Halloween: seven spooktacular charts in a scary year for markets

This blog first appeared in the Financial Times

It’s that time of year again – Halloween and time for the Bond Vigilantes’ usual round up of the scariest charts in global finance! With rising inflation and the cost of living crisis, 2022 has been a scary year for everyone. Turning our focus to markets, rising bond yields and CPI prints mean we have certainly found no shortage of scary charts either.

While spooky for bond investors, 2022 has also made fixed income a more interesting place to be an investor. After years of low, rangebound bond yields, markets have finally escaped the zero bound – in the case of the German 10 year yield, going from below zero just months ago at the start of 2022 to close to 2.5% over recent days.

Rising yields have been driven higher in the UK too by the return of the eponymous Bond Vigilantes, challenging the government’s tax-cutting policies in a time that many households will require fiscal support.

Likewise, as we wrote last week, after many years of a Halloween ‘treat’ for markets in the form of QE, it will soon be time for the ‘trick’ (QT)!

With all this in mind, here are the Bond Vigilantes’ scariest charts for 2022. Happy Halloween!

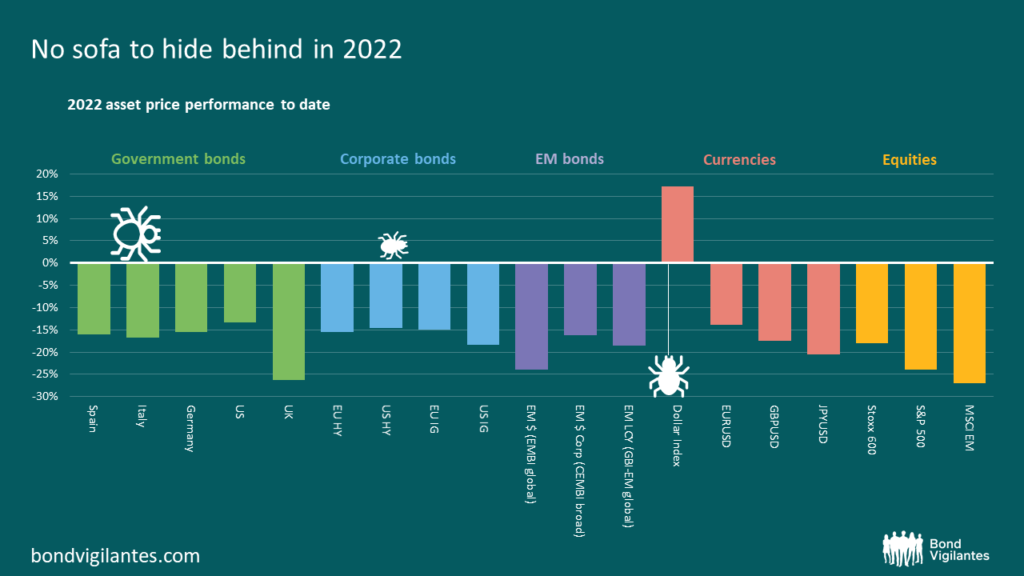

1. No sofa to hide behind in 2022

One of the scariest charts for investors this year will be a look at their 2022 portfolio returns. Whether in government bonds, corporate bonds, emerging market bonds, currencies or equities, there really were very few places to hide this year from the spectre of rising interest rates and a ghostly slowdown in growth. The dollar was one of the few assets in our chart to see a positive return so far this year.

Source: Bloomberg, ICE Bank of America, JP Morgan (30 September 2022).

