Czech out: Thoughts on the removal of the currency cap

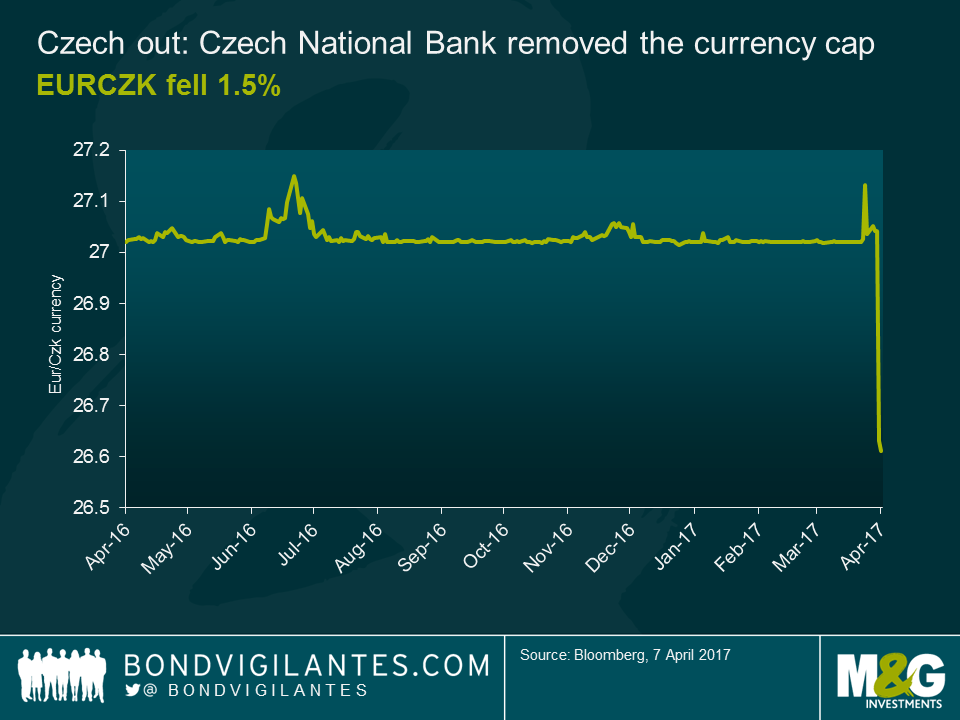

The Czech National Bank (CNB) has removed its cap against the Euro, which I blogged about earlier this year. Though the signs had been pointing to an early removal (headline inflation had been within the target range since October last year and the CNB had hardened its signalling language), the timing of yesterday’s move at the central bank’s extraordinary meeting did come as a surprise. Currency appreciation post the event has been fairly muted, with the CZK rallying 1.5% against EUR on the day.

The CNB is likely breathing a sigh of relief; the Czech Republic is an export orientated economy and thus excessive appreciation would hamper this somewhat. But where does it go from here? As I mentioned in my previous blog, when the cap was in force, the CNB would not permit appreciation beyond the level at which they intervened; approx. EURCZK 25.7 (the market closed at EURCZK 26.6), so this is perhaps a reasonable expectation regarding the appreciation ceiling.

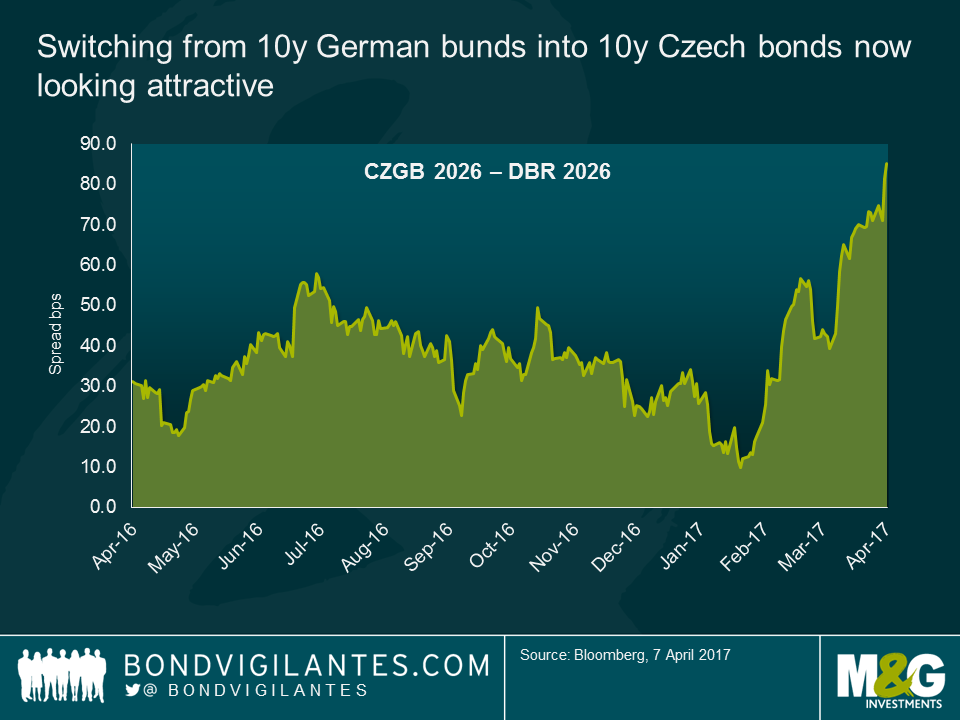

The rates space is also interesting. The removal of the cap is a monetary tightening, with CNB governor highlighting in his press conference that “ending the cap was the first step toward gradual policy tightening”. With the market pricing in the expectation of this, the sell-off in the Czech sovereign bond curve (alongside the currency appreciation) is perhaps now pricing in more of a tightening that the CNB should have liked.

If the CNB monetary tightening is to be a gradual measured response, instead of the bear steepening that the market may be assuming, this now becomes appealing from a relative value perspective – see the graph below – but also on a currency hedged basis.

The final aspect to bear in mind is that Czech bonds will be held in the main bond benchmark indices from the end of this month. CZGBs will be included in the GBI-Emerging Market index on 28th April with a weight of 3.3%. This will create demand for the bonds for those using this index as their passive or active benchmark which will put some small appreciation pressure on the currency. Bigger moves could however occur in the opposite direction and the currency could of course depreciate from here, should the large speculative investor flows (estimated at $65bn) anticipating the removal of the cap now dissipate, which would lighten the CNB’s workload somewhat.

In maintaining the currency cap, the CNB accumulated €47.8bn of reserves which, according to its website, it will continue to invest in “high quality, safe instruments” and “will not sell the returns on those reserves for the foreseeable future”. There will be further interesting times ahead for the CNB who – either way – stand ready to intervene against extreme exchange rate fluctuations.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox