The single-bond EM sovereign issuer: overlooked, underappreciated

I recently attended a panel on emerging market (EM) corporate bonds and one of the speakers mentioned their extra caution (or even avoidance!) in investing in corporate issuers that have only issued a single bond. While the investor did not delve deeper into the topic, this is something I rarely pay extra attention to when investing in sovereign hard currency bonds. Most of the factors that apply to a single bond issue can also apply to an issuer that has issued a series of bonds.

- Assessing the issuer’s fundamental trajectory from an economic and political/policy making angle

- Ability and willingness to pay

- Transparency and governance

- Data quality and ability to monitor the credit subsequently

- Liquidity of the instrument

A major difference is that, while corporates may ‘disappear’ (go bankrupt, be merged, sold etc.), sovereigns rarely do. In fact, many sovereigns are serial defaulters with several bonds outstanding (Argentina, Ecuador etc). Their history has not prevented them from issuing new bonds once investors perceive new stability.

Are single issue sovereigns worse investments than countries with a well-developed curve?

Puzzled, I decided to review the sovereign hard currency bond universe to see if this is justified or not.

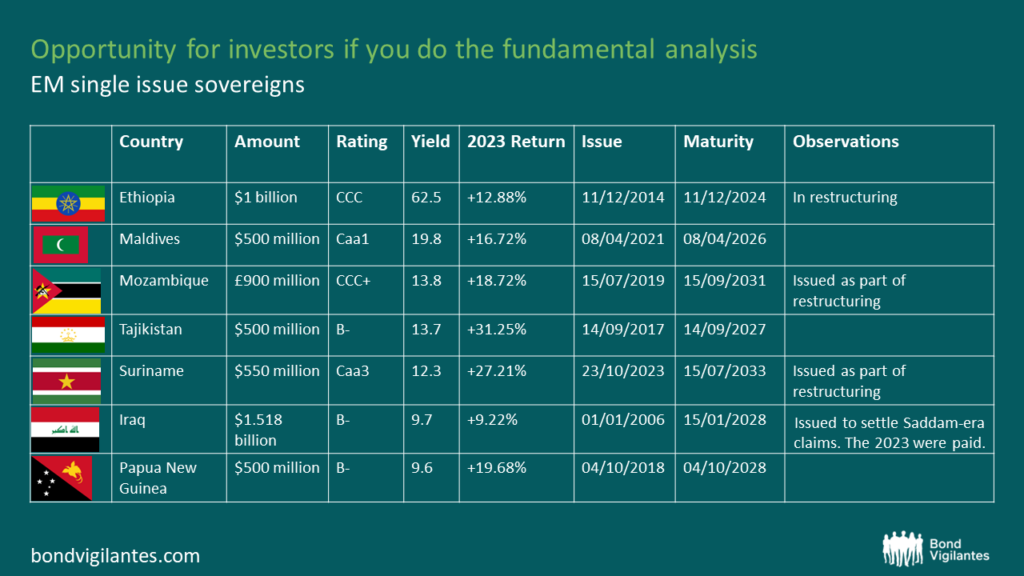

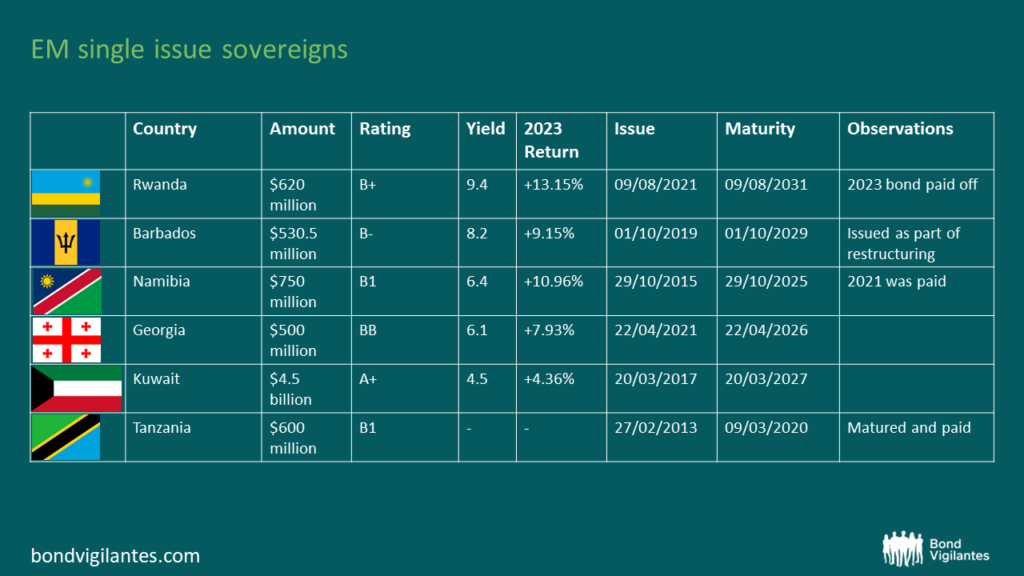

A first time issuer lacks a repayment track record and assessing the fair value of a debut issue can be challenging. However, many issuers have issued a single debut bond and have subsequently had successful further issues. Some of these matured and were repaid, or were refinanced with other new issues, cash or other types of debt. Other issuers have been less successful and have already or will have to restructure their bonds. There is also uncertainty over some single issues due to mature in the coming years (Maldives and Mozambique) and whether they will pay back in full.

Source: JPMorgan, Bloomberg, M&G (December 2023)

Source: JPMorgan, Bloomberg, M&G (December 2023)

Most of these issuers are smaller economies that cannot issue more than one bond. Many issuers chose to issue $500 million, which is the minimum amount required for inclusion in the JP Morgan EM Bond Index, a widely-used benchmark. In some cases, a single $500 million bond can be close to 10% of GDP! Some issuers (Namibia, Iraq, Rwanda) paid back earlier bonds, but some have restructured over the last few years (Mozambique, Suriname, Barbados) or are in the process of doing so (Ethiopia). Still, the overwhelming majority of the credits are high yield. In fact, Kuwait is the only investment grade credit and it has not issued additional bonds out of choice, as it consistently runs fiscal surpluses and has very little debt. Georgia is the rare BB credit which has also chosen not to issue additional Eurobonds.

Conclusion

As the 2023 returns show, these types of credits can often contribute to outperformance, if one gets the fundamental call right. Equally, things can end in tears if one gets the story wrong. While these credits are normally riskier and often require a deeper analysis than mainstream EM names, they should not be shunned altogether. In fact, the table includes one of our former investments, my beloved Tanzania 2020 floater, which matured and got fully repaid. We look forward to similarly interesting new opportunities in the future.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.