Emerging Markets debt: 2024 review and 2025 outlook

The base case macroeconomic scenario for 2025 is still in a state of flux given the uncertainties regarding policy, especially in the US. Hopefully, the fog will start dissipating in a few weeks once the new administration takes office, but it is possible that we will still be wondering what happens next for several months. The consensus appears to be that there will be tariffs imposed on Chinese goods (60%?, what type of goods?), but it is far less certain how much will be applied to other countries.

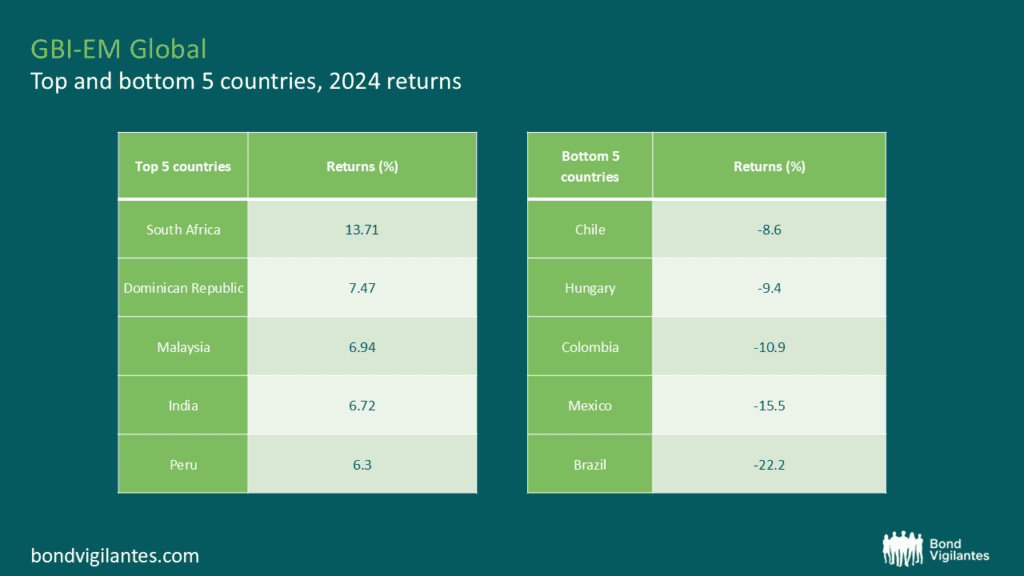

While macroeconomic uncertainties abound, the geopolitical and political outlook might be less murky. Key geopolitical issues (Russia-Ukraine, the Middle East and China-Taiwan) remain unresolved but perhaps that is an area where the Trump administration can surprise on the upside. Furthermore, the election calendar in 2025 is not as heavy as what we saw in 2024. Markets tend to associate the election uncertainty with downside risks and negative performance, but in fact, the opposite can often be true. South Africa posted stellar local currency returns in 2024 on expectations of better prospects for reforms following its election and unity government. That was a very rare strong return in an otherwise dismal year for local currency returns.

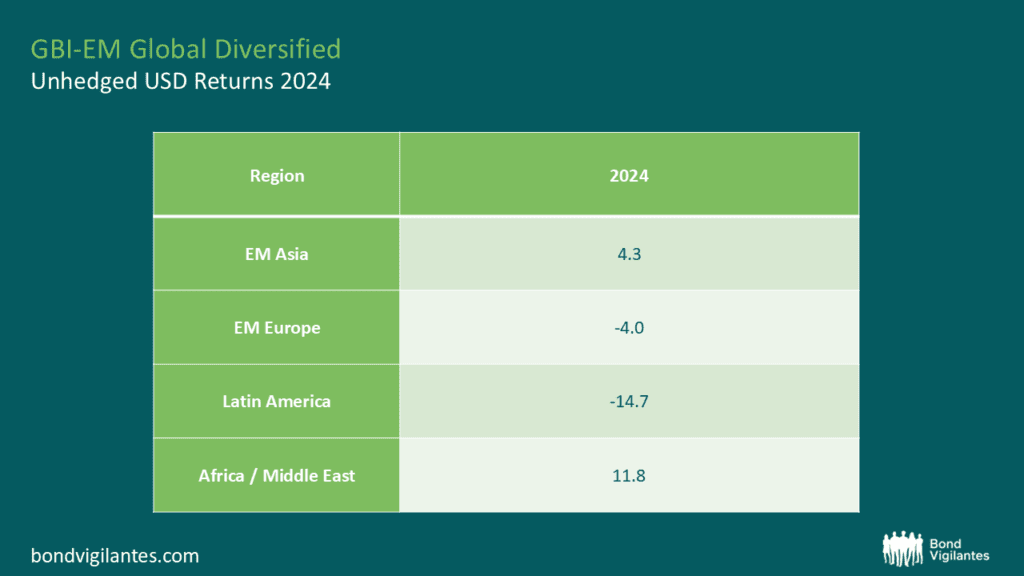

A year to forget for local currency bonds

The disinflation story in emerging markets (EM) is pretty much done, with few exceptions in high-inflation countries such as Argentina, Turkey, Egypt and Nigeria. It is remarkable how poorly Latin America performed in 2024, driven by both FX depreciation and higher yields. There is much more limited scope for rate cuts given the expected path for inflation in most inflation-targeting economies. However, there is scope for yields to rally should country-specific concerns dissipate (e.g. better fiscal prospects in Brazil, more clarity on US-Mexico trade and broader economic issues, etc.) and should currencies stabilise or recover some of the depreciation seen in 2024.

Source: JP Morgan

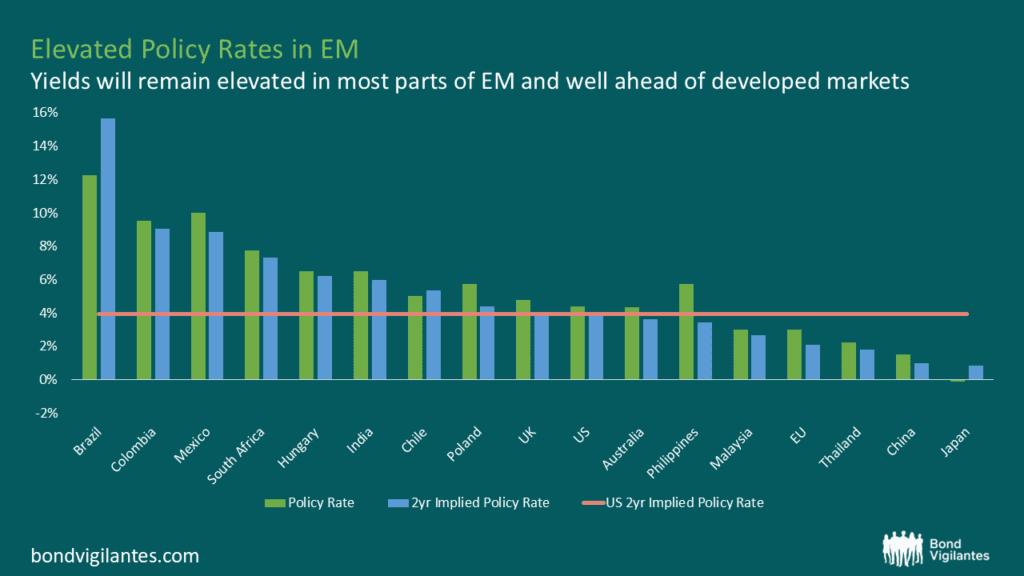

I did not expect such poor performance. In fact, not only did higher carry fail to translate to better total returns (e.g. Brazil, Colombia, Mexico, Hungary) but the lower carry countries were often the outperformers as well (e.g. Asia) as their low yields went even lower on monetary policy easing and fears of deflation.

Source: Bloomberg, December 2024

We remain selectively constructive on EM currencies as valuations are even more compelling after the sell-off over the past year (see below).

Source: BIS, Bloomberg, as at 8th January 2025

Timing the trade is tricky, however, as the fate of the USD will largely depend on the upcoming policy mix of the new administration. Local currency EM bonds remain unloved, but this bodes well for contrarian investors willing to step in and stomach some volatility. However, elevated short-term rates in key markets such as the US, UK and to a lesser extent the Eurozone, remain a headwind to the asset class and the global macroeconomic uncertainly does not help either. EM local bonds (and arguably also hard currency, especially investment grade given prevailing tight spreads) still face stiff competition from high short-term rates in the US, UK and Eurozone. That could improve going forward as those central banks continue easing but ‘higher for longer’ core rates remain a risk, especially if US inflation expectations deteriorate on back of tariffs.

Keep an eye out for our upcoming blog on EM high yield, which will delve deeper into the performance and outlook of this segment.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.