Panoramic Weekly: Patient Fed boosts markets

Goldilocks, one of investors’ favourite economic scenarios, seems to have returned in the new year after almost vanishing in 2018: a strong US jobs report and dovish comments from US Federal Reserve (Fed) chair Jerome Powell have reinstated the not-too-hot, not-too-cold environment that combines relatively low rates and good-enough economic growth – supporting risk assets. US High Yield spreads, for instance, have rallied 80 basis points (bps) so far this year, after widening more than 1% in a dark December. Equities have soared.

Optimism has been mainly triggered by Powell, who said on Friday that the Fed would be patient on its rate hiking path as inflation remains muted. Markets reacted with force: expectations of a March Fed hike have now plunged to 5%, down from 41% one month ago, while inflation expectations and the dollar fell. These tailwinds favoured Emerging Markets and their currencies, which rallied also on the back of more Chinese monetary policy easing measures, and despite soft data from the world’s second-largest economy: China’s December producer and consumer inflation both came in below expectations. In Europe, disappointing German data held the euro, which remained flat against a falling dollar.

Heading up:

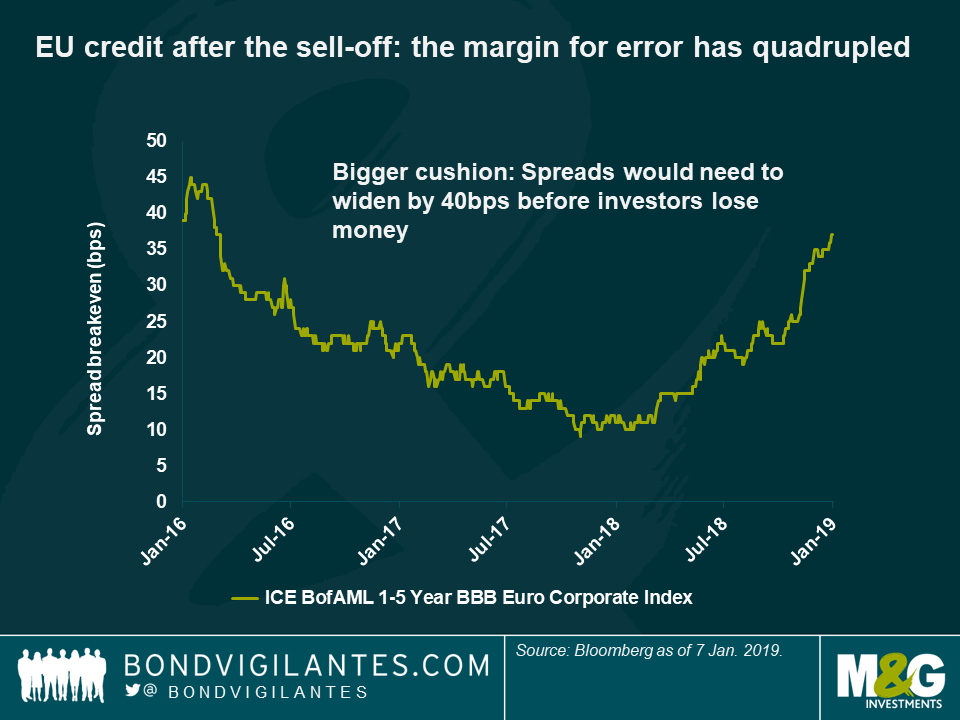

Cushions – credit sell-off increases margin for error: Despite the pain, at least the recent credit market sell-off has left investors with a bigger protective cushion before losing money: according to M&G fund manager Wolfgang Bauer, spreads of short-maturity, European Investment Grade corporate bonds would need to widen by 40 basis points (bps) this year before dragging investors into negative returns. This cushion, calculated as the index’s OAS/Libor spread divided by its spread duration, was below 10bps barely one year ago, a level which practically priced in perfection. As seen in the chart, the cushion has been growing as markets fell, especially following the Italian election in May, which raised fears about the future of the EU. This margin has now reached the highest level in about two years and is about four times bigger than a year ago. According to Wolfgang though, European corporate bonds are still sensitive to political volatility and to ample supply (usually a negative for bond prices). European data has also been disappointing, although economic growth is still expected to rise by 1.6% this year and by 1.5% in 2020 (down from 1.9% in 2018). Don’t miss Wolfgang’s credit review: Self-check: how did we do in our 2018 predictions?

