The Case for Sterling Fixed Income

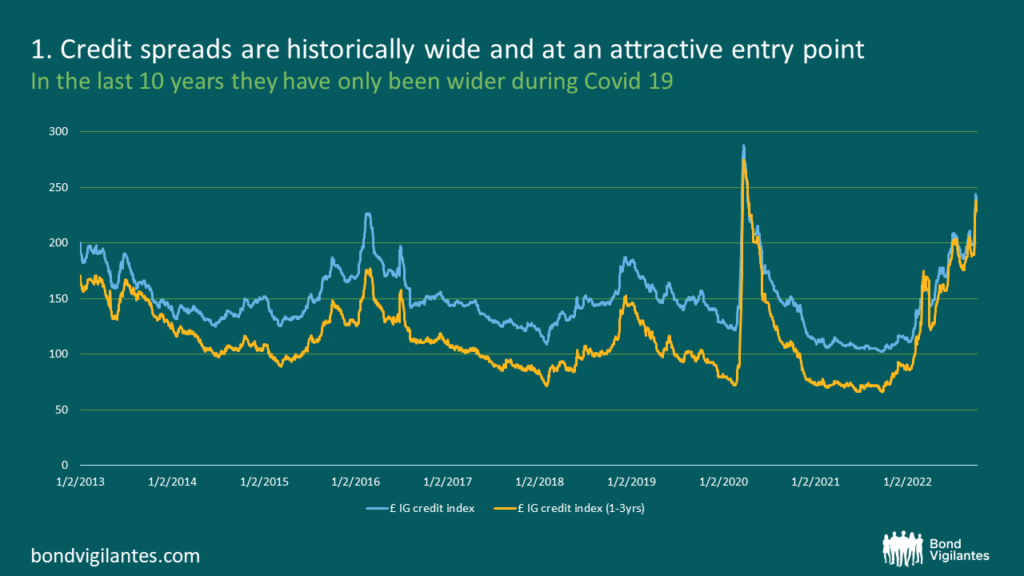

- Credit spreads versus gilts are historically wide and at an attractive entry point. In the last 10 years they have only been wider during the covid sell off.

Source: M&G Bloomberg 11 October 2022 BofA UR00 and UR01 Sterling Investment Grade credit indices

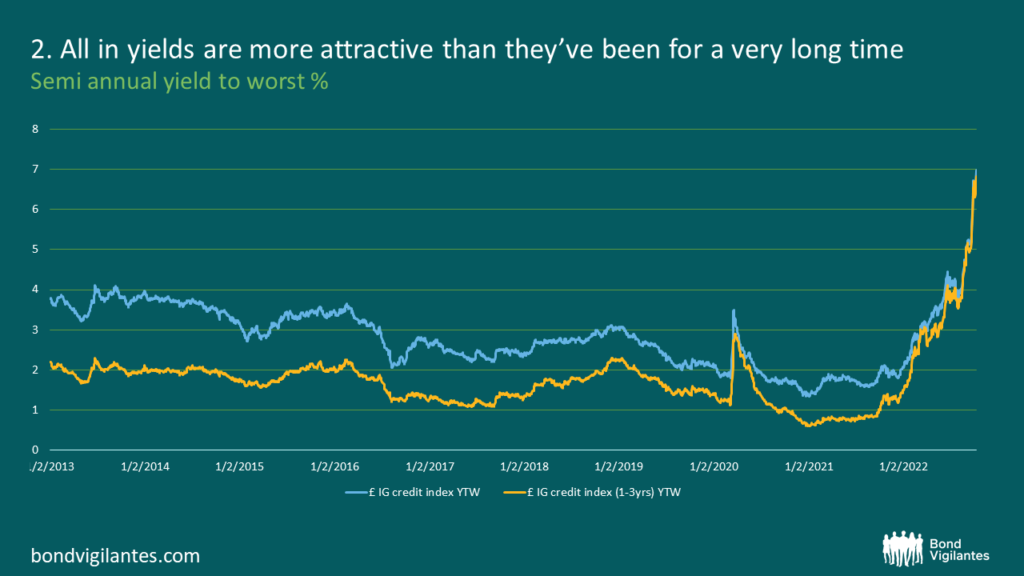

2. All in yields are more attractive than they’ve been for a very long time

Source: M&G Bloomberg 11 October 2022 BofA UR00 and UR01 Sterling Investment Grade credit indices

