Who’s afraid of the Big Bad Wolf?

Governments are perched atop a mountain of debt, and the question of how to reduce it has become one of the most pressing long-term challenges for the economy. Broadly speaking, there are three ways to deal with debt:

- Default, the least palatable option

A sovereign default is theoretically possible, but for a country like the US, which has full control over its monetary system, this is extremely unlikely. Default is economically destructive, politically toxic, and would undermine the very foundation of the global financial system, given the role of Treasuries as the world’s reserve asset. This path is a last resort.

- Growth, the most desirable but unlikely

Growing out of debt is the cleanest option. Strong GDP growth allows debt-to-GDP ratios to fall naturally, as the economy expands faster than debt accumulates. But this solution has proved elusive for most developed economies. Growth has been disappointing over the past two decades, and demographic trends, particularly slowing population growth, suggest headwinds will only get stronger. Perhaps an AI-driven productivity boom could shift this picture.

- Inflation, the most likely outcome

The most realistic path is to let inflation do the work. As nominal GDP rises, the burden of fixed-rate debt shrinks in relative terms. This method spreads the cost across the population quietly and gradually, eroding the real value of government liabilities, while the electorate suffers from a lower standard of living.

Stable inflation expectations: A false comfort?

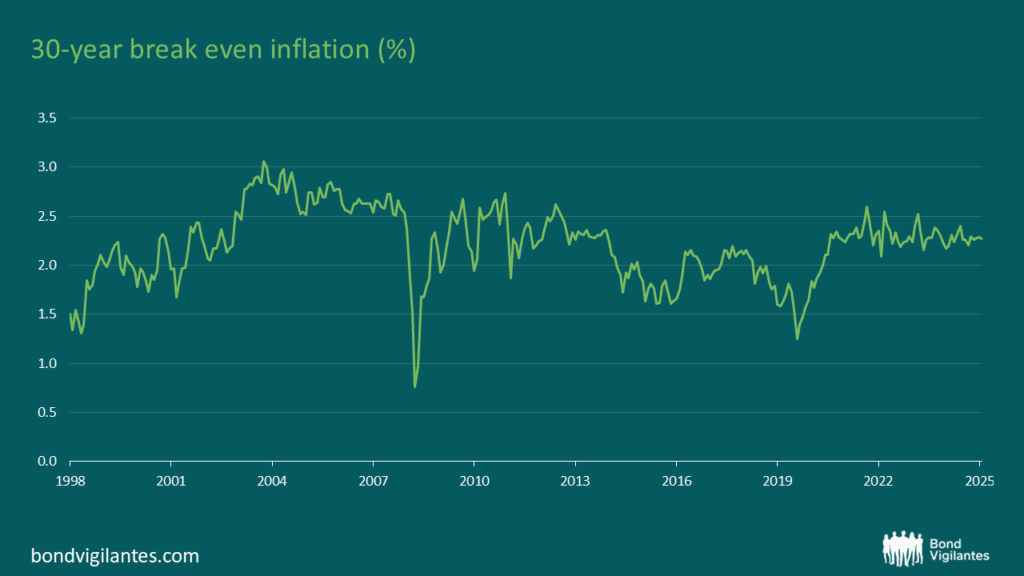

For years, long-term inflation expectations have remained remarkably anchored around 2%.

Source: Bloomberg

This stability suggests markets believe in the Federal Reserve’s ability to control inflation over the long run, despite cyclical volatility. But the assumptions underpinning this faith deserve scrutiny.

Structural pressures on inflation

- Debt management strategy: If inflating away debt is indeed the most likely US strategy, then we should expect inflation. Even if gradual, the intentional pursuit of higher nominal growth through tolerating above-target inflation should nudge expectations upward.

- Deglobalisation: Rising protectionism, reshoring supply chains, and tariff wars all point to structurally higher costs of goods and services. While tariffs are often dismissed as one-off shocks, a sustained shift in global trade dynamics could embed higher inflation over the long run.

- Policy pressure on the Fed: Concerns are mounting over the Fed’s recent policy decisions, with investors increasingly questioning the central bank’s independence amid signs of political influence. With debt interest expense now the second largest expense after social security, lowering interest rates will meaningfully improve this metric and bring some welcome relief for the government.

However, does the economic backdrop warrant rate cuts? Strong growth, record-high risk asset valuations, housing at record levels, low unemployment, and above-target inflation all suggest the opposite of rate-cut justification. The politicisation of monetary policy risks undermining the Fed’s inflation-fighting credibility.

Gold has long been considered as a safe haven asset to protect against market stress and a hedge against inflation. Perhaps the rapid increase in the price of gold is the best barometer for these stresses.

Why inflation expectations should drift higher

Given these dynamics, the question is not whether inflation will flare temporarily, it already has, but whether the long-term anchor of 2% can realistically hold. Debt reduction through inflation, structural deglobalisation, and political interference in monetary policy are all long-term inflationary forces.

Yet markets continue to price in remarkable stability. This disconnect suggests investors may be underestimating the structural shifts underway. If long-term inflation expectations begin to move higher, it will not be a random shock, but a rational repricing to reflect economic and political realities.

Given pricing of long-term inflation, it would seem no one is afraid of the Big Bad Wolf.

Long-dated TIPS anyone?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.