Can Russia stomach new US sanctions?

After the summer break, the US Congress is scheduled to review various bills proposing additional sanctions on Russia. The proposals include additional restrictions on Russian imports and exports to the US, as well as on activities of Russian banks in the country. Under consideration there will also be a ban, for US citizens, to trade any newly-issued Russian sovereign debt with a maturity of more than 14 days. Trading of older debt remains unaffected. Since US sanctions on Russia started in 2014, financial institutions and corporates have been able to muddle through some of the restrictions – will it be different this time?

If the US approves the ban that would prevent US investors from financing the Russian government, it is likely that many European banks and investors would follow suit, especially if they have operations in the US. This could dramatically reduce daily trading volumes of the new debt.

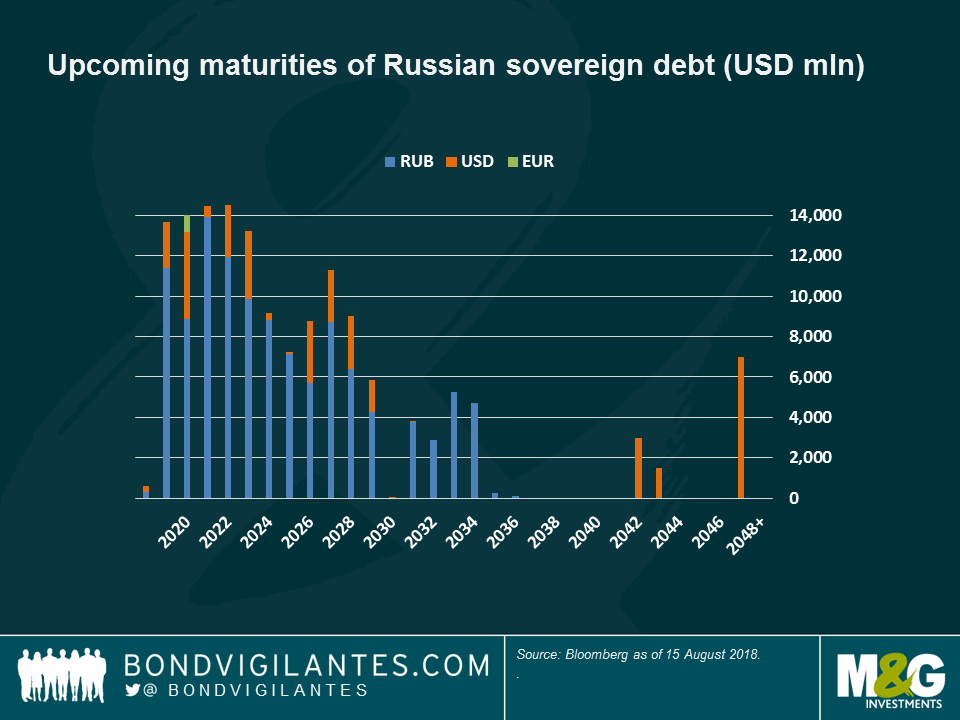

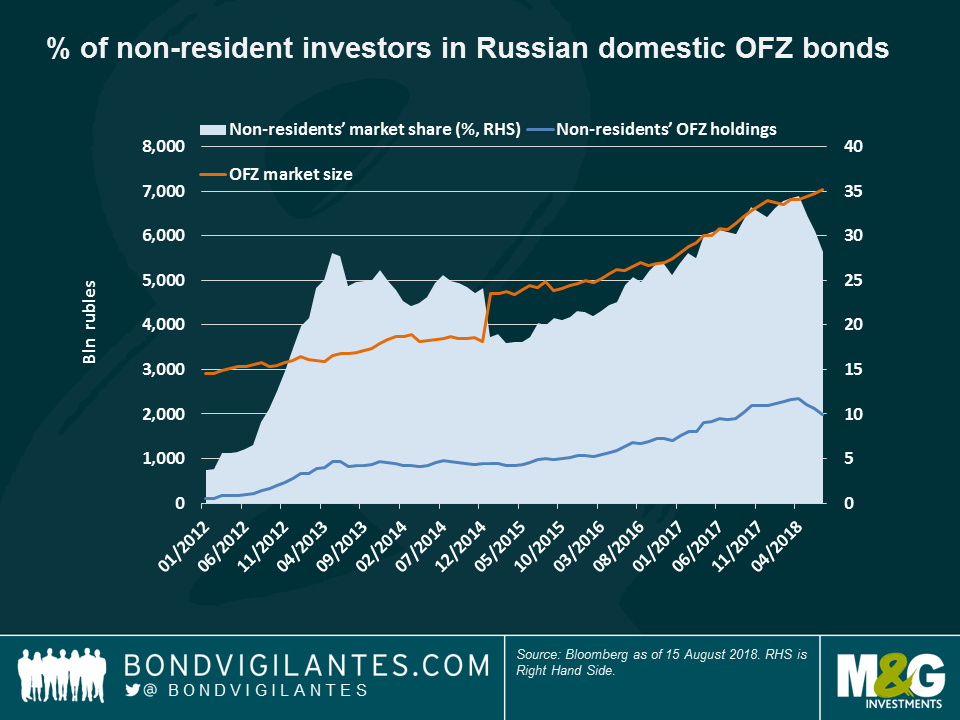

How damaging could this be for Russia’s financing needs? As seen on the two charts below, Russian sovereign debt amortizations are largely concentrated on ruble-denominated local bonds, known as ‘OFZs’. The Central Bank estimates that approximately 28% of them are currently held by non-residents, as seen on Chart II.

Chart I: Upcoming maturities of Russian sovereign debt (in USD million)

Chart II: % of non-resident investors in Russian domestic OFZ bonds

It is possible, however, that the non-resident ownership figure is underestimated if some of the exposure is held through synthetic instruments, such as credit-linked notes, total return swaps, etc. An IMF analysis of the evolution and opening up of Russia’s domestic market highlighted