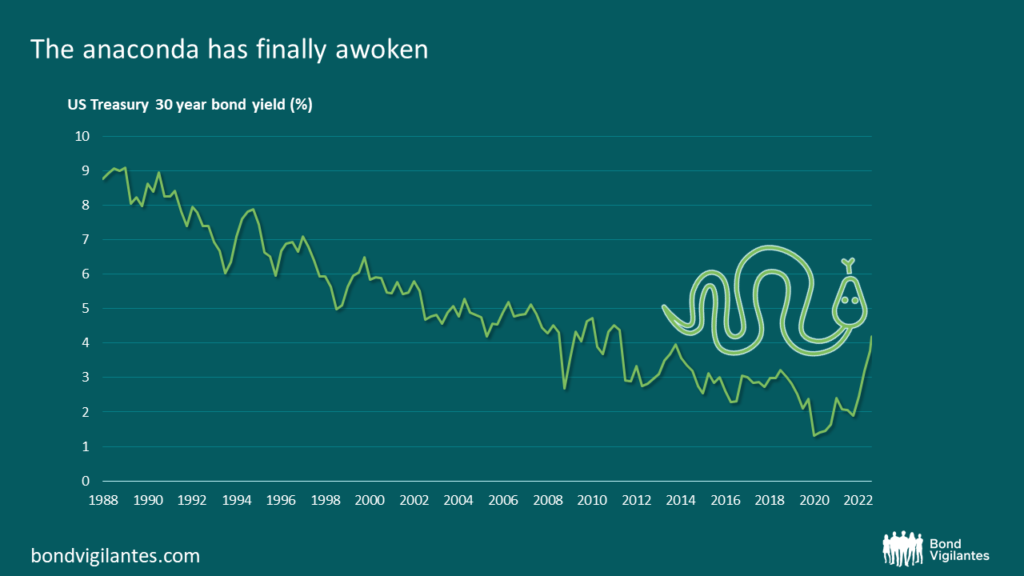

2. The waking of the giant anaconda

We have previously compared the long end of the US Treasury market to a giant anaconda: drawing little attention during its long slumber, but making markets shake the moment it wakes and rears its head.

For many years, long-dated Treasury bonds have made investors smile: a multi-decade bull market in yields made financing cheap and gave investors healthy returns. The moves in long-dated Treasury yields can be poisonous though, as they affect mortgage rates and the price of debt around the world. This year, the whole Treasury curve has risen, and the giant anaconda may finally have awoken…

Source: M&G, Bloomberg (26 October 2022)

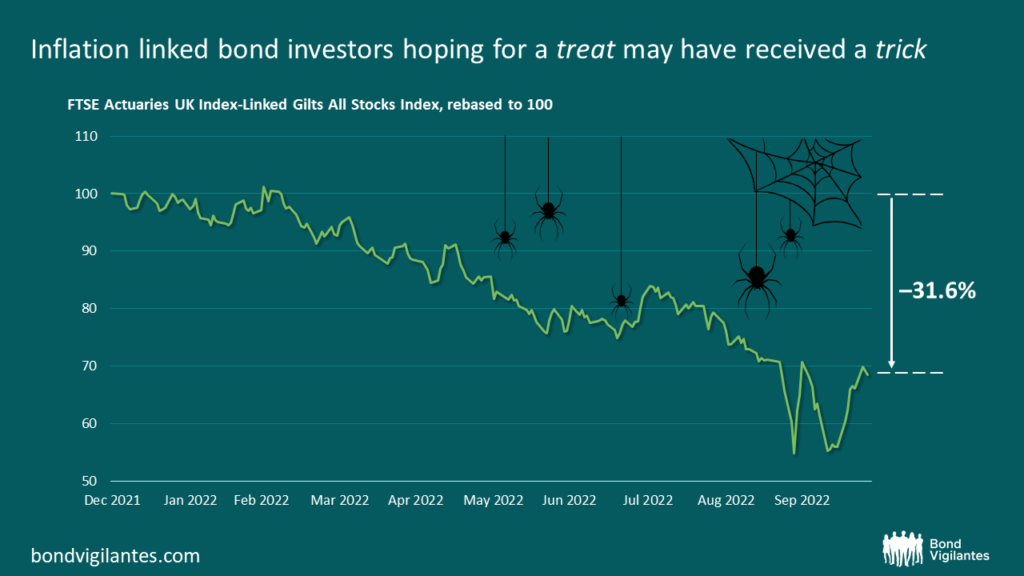

3. Inflation linked bond investors hoping for a treat may have received a trick instead

One place investors may have tried to shelter from the headwinds of 2022 is in inflation linked bonds. These may sound like the perfect place to hide in a year that has seen CPI reach double digits in the UK, and not far off it in Europe and the US. But a quick look at year to date returns of the FTSE Actuaries UK Index-Linked Gilts All Stocks Index makes for scary viewing – this index is down over 30% year to date.

What is going on here? It is important to remember that, while inflation linked bonds do contain a treat, in having their principal and coupons linked to inflation, they also carry a potential trick: they can have a lot of interest rate duration. In inflationary environments, in which central banks tend to hike rates, rising interest rates is bad news for bonds with a lot of duration as linker investors may have found to their peril this year. One way to mitigate this effect is to invest in much shorter dated linkers.