3. Yields versus spreads. As the above charts show there is little difference – in yields or spreads – between the corporate bond index and the shorter dated (1-3yr) index. So if you think that yields are likely to rise further, you’re better off buying the shorter dated universe. However…

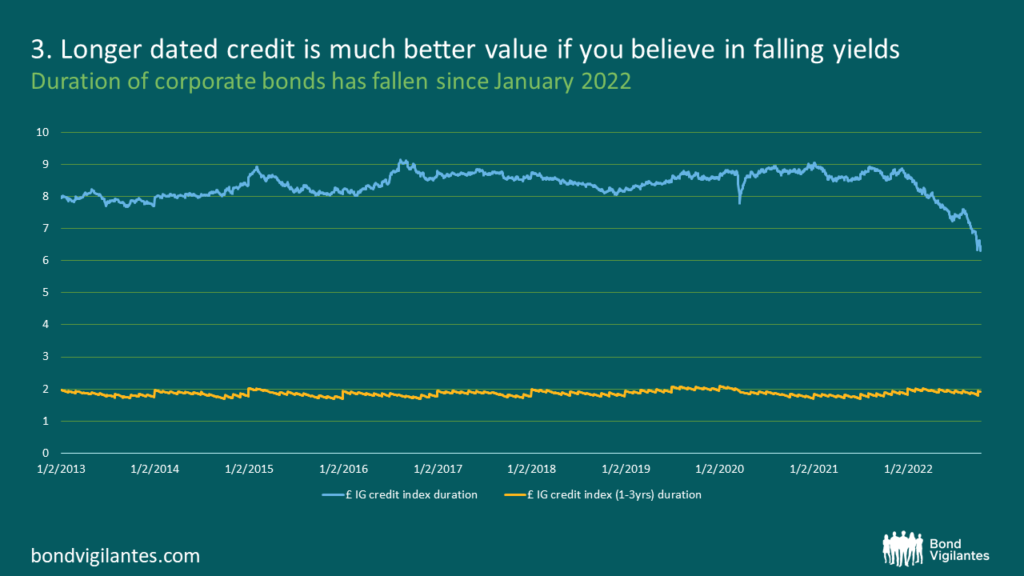

4. Longer dated credit is also looking much better value, if you think yields are likely to fall. Bear with me here. Their greater convexity – the degree to which a bond’s sensitivity to yield changes, given a change in yield – makes a compelling investment case. For the mathematically minded amongst you, convexity is the second derivation of duration (a bond price’s sensitivity to a change in yields).

As you can see the duration of the corporate bond index has fallen by over 2 years since the beginning of the year.

Source: M&G Bloomberg 11 October 2022 BofA UR00 and UR01 Sterling Investment Grade credit indicies

This isn’t because the universe of bonds has suddenly become shorter dated. It’s because the moves in yield have been so pronounced, that the same bonds now have less sensitivity to further increases in yields, than they did nine months ago. I’ve included the short dated index for comparison – as you can see short dated bonds have very little convexity.

In other words, the return profile is not symmetrical. If yields go higher, yes you will still get hurt, but not by as much as you would have previously. If yields fall, you will end up gaining more in capital value than you previously would have too. So, if you believe yields are likely to fall from here, convexity is very much your friend.

