Navigating the technical of the Euro Investment Grade market

Fundamental vs Technical Factors

Bond valuations are impacted both by fundamental and technical factors. Active managers typically have experienced fund managers and credit analyst teams to analyse the fundamentals impacting each bond issuer. The focus of this blog will be on the technical factors – which are more in the trading team’s domain.

Let me refresh what we mean by each of these terms:

- Fundamental analysis attempts to determine intrinsic value by analysing underlying company cash flow generation or asset values, for example.

- Technical factors relate largely to supply and demand, which feed into the trading parlance of ‘liquidity’ or ease of transacting. There are different types of ‘technicals’ that I will discuss in turn below. It is essential for a trader to remain informed of the prevalent technicals and trading flow dominating the marketplace. This helps to inform counterparty selection and to successfully access liquidity.

Technicals: sizes, shapes, vintages and positioning

Let’s discuss some simple examples of technicals using various characteristics of a bond on an individual basis.

Issue size: reducing the point to its simplest form, the smaller a bond issue, generally the less liquid it will be and vice-versa. In Europe, a deal size of €300m or below is regarded small, a benchmark size would typically be €500-750m, and larger deals would be €1bn+. The size of the deal will have an impact on its liquidity.

Shapes: denominations can also have some impact. A bond with 1k/1k[1] is more marketable to retail clients than bonds with a 100k minimum increment. This is most pronounced in Italian credit where the domestic investor base has a strong retail focus.

Vintages: when a bond is newly issued there is plentiful liquidity for a short period. It takes time for bonds to be cleared from shorter-term holders and market-makers to longer-term investors. Once a bond has found a home with longer-term investors there is less ‘free-float’[2] actively trading; hence, liquidity becomes more challenging and can create a stronger technical. Contrastingly, a high expectation of supply in the market overall, or for a particular sector/issuer, can weaken the technical in the short-term.

Positioning: economics 101 – if demand is greater than supply at any one time, a bond will have a strong technical,and vice-versa. News flow regarding an issuer, either positive or negative, will drive changes in market positioning as buyers/sellers react to add/exit their position. If the willingness of market-makers, whose job it is to provide liquidity to clients at a given price whilst capturing the bid/offer spread, is either strong or limited, then prices can be exacerbated considerably.

European Investment Grade – where are we now?

Credit spreads are at a similar valuation today to where they were in the first quarter of 2021. At that time, the market had the full support of central banks via Quantitative Easing (QE) in response to the COVID pandemic, including sizeable direct purchases of the asset class. In the absence of QE today, the other significant difference is higher government bond yields; as interest rates have been increased across developed markets to combat inflation. This has transformed the level of demand for the asset class, providing a combination of higher returns and historically low default rates.

Fixed Maturity Products

Now that we understand what technicals are, let us look at the first thematic change we have seen in the marketplace.

With the fixed income market offering higher all-in-yield returns we have witnessed the advent of so called ‘Fixed Maturity Products’ (FMP). The first wave of these funds originated from France; however, we now see multiple offerings from Italy and Spain. FMP seek to offer domestic savers a fixed yield, typically for five years. The funds buy and hold assets around the five year maturity to secure a yield for their customers and collect a spread for themselves.

The five-year bund yield has moved from negative yielding in 2020-21 during COVID to around 2.4% today. If you add a typical credit spread of 100-120bps you produce an all-in-yield of around 3.5%. This has proved to be somewhat of an easy sell to retail clients, when comparing this to domestic products like the Livret-A in France, where the typical return has been 2-2.5%. The other main comparison for the retail market is bank deposit rates, where returns have been considerably lower, hence we have seen the movement of these savings into FMP.

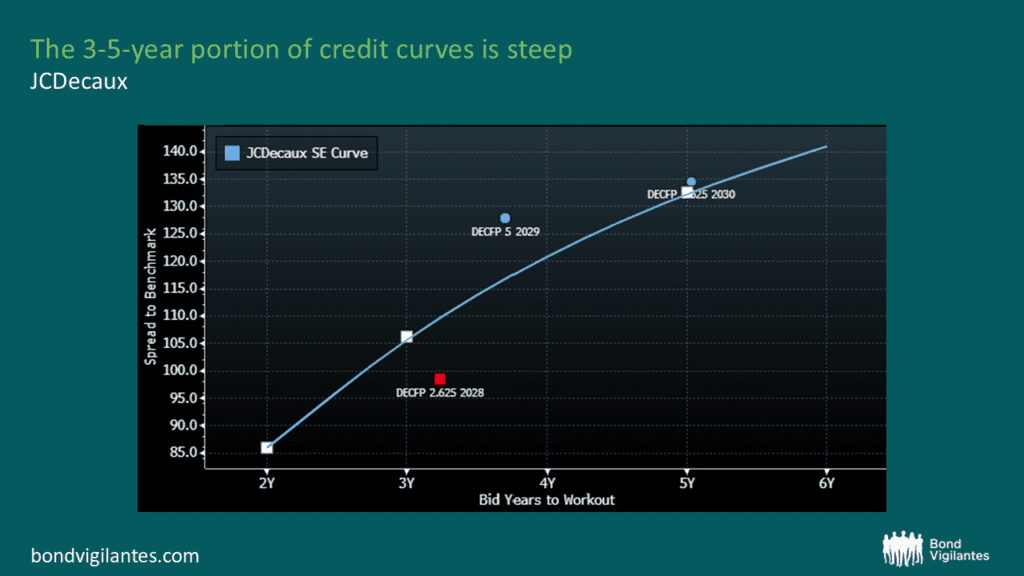

FMP have effectively replaced a portion of the QE bid I mentioned previously. Whilst it isn’t an exact science, it’s approximately 20% of the size, not a full replacement – but still a significant strong technical. This has resulted in the 3-5 year part of many investment grade issuers, particularly those rated BBB- (to maximise for yield), becoming quite steep. The JCDecaux curve below illustrates this well.

