The cost of security: The impact of higher defence spending on debt-laden nations

In an era of rising geopolitical tensions, many nations are ramping up defence spending to bolster security. However, for countries already burdened with high debt, this creates a fiscal dilemma: how to fund military expansion without worsening financial instability. Nowhere is this debate more pressing than in Europe, where Germany—historically the continent’s fiscal anchor, undertook a historic change to its fiscal policy.

The burden of debt and defence

An increase in defence spending presents a strict trade-off for heavily indebted countries. Governments must either:

- Raise taxes – politically unpopular and potentially damaging to growth.

- Cut other spending – risking social discontent as welfare programs, infrastructure, or education suffer.

- Borrow more – worsening fiscal deficits and increasing interest costs.

Many western nations, including France, Belgium and the UK, already have debt-to-GDP ratios exceeding 90%, a level often associated with slower economic growth and rising debt-servicing costs. Higher interest rates make borrowing more expensive, meaning every additional dollar or euro spent on defence further strains government finances.

Germany, with its historically cautious fiscal approach, has long provided Europe with a sense of stability. But if Berlin abandons its “Schuldenbremse” (debt brake), the consequences could ripple across the entire region.

Germany’s debt brake: The last fiscal anchor in Europe is creaking!

If Germany does abandon its debt brake, two major risks emerge:

- Loss of fiscal discipline across Europe

- Germany has historically been the economic stabiliser of the eurozone, often pushing for fiscal restraint in countries like Italy, Spain, and France. If Germany embraces deficit spending, other nations may follow suit, leading to a more relaxed approach to debt across Europe.

- This could weaken confidence in European government bonds, raising borrowing costs for highly indebted nations.

- Increased risk of inflation and market instability

- More deficit spending will likely fuel inflationary pressures

- Investors will demand higher yields on European sovereign bonds, putting additional strain on public finances.

- A fractured European fiscal policy could weaken the euro, making imports more expensive and eroding purchasing power.

What happens next?

- Tighter monetary policy: If increased government spending fuels inflation, central banks may be forced to keep interest rates higher for longer, slowing economic growth.

- Greater EU fiscal integration: If Germany relaxes its debt rules, there may be renewed calls for collective EU borrowing (like the COVID recovery fund) to share the burden. Will the Europhiles finally get their wish, or will we see a slow Balkanisation of Europe as high outstanding debt forces countries’ hands?

- Market reactions: Investors could reassess European sovereign risk, leading to rising bond yields, particularly for countries with weaker fiscal positions. This could introduce a new level of uncertainty and volatility into the European market.

Ultimately, while stronger defence capabilities are necessary in an uncertain world, the financial cost could be as destabilising as what is raging on Europe’s doorstep. If Germany, Europe’s traditional fiscal anchor, shifts toward looser debt policies, the eurozone could face a new era of fiscal uncertainty—one that challenges the economic stability of the entire continent. For now, the fiscal boost will be seen as a positive, higher growth, higher inflation and a stronger euro. Also, don’t forget that it’s not just Germany increasing spending. Spain, Italy, Belgium, and Portugal need to increase defence spending considerably from here, which should fuel growth and inflation further.

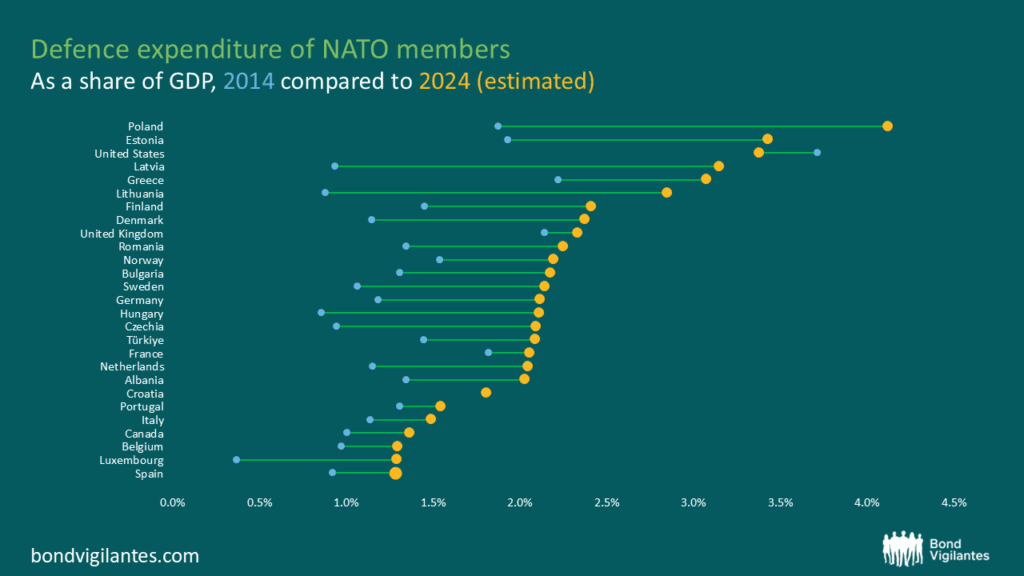

Source: NATO, Defence Expenditure of NATO Countries (2014-2024)

The UK is in a similarly challenging position. The UK government must carefully navigate its foreign policy to maintain strong economic and security ties with both Europe and the US, balancing conflicting interests. It seeks close trade and regulatory alignment with the EU to protect economic and financial stability while avoiding commitments that could constrain its post-Brexit sovereignty. At the same time, it prioritises a deep security and economic partnership with the US, aligning on defence and geopolitical strategy, even when American policies diverge from European interests. This balancing act requires diplomatic agility to avoid being caught between two major allies with differing trade, defence, and global governance priorities.

With the tectonic plates shifting, time will tell how this all unfolds.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.