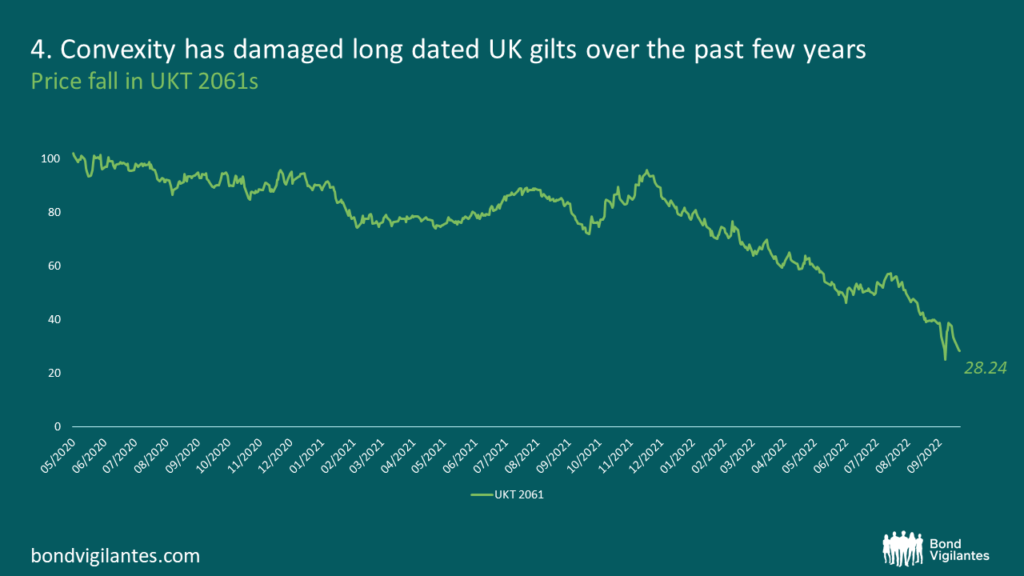

This dynamic is (unsurprisingly) also at play in the longer dated world of gilts. Last December 40 year UK government debt was trading just below a 96 cash price. Now you can pick those bonds up for a price in the 20’s. Again, not a bad relative value trade for the long term investor.

Source: M&G Bloomberg 11 October 2022

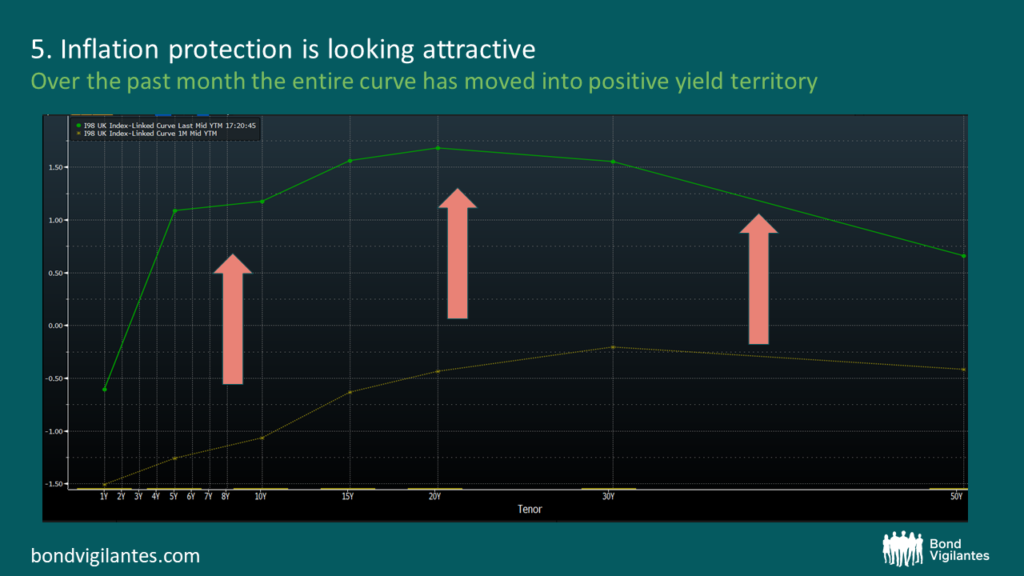

5. Inflation protection is looking attractive (or sensible) again. The last month has pretty much seen the whole UK linker curve move from negative yields into positive territory. This means that for practically any period of your choosing, you can now receive a guaranteed return above inflation, instead of paying for the benefit of owning that protection. Again, given the current economic climate, this feels like an interesting trade for the long term investor.

Source: M&G Bloomberg 11 October 2022

So regardless of your maturity/duration preference, or whether you are a gilt, credit or inflation investor, the UK Fixed income market is looking like a much more exciting asset class, than it previously has done.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.