Source: M&G, Bloomberg (26 October 2022)

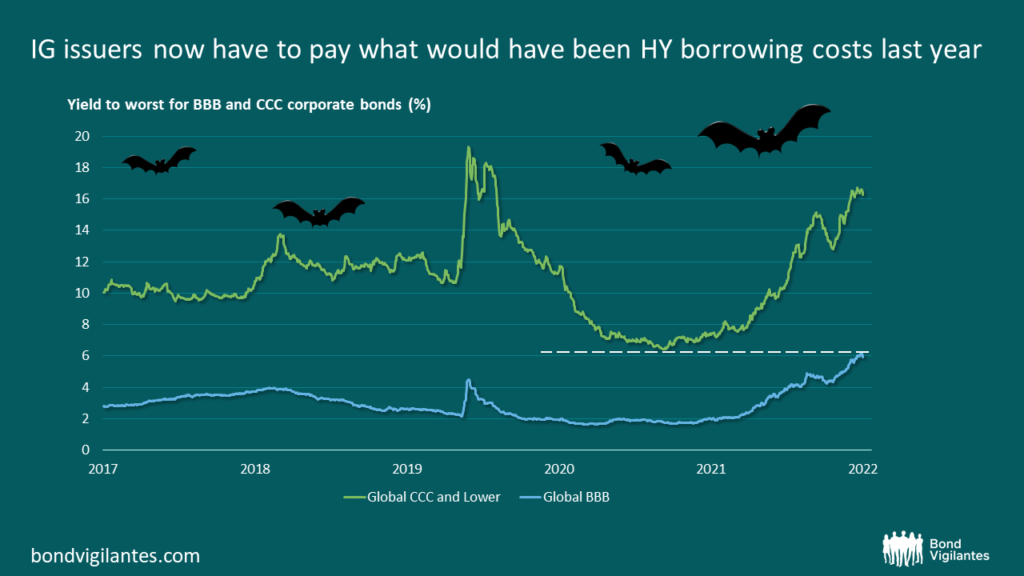

4. Boo! IG issuers now have to pay HY borrowing costs

Turning now to those companies issuing bonds, 2022 had a spooky surprise for investment grade issuers, who are now having to pay what the market recently would have priced as high yield borrowing costs. From as low as 1.6% all-in yields at the start of 2021, BBB-rated investment grade issuers are now having to pay eye-watering borrowing costs of 6.1% – not far off the 6.4% that CCC-rated high yield issuers were being charged that same year.

This chart may send ghostly shivers down the backs of any IG companies with approaching refinancing risks.

Source: M&G, Bloomberg (26 October 2022)

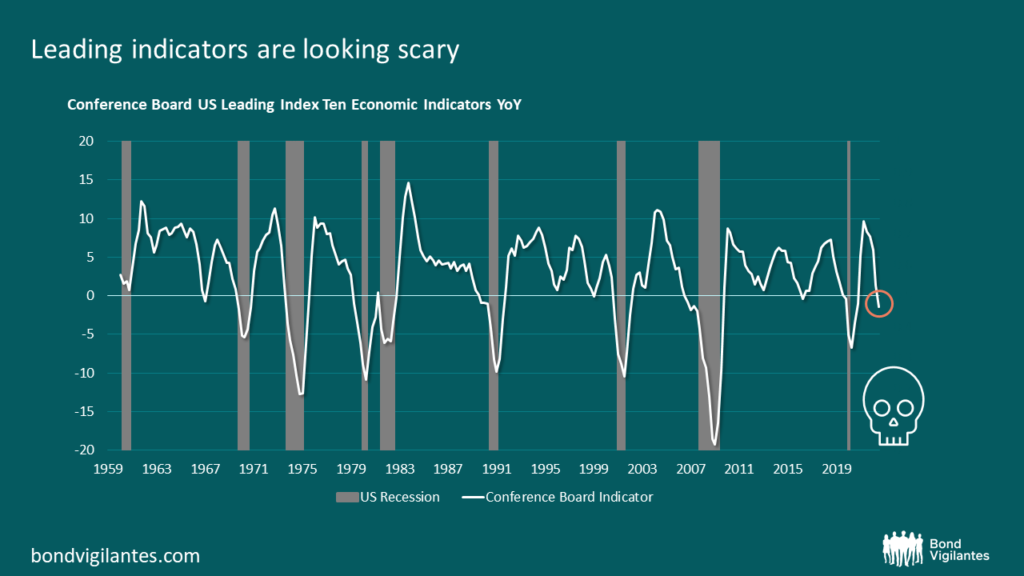

5. Leading indicators are looking scary

There are some frightening ghouls hiding behind this chart, which shows the US Conference Board leading indicators index. From jobless claims data and production measures, to new orders and consumer expectations, this index is a combination of the most used leading economic indicators and makes for grim viewing. Recently it plunged below zero, which in the past has suggested a recession is about to come.

Source: M&G, Bloomberg (23 October 2022).