Source: Bloomberg, February 2025

As the success of FMP has grown, the breadth and number of players has increased. Data on the scale of these funds is hard to come by but a conservative estimate would be in the €50-70bn range across 30-40 different providers. Consequently, we have observed very predictable flows being invested at the end of each month via Portfolio Trades which has been the chosen method of deployment for the reasons I discussed in my previous blog.

Expanding investable universe – both size and duration

Size and breadth

The other notable change we have seen in recent years is the increasing size and breadth of the European investment grade universe. As measured by the ICE BofA ER00 index, the market has increased from 3,185 bonds in 2019 to around 4,300 today! 10 years ago it was 1,893.

Naturally, as issuers look to non-domestic markets for financing, not all issuers can be a core focus for every manager or analyst. This can provide active managers, who typically have larger internal credit research teams, opportunities to analyse issuers that are not as well covered by the broader market. Consider the Bupa 5% 2030 bond, issued in October 2023 (XS2690050682). This deal came with a reasonable discount as it was the issuers inaugural euro-denominated deal. Unfortunately for the deal, the market was very weak that day, so the order book fell apart and the banks underwriting the deal had to take some on their balance sheet. The bond was issued at bunds+224 and traded as wide as bunds+250 in a very respectable size of €50-100m. These types of scenarios can provide active managers with opportunities for meaningful outperformance.

Duration

Historically, the European bond market has been much shorter dated in comparison to either the US dollar or sterling markets. There are many structural factors that impact demand for different duration assets. For example, in the UK and Germany, pension fund liabilities naturally create demand for longer-dated assets. In France and Italy, insurer demand generally isn’t as long-dated with investors focusing more on the 10-12 year area.

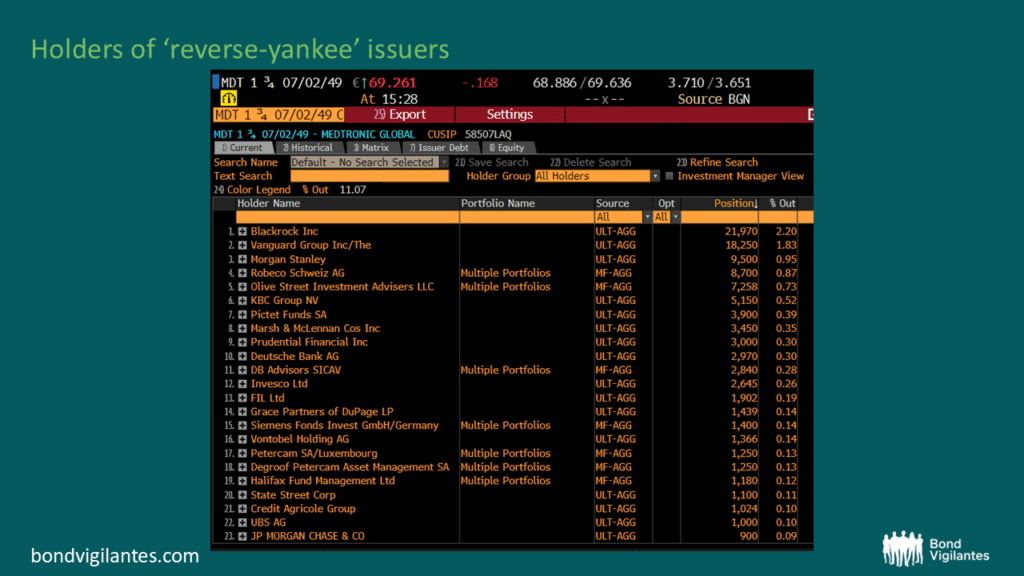

In 2019, there was a significant increase in 30-year issuance, particularly from reverse-yankee issuers[3], as it was cheaper for them to issue euro-denominated bonds rather than euro US dollar-denominated. This type of paper will normally sit with UK, German or more global asset managers. When credit curves are quite flat between the 8-12 year part of the curve, but are then steep beyond the 20-year point, you will typically see demand step in to buy these part of the market, and buyers will swap back to base currencies like sterling or US dollars. Below is an example holders screen from Bloomberg demonstrating this.

Source: Bloomberg, February 2025

Conclusion

Understanding both fundamental and technical factors is key to a successful investment approach. We believe experienced Fund Managers, a deep analyst bench, and traders who are asset class specific, is the recipe for persistent out performance.

[1] ‘1k/1k denominations’ refer to bonds that can be bought and sold in increments of 1000 units, making them more accessible to retail investors.

[2] ‘Free-float’ refers to the portion of a bond issue that is available for trading in the open market, as opposed to being held by long-term investors who are less likely to sell.

[3] ‘Reverse-yankee issuers’ are US companies that issue bonds in euros or sterling, instead of US dollars.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.