EM sovereigns: higher financing needs amid tighter valuations call for increased differentiation

A couple of weeks ago, the International Monetary Fund (IMF) released its usual semi-annual World Economic Outlook update. While the whole process of forecasting has seemingly become increasingly difficult in recent years (partly due to inherently unpredictable crisis events), the IMF’s views retain their gravitas of authority. One can agree or disagree with them, but nonetheless they continue to serve as a point of reference, especially for emerging market countries – for which there is less certainty, data and knowledge (compared to advanced economies). This time the main message from the IMF has been somewhat unusually bullish, especially taking into account its conservative nature. The institution claims that the global economy has avoided a recession despite “many gloomy predictions”, whilst a robust monetary policy response has successfully combatted the inflation surge, guiding the economy towards a soft landing. With some room for monetary easing to support economic growth in the near term, the IMF now emphasises the need for more pronounced fiscal consolidation.

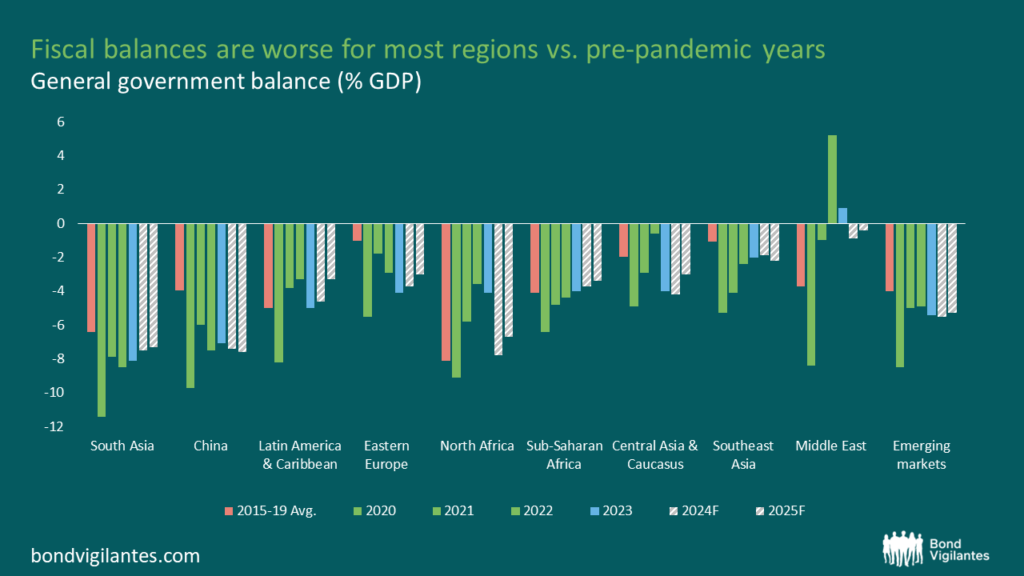

For emerging market economies, 2023 has been confirmed as the year of fiscal expansion – with the average EM fiscal deficit widening by 0.5pp from 2022 to 5.4% of GDP. Moreover, the IMF expects it to inch higher to 5.5% of GDP in 2024. Looking back, just a year ago, the 2023 fiscal expansion was assumed to be a one-off to be fully reversed in 2024, with further fiscal consolidation in the following years. In contrast, now the EM fiscal deficit is expected to remain above 5% of GDP until the end of the forecast horizon (2029). Effectively, this implies that post-COVID fiscal consolidation was, on average, completed in 2022, and the EM fiscal deficit is no longer expected to return to 2015-19 average of 4% of GDP (Figure 1). This pushed EM general government debt to 68% of GDP in 2023, compared to 55% in 2019. Although the aggregated EM numbers are heavily skewed by China (which witnessed a substantial increase from 60% of GDP in 2019 to 84% in 2023), general government debt remains higher than in 2019 for the majority of EM countries (Figure 2).

Source: IMF, M&G

Source: IMF, M&G

At first glance, a slightly higher EM fiscal deficit might not appear to be a significant change – perhaps until one considers that EM nominal GDP was close to $43 trillion in 2023. Moreover, the IMF expects it to rise by another $2-3 trillion per annum in the coming years. So even a 0.1pp of GDP deficit widening in 2024 implies a further c.$170 billion increase in financing needs for EM sovereigns as a whole, on top of the c.$260 billion increase that already occurred in 2023. This money will have to come from somewhere in an environment where still-high interest rates are expected to persist across EM countries at least through 2024, as evidenced by their recent repricing in line with the more hawkish US Fed. While international financial institutions and multilaterals might be expected to step up their financial support, increased market debt issuance looks unavoidable as well. With the exception of a few large and higher-rated EM sovereigns, local markets lack the sufficient depth to absorb such an increase, so the support will have to come from higher external issuance.