last year the significant role of foreign investors, especially in the earlier years, such as 2012. But while the risk of underestimating foreign ownership exists, investments in Russian local debt through proxies may be less than in the past, when foreign investors could not easily access the local market and had to use alternative instruments to gain exposure to Russian local debt.

If we assume that US and European investors (including their proxy holdings) own 33% of the OFZ market and, conservatively, 100% of the foreign currency debt, this could imply that Russia could face a funding gap of around $5-7 billion per year between 2019-23. However, and based on past investor surveys, non-residents are most likely invested in securities maturing in 5-15 years, while local investors, including the banks, tend to favour shorter-dated securities. This would give some breathing room for Russia to adapt to the new sanctions, if approved.

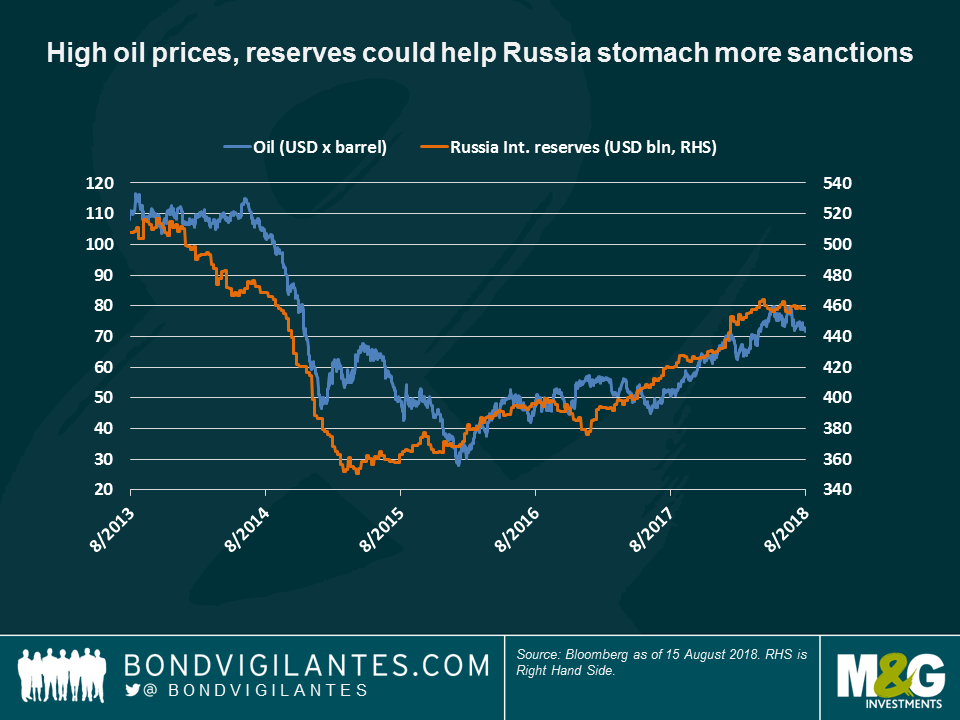

Furthermore, the recent recovery in oil prices and a pick-up in economic activity has allowed Russia to return to a fiscal surplus, in addition to its long-standing current account surplus. As seen on Chart III, Russia’s foreign exchange reserves, through USD purchases by the Central Bank, have recovered to $450 billion, just below their pre-2014 sanctions level. If oil prices were to remain at current levels and if the potential new round of sanctions does not materially dent economic growth through a shock in confidence and domestic liquidity, the proposed sanctions, while a set-back, seem ultimately surmountable for Russia’s strong balance sheet.

Chart III: High oil prices and strong reserves could help Russia stomach more sanctions

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox