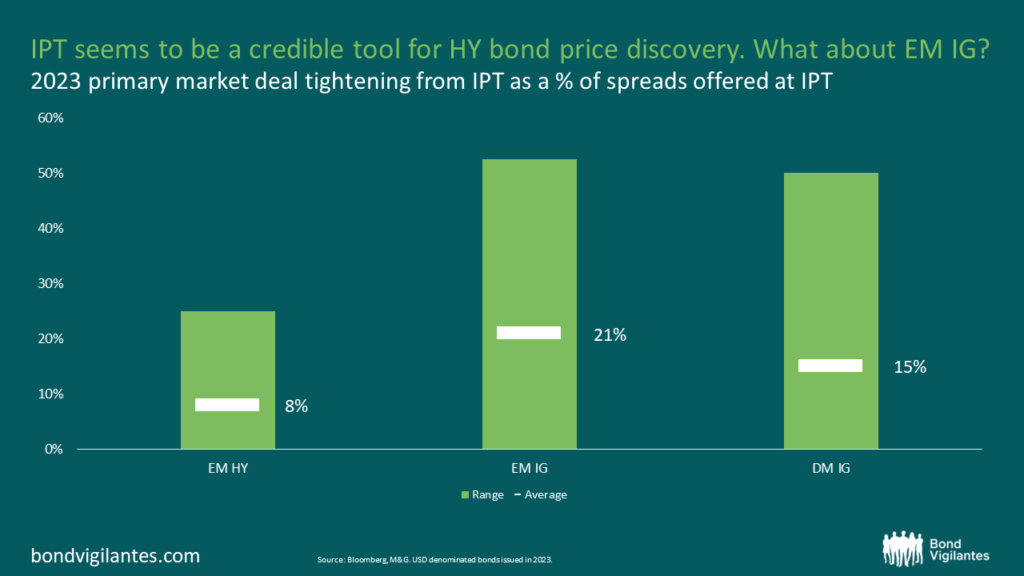

- EM IG deals tighten more than HY deals. Whilst in absolute terms, HY deals tighten by a larger amount (range 0-125bps), in reality they tighten much less than IG as a percentage of initial spreads offered at IPT. EM IG deals saw an average tightening of 21% with some of them as high as over 50%. EM HY deals tightened on average by 8% in spread terms, with a maximum range of 25%. The median tightening of EM IG is 35bps vs 33bps for HY.

- DM IG ($) deals tightened by a median of 25bps vs 35bps for EM IG ($). As a percentage of initial spreads offered at IPT, DM IG averages 15% (range 0-50%) vs 21% for EM IG.

- With less than 10% spread tightening on average for EM HY, IPT seems to offer a credible starting point for price discovery of less liquid asset classes.

- There seems to be a geographic bias to tightening. In 2023, the top 15 EM IG deals that experienced the most tightening are all from China. They are followed closely from South Korea. Interestingly, within IG the region that saw the least tightening (in USD) was Eastern Europe (Romania, Hungary) – likely due to reduced demand for US dollar paper.

Based on the above observations, the relevance of IPT as a price discovery tool in EM IG is questionable because they are consistently unrealistic. Using an analogy with the residential property market, what would be the point of intentionally marketing a house 25-50% cheaper than its fair value if not for the sole purpose of building interest of buyers that would otherwise not bother?

There is no doubt that a massive order book on the back of an unrealistic IPT presents the illusion of a successful deal. But syndicate banks argue that (i) they face reputational risk of a failed deal, hence they must play safe by setting higher rather than lower IPTs, (ii) some investors themselves don’t stick to their Indication of Interest (IOI) and too often communicate inflated pricing interest ahead of the deal, and (iii) at IPT investors still retain a free option to pull their order if the deal tightens later on. Whilst the “free option” argument is true, asset managers as investors have many psychological biases, in particular commitment bias and waste avoidance, that may alter good judgment and lead to them not pulling their order.

On the buy side, when a new bond deal is announced, hours, sometimes days of research have already been performed by the credit research team. The portfolio management team discusses the deal together with the research that has been produced, analyse the risk/reward of the bond security, its relevance to portfolio construction, etc. In addition, the data management team, fund manager assistant team and so on ensure that the relevant security is well set up in the order management system and upon a decision to invest, a number of additional checks are performed (e.g. pre-trade compliance) and the dealing desk finally communicates the order to the banks. Many individuals/systems are involved in this process and the allocation of resources is significant.

So when IPT comes very attractive, an order is placed, and final pricing comes after unreasonable tightening, it is the responsibility of the portfolio management team to maintain strong discipline and pull their order, i.e. fight a tendency to stick to an original order (commitment bias), for which a lot of resources and time have been deployed (waste avoidance). It is admittedly more difficult to pull an order at the very end of the process rather than to pass on an opportunity ahead of that same process.

Again using the property market analogy, it is never easy to pull an offer where a seller increases the price of a property just before exchange and after months of due diligence by the buyer. As long as investors do not apply strict discipline on pricing by setting a limit – and, more importantly, sticking to this limit – it is likely that emerging market IPTs in the IG space will continue to be used by banks as a book-building momentum tactic as opposed to what it should really be, a genuine price discovery tool.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.