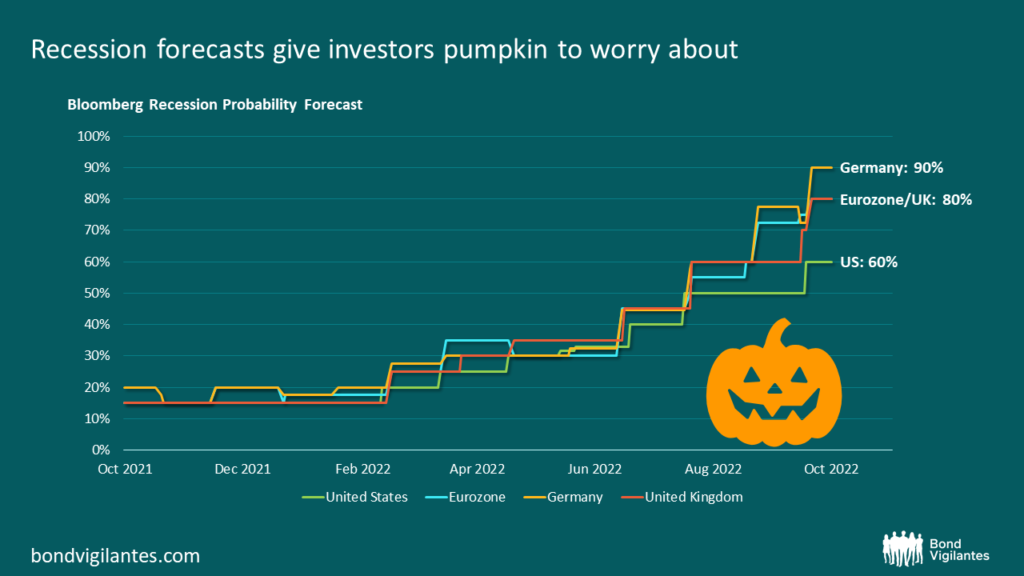

6. Recession forecasts give investors pumpkin to worry about

Perhaps these leading indicators, along with the inflationary pressures being felt around the world, help explain this next alarming chart. Economists’ forecasts for the probability of a recession coming over the next year have been steadily creeping up in 2022. This chart makes for terrifying viewing, with forecasts now having reached 80% in the UK and Eurozone.

Source: M&G, Bloomberg (26 October 2022)

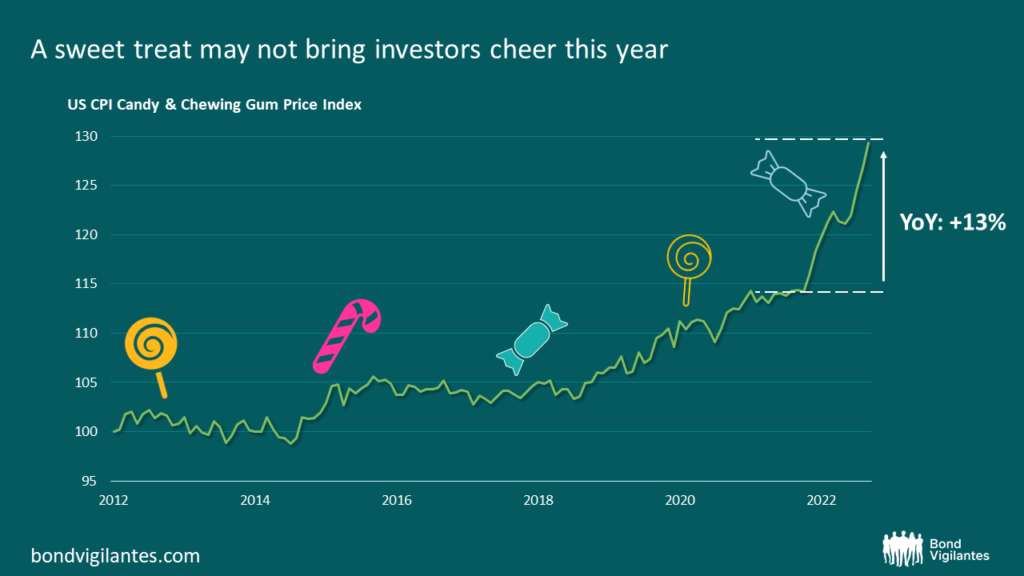

7. And finally… a sweet treat may not bring investors cheer this year

Finally, the cost of Halloween may be going up this year for those hoping some sweet treats may cheer them up after seeing these scary charts. The US CPI Candy & Chewing Gum Index (!) reveals inflation here at over 13% in the year from September 2021 to September 2022 – to put this in perspective, it took around seven years to see the same level of inflation in the candy index in the period up to 2021.

Source: M&G, Bloomberg (26 October 2022)

Happy Halloween!

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.