Further adding to the external financing needs, EM sovereign hard currency amortisations and coupons are expected to reach an all-time high of $134 billion this year, up by $32 billion from last year (as estimated by JP Morgan). Taking into account all of the above, it is not surprising that Q1 2024 sovereign external issuance in EM turned out to be one of the highest on record, with countries like Poland and Romania already matching or exceeding their issuance for the whole of 2023.

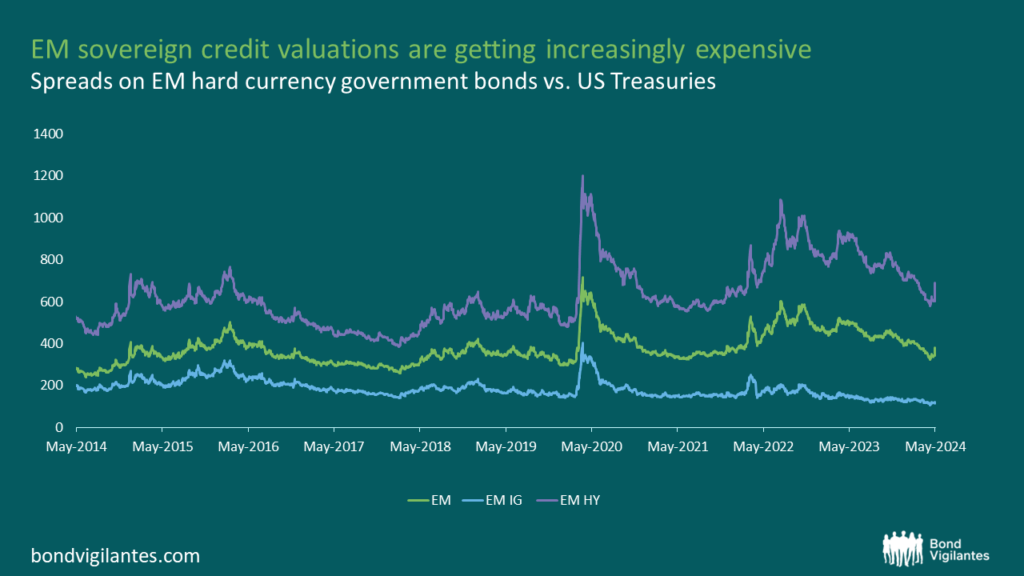

While the market seemingly digested the high issuance of 2023 without problems, one should not forget that it had been (correctly) expected to be a very good year for EM fixed income following the slump of 2022, prompting investors to buy risky assets. The situation may well be different now with EM hard currency sovereign spreads already at somewhat expensive levels following the broad multi-month rally (Figure 3). In other words, the market would now have to absorb even higher issuance levels without the ‘almost guaranteed’ base-effect boost to the expected total returns witnessed in 2023. All of this happens against the backdrop of EM-dedicated bond funds, on aggregate, continuing to register outflows this year, making the market more sensitive to inherently more volatile flows from non-EM-dedicated investors.

Source: JP Morgan EMBI indices, Bloomberg, M&G

Looking a bit deeper beneath the surface, the situation appears to be more diverse (and somewhat better) than the aggregated IMF data suggests. Fiscal deterioration in 2023 was far from uniform across EM, with some regions performing much better than others (Figure 1). In particular, for South and Southeast Asia the fiscal deficits were actually lower than in 2022 and are expected to improve further this year. Moreover, most countries with the largest deficits in Asia (e.g. China, India, the Philippines, Malaysia) are investment grade sovereigns with established local debt markets, which should limit any financing concerns. Importantly, the fiscal deficits for most Sub-Saharan African (SSA) countries were also lower in 2023, and the IMF expects them to trend further down in 2024-25. With SSA countries being generally the lowest-rated across EM, it is indeed encouraging to see this trend, as well as recent market access from some SSA sovereigns after years of pause.

Meanwhile, other EM regions experienced significant fiscal deterioration in 2023. Middle East and Central Asia & the Caucasus were the worst-performing in relative terms, impacted heavily by lower commodity prices after very high levels observed in 2022. On the positive side, for most countries in these regions the underperformance only meant a change from fiscal surpluses of 2022 to either lower surpluses or small deficits in 2023. For Central Asia & the Caucasus, the aggregated data was also skewed by Turkey which experienced an earthquake, and had important elections in 2023, which led to a significant spending boost. In fact, many countries among those lacking near-term fiscal consolidation plans will have elections this year or next – e.g. Romania, Mexico, South Africa, and Poland. It will be important that this election-related underperformance is reversed in the subsequent years.

Against the backdrop of higher EM sovereign external financing needs and still-high interest rates, even the countries that are making good progress on fiscal consolidation should not rest on their laurels. In the environment of EM sovereign credit valuations becoming increasingly expensive and EM-dedicated bond funds, on aggregate, continuing to register outflows, the market will increasingly differentiate between EM issuers, favouring fundamentally improving stories with credible policy track records.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.