US dollar and oil prices – perplexing the Fed: The strong correlation between oil prices and the US dollar over the past decade has surprised many investors – not least the Fed. In its recent blog “The perplexing co-movement of the dollar and oil prices,” the US central bank questions the logic behind the dollar’s weakness against the euro when oil prices rise. According to the bloggers, a 10% increase in oil prices is associated with a 1.5% depreciation of the dollar against the euro, something which not always makes sense as oil prices are often driven by Asian demand and Middle East output. Why would this affect the USD/Euro exchange rate? One explanation, the Fed argues, is that higher oil prices lower expected US output relative to Europe’s, dragging the greenback lower. This happens as Europe tends to tax gasoline more heavily, making European consumers less sensitive to petrol prices. However, the Fed admits it is hard to imagine that the levels of congestion on European roads do actually drive the USD/Euro exchange rate. The central bank leaves this issue as an open question – at the same time that oil prices are rising, and the dollar, falling.

Heading down:

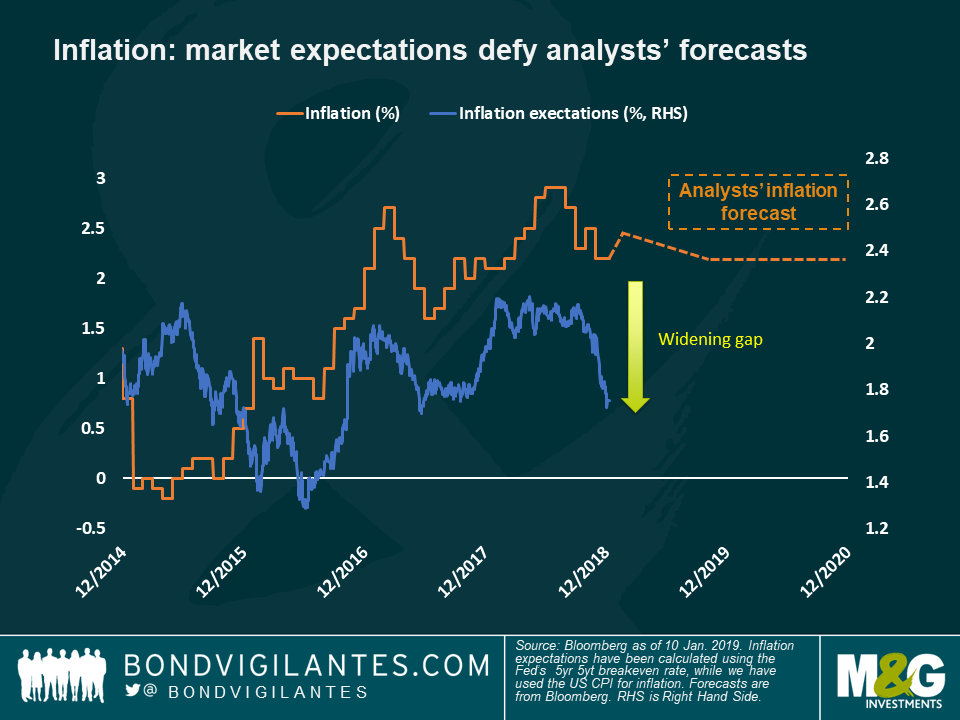

US inflation expectations – Powelled: Fed chair Powell’s recent reassurance that the central bank remains data-dependent, watchful of market reactions and not blind to inflation’s failure to significantly pick up, threw a bucket of cold water over US inflation expectations. Also challenged by the recent drop in oil prices, the Fed’s favourite inflation expectations gauge – the five-year forward breakeven rate (blue line) – has plunged to 1.75%, the lowest level since June 2017. The figure is substantially below the country’s consumer inflation forecasts (dotted orange line), a mean average of multiple analysts’ quotes, currently expecting inflation to have reached 2.4% in 2018, slowing down to 2.2% in both 2019 and 2020. As seen in the chart, the increasing difference between the two magnitudes breaks a close correlation over the years: some observers say this is because analysts’ inflation forecasts are unrealistic, while others say that breakeven rates, or market expectations, are too pessimistic as the US economy is still expected to deliver economic growth of 2.6% this year and 1.9%, next. As ever, mis-pricing are what active investors look for – as long as they are right.

Germany – in recession? Ten-year German bund yields are trading again at 0.2%, having reached a 2-year low of 0.15% at the beginning of the year. This time, though, the yield drop may come for all the wrong reasons rather than because of safe-haven demand: industrial production fell for a third straight month in November, bringing the annualized figure to a negative 4.7%, the lowest since 2009, and raising concerns about Europe’s strongest economy slipping into recession. German industry has been hit, among other things, by reduced global trade and a slowdown in China – Chinese car sales fell by 6% in 2018.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox