Portfolio Trading – Three key advantages for investors

Portfolio Trading (PT) has seen a sharp rise in prominence over the last few years, establishing itself as an integral part of today’s world of credit trading. Thanks to improved integrated technology, fixed income dealers have made significant advances from the rudimentary embers of trading lists of bonds on spreadsheets over email.

In a PT, a list of bonds is traded on an aggregated weighted average price or spread. This can be executed at any point in time, or against benchmark prices, such as the 16:15 Bloomberg BVAL1.

I was prompted to write this blog when, in December last year, I was hearing from salespeople and traders alike about the contrast in liquidity provided to clients through PT compared to single line Request-for-Quote (RFQ). As a trader at M&G, I had first-hand experience of this dynamic as we were able to source illiquid and off-the-run bonds amidst a backdrop of a rallying market.

- Increased Liquidity

The key advantage of PT is its ability to give rise to increased liquidity. Portfolio trading sees the aggregation of multiple liquidity providers within the same institution: a line trader, the algo book, and the PT team. Aggregating these liquidity sources has proved to be very powerful. The team pricing the PT in aggregate also analyses the risk differently. Instead of modelling each individual bond trade, they consider the collective risk profile of the portfolio and how it maps against current positioning, or how readily the risk can be hedged via an Exchange Traded Fund (ETF) or a synthetic index.

The same can be said from the client perspective as well. In general, the price and transfer of risk via a PT is considered from an aggregate perspective: the all-in-cost. For example, if a client is able to buy or sell a large list of bonds within the composite bid/offer, even with a few individual line items priced outside of this spread, it would represent a good outcome in most cases.

- Positioning

Active Investing

Access to liquidity allows an active manager to achieve their desired weightings within a portfolio. Active Managers aim to generate alpha through conviction in their overweight and underweight positions. If they are able to source or place bonds to maintain these convictions, this maximises that alpha for clients and helps to reduce tracking errors across strategies.

There are multiple examples of bonds that are mispriced, offering compelling value due to factors such as being unrated by credit agencies or perhaps sub-benchmark tranche size. These off-benchmark positions can be illiquid, particularly during periods like August and December when desks are not fully staffed and individual line items can be difficult or impossible to trade. However, within reason and with full transparency, dealers are more willing to price these types of bonds if part of a larger PT.

Exchange Traded Funds and Passive Investing

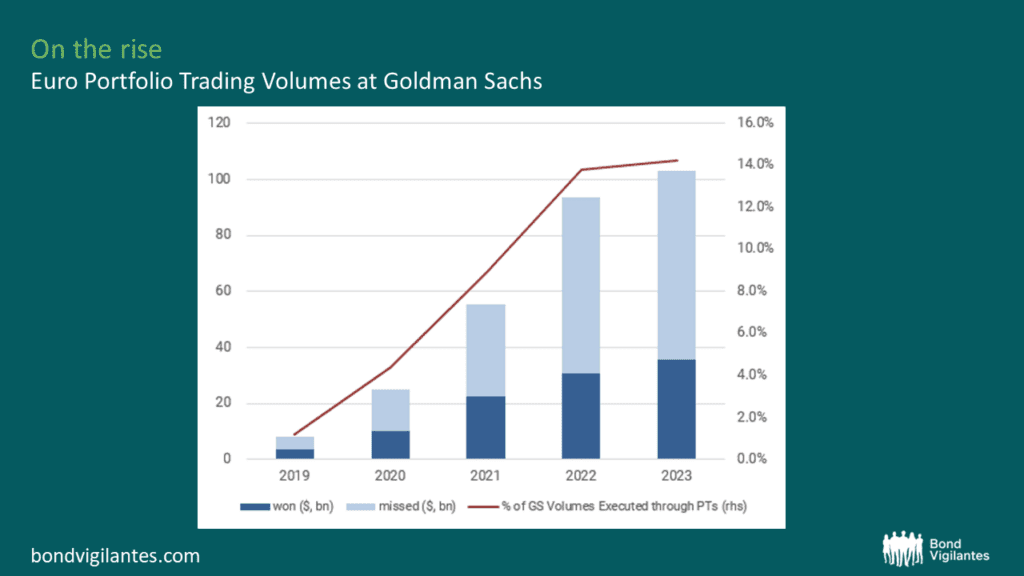

The development of PT tools has been greatly aided by the increased transparency in cash bond markets. This has been driven by a growing market-wide acceptance of third party pricing tools in credit (BVAL/CBBT2) and the growth in passive investment and ETFs. The availability of pricing points for dealers to accurately price a portfolio of risk has improved dramatically. This has led to a hugely competitive landscape for PT, particularly within the Euro and US Dollar investment grade markets, which has been the focus of the PT activity. Estimates suggest that PT volume constitutes 10-12% of overall market volume.

The below chart illustrates the growth of Euro PT volumes at Goldman Sachs:

Source: Goldman Sachs, as at 23 February 2024, €m volume has been converted back into $ equivalent

- Certainty of Execution

M&G primarily uses PT to facilitate large client flows. Similarly, PT has proven to be a highly effective method of launching funds, with some instances of investing €1bn in a single day across multiple asset classes. Historically, the capacity and technology were not widely available to facilitate this type of flow repeatedly. The enablement of straight-through processing and associated transaction cost analysis represents a significant advancement from the multiple technology providers. A comparable flow from start-to-end could quite easily have taken over a week to transact five years ago.

This has enabled a confident message to be relayed to clients and sales/distribution teams about the ability to invest, thereby minimising clients’ time out of the market.

There are multiple types of client for PT. I have discussed the benefits to an active manager throughout this blog. There are also heavy users of PTs around month-end, whether it be passive funds rebalancing to benchmark, or income-type products that are sold throughout the month and then those proceeds invested at of the end of the month. Insurers and pension funds also use PTs to rebalance their asset allocations/investment risk profiles.

The LDI crisis in the UK also saw some heavy use of PT even within the Sterling market. Managers were forced to fund client outflows quickly as the Gilt market experienced heavy volatility. PT offered clients an avenue that provided certainty of execution for all line items in a time of maximum stress.

Looking ahead

I observe substantial investment into PT ecosystem across many market participants and believe the protocol will grow in importance within fixed income trading. Time will tell whether PT can be expanded further across other asset classes but, for now, we will continue to collaborate with all proponents of PT.

1 BVAL is a Bloomberg Valuation which provides pricing at different snapshots throughout the day based on both indicative quotes and direct comparable, if illiquid.

2 CBBT is a real-time composite, based on the most recently available executable contributions from dealers.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.