Corporate hybrids: one notch closer to Senior; a methodology shift and its market reverberations

The credit rating agency Moody’s introduced a pivotal change to its hybrid capital methodology back in February 2024, one that is quietly reshaping the corporate hybrid landscape. By allowing certain hybrid instruments to be rated just one notch below senior unsecured debt, Moody’s has not only recalibrated the risk-reward profile of these instruments but also catalysed structural innovation and issuance momentum across both sides of the Atlantic.

The Catalyst: Moody’s methodology update

Corporate hybrids are typically rated two notches below senior unsecured debt, reflecting their subordinated status, long-dated or perpetual maturity, and optional coupon deferral features. Moody’s February 2024 update introduced a new structure, termed ‘ordinary subordinated,’ that qualifies for a one-notch differential provided it meets three key criteria:

- Seniority: the hybrid must rank above legacy hybrid instruments but remain subordinate to senior unsecured debt

- Maturity: the instrument must be dated, typically with a maturity of 30–60 years

- Coupon deferral: interest deferral must be limited to 5 years before triggering an event of default

This structural development differentiates the asset class from preferred stock, and reflects a recognition that through evolution, hybrids have demonstrated resilience and persistence through multiple market cycles.

Adoption: Who’s embracing the new structure?

Several European issuers have been early adopters of the new framework, albeit with varying degrees of commitment:

- Centrica, EDP, and Lufthansa issued hybrids that meet the new criteria, with EDP going a step further by amending legacy documentation to elevate the new tranche’s seniority

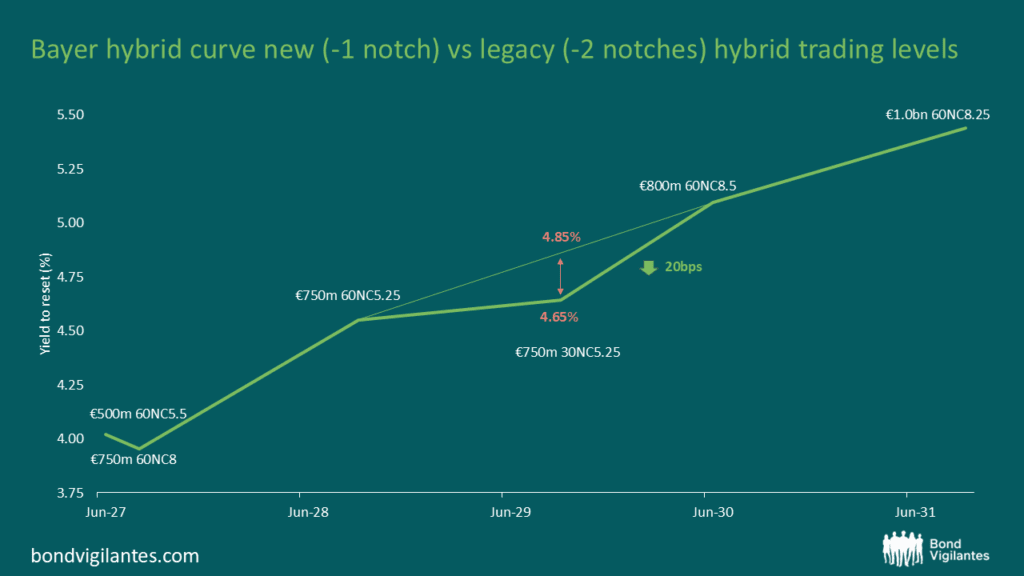

- Bayer issued a €750m ordinary subordinated hybrid in September 2024, explicitly ranking it senior to its existing deeply subordinated stack. This tranche was rated one notch below senior and saw strong primary demand, although it caused a modest widening in the secondary curve of legacy hybrids

- Merck KGaA took a more cautious approach, embedding ‘flipper’ language that allows the hybrid to become senior to legacy instruments but only once those are repaid

Across the pond in the US, the change could be even more transformative. Moody’s now grants 50% equity credit to subordinated bonds, up from 25%, bringing them on par with preferred shares, but with the added benefit of tax-deductible interest. This, in part, has supported a surge in US corporate hybrid issuance, with over $40bn of new supply in 2024 against only $4.6bn in 2023, with strong momentum thus far in 2025.

Implications: A new layer in the cap stack

The implications of this shift are multi-faceted:

1. Capital structure optimisation

Issuers can now access hybrid capital that is both cheaper than equity and more favourably rated than legacy hybrids. This will be particularly attractive for companies with large capex needs, such as utilities and energy firms, seeking to preserve senior ratings while avoiding shareholder dilution.

2. Investor angle

For investors, the one-notch structure offers another risk-return proposition. It reduces subordination risk while retaining 50% equity credit. The instruments should trade tighter than traditional hybrids, reflecting their improved seniority. At the same time, they may be a thin part of the cap stack vis-a-vis existing seniors and hybrids, and their default risk likely similar to deeply subordinated instruments, with high expected loss on default and low recovery. Arguably, the key feature that investors will value is the typically 30-year term, which makes the instrument dated and potentially more resilient than perps (perpetuals) during volatile phases in the market.

3. Market dynamics

The emergence of this structure is introducing a bifurcation in the corporate hybrid market that we are only seeing a glimpse of now. Issuers with legacy stacks must now decide whether to create a senior hybrid layer, potentially alienating holders of older tranches, or wait until legacy instruments mature. A glance at Bayer’s hybrid curve offers an early look into how the market sees this. Ostensibly, the new -1 notch BAYNGR 5.5 hybrid trades slightly inside the remaining curve, reflecting its senior status versus 5 tranches of legacy deeply subordinated hybrids, but a sample size of one is far from conclusive at this stage.

Source: Bloomberg

Challenges and considerations

Despite its advantages, the new structure is not without complications:

- Accounting trade-offs: dated hybrids may not qualify for IFRS equity treatment, which could impact leverage ratios and financial covenants

- Documentation complexity: managing multiple layers of hybrids with different seniority and deferral terms adds legal complexity

- Rating divergence: while Moody’s may assign a one-notch differential, S&P and Fitch continue to apply a two-notch approach, leading to rating inconsistencies. Which combination of one, two or three agencies issuers pick for a rating will become more pertinent

Conclusion: A maturing market with new frontiers

The corporate hybrid market is no stranger to changes in frameworks over the years, albeit with increasing stability as the market has matured. Moody’s methodology change marks yet another, and unlikely the last, evolution of corporate hybrids.

The emergence of the one-notch hybrid is both an opportunity and a challenge. It demands a nuanced understanding of structural features, issuer intent, and rating agency criteria where active management will play a key role. For those able to engage and do the work, it offers a new frontier in capital structure optimisation and credit portfolio construction.

Meanwhile, this development may have awoken the sleeping US corporate hybrid market, now stirring and poised to unleash its formidable potential on the financial landscape. An expanding universe will create more opportunities for investors who can actively select across markets.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.