Emerging Market Bank Subordinated Debt Set to Make Waves in the Primary Market

Notwithstanding the recent bout of volatility, emerging market (EM) corporate credit has performed well this year, posting returns of 5.6% to July 2024 at the index level. There are several reasons for this, including the low leverage in this space, greater state participation in (and therefore protection of) the corporate sector than in developed markets (DM), and the relatively high-quality and short-duration nature of the universe. However, one reason stands out as contributing enormously to the market’s strong pricing performance: negative net financing, which means that more bonds are being redeemed than issued, leaving more cash to chase fewer bonds. This has now become a multi-year trend, driven mainly by Asia (particularly China). According to some estimates, the negative net financing figure for 2024 could rise as high as $190bn. There is one sector, however, where we believe issuance will remain robust and even increase substantially over the next few years, namely that of subordinated bank bonds.

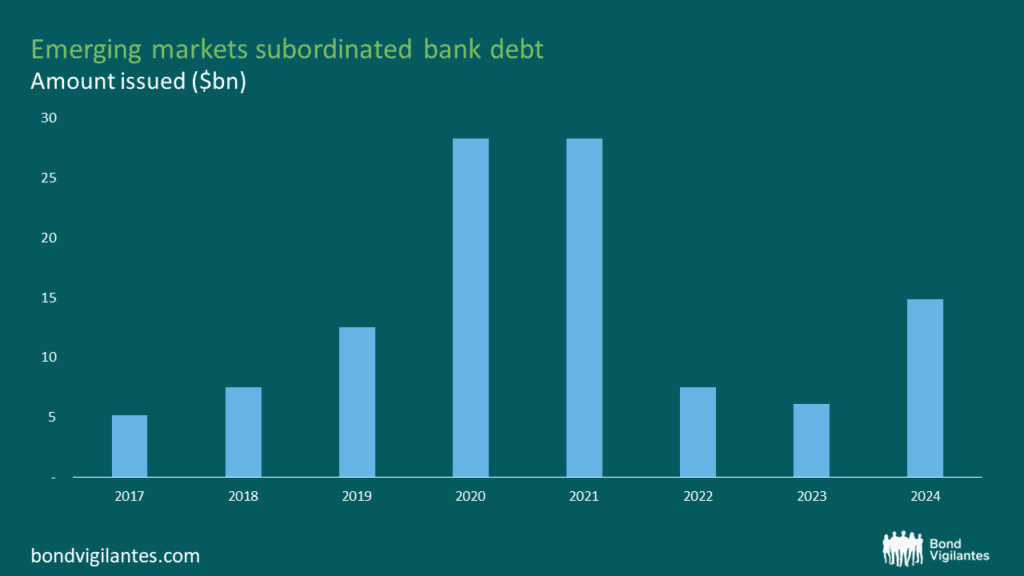

The current stock of USD-denominated EM bank capital instruments in the universe stands at around $122bn and accounts for about 30% of total outstanding index-eligible EM bank debt. The chart below shows that the issuance of bank capital instruments – both AT1 and Tier 2 debt (the key features of which have been discussed here) – increased substantially from $5.2bn in 2017 to $28.3bn in each of 2020 and 2021. Issuance then subsided for a couple of years as the market shifted into risk-off mode following Russia’s invasion of Ukraine and the subsequent Federal Reserve (Fed) rate-hiking cycle, before rising again as soon as the market reopened in late 2023. So far this year, EM banks have issued $14.9bn of subordinated debt (sub debt), meaning that we have the potential to reach the heights last achieved in 2021, demonstrating the enduring popularity of these instruments.

Source: M&G, Bloomberg, August 2024

There are several reasons to expect the stock of sub debt in this space to increase. As banks grow, they will need more capital to support their assets. Sub debt is an efficient way to achieve the required level of capitalisation without diluting their equity further or reducing return on equity (RoE). Sub debt issued in USD helps to protect banks against the impact of currency volatility on regulatory capital ratios, particularly if they have a substantial amount of USD loans on their books. In addition to these natural incentives for banks to increase their stock of subordinated bonds over time, regulators often mandate their issuance. This year, for instance, Chile introduced full Basel III regulations mandating banks to hold a certain amount of AT1 bonds as part of their capital stack. This led to well-received AT1 issues from Banco del Estado de Chile and Banco de Credito e Inversiones. Finally, a falling Fed rates cycle, which the market currently expects, would open the door for banks to issue subordinated securities at rates they feel comfortable paying. High Fed rates were a key reason for the drop-off in issuance in 2022-23, and they also drove issuers with deep local markets, such as in South Africa and Brazil, to issue sub debt locally rather than internationally. Lower Fed rates may change the pricing dynamic. As rates fall, we therefore expect the amount of new subordinated bonds appearing in the market to rise.

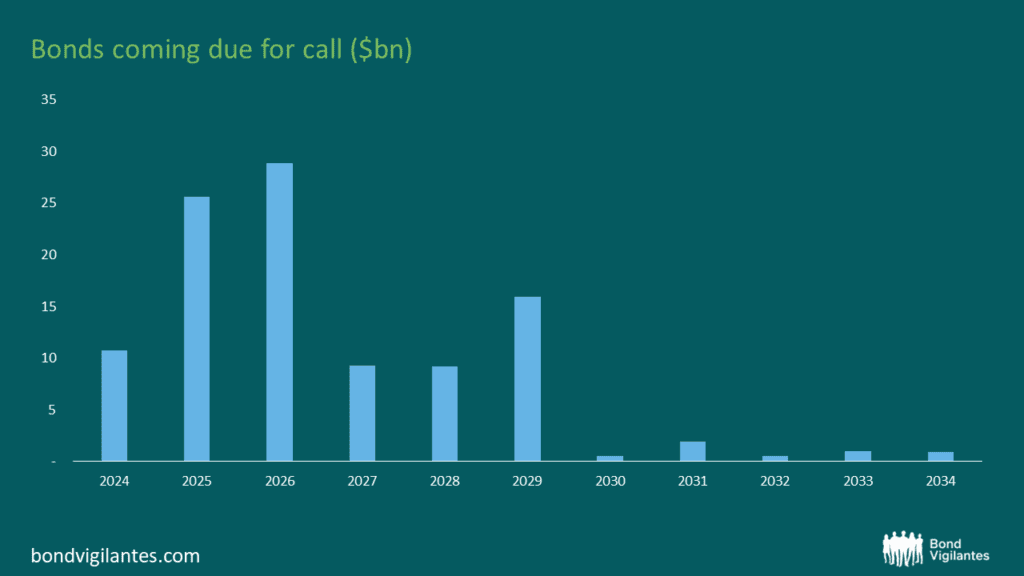

There is one other important reason to expect the issuance of subordinated bank debt to accelerate: the call schedule. The vast majority of these instruments (86% of the current stock and almost all instruments issued since 2019) are callable, generally five years after issuance. We expect the vast majority of these calls to be honoured (for the reasons why, see here). The chart below shows that, by the end of 2026, 62.4% of the stock of callable bonds ($65.1bn) will encounter their next call date. There are a further $10.7bn of such instruments to refinance this year alone, on top of the $14.8bn already issued. In 2025, this number rises to $25.6bn and thence to $28.9bn in 2026. In other words, just refinancing calls for these years requires meeting the record issuance levels of 2020-21. With growing bank balance sheets, regulatory developments, and the addition of maturing names to this market, we expect those records to be comfortably surpassed as the asset class continues to grow.

Source: M&G, Bloomberg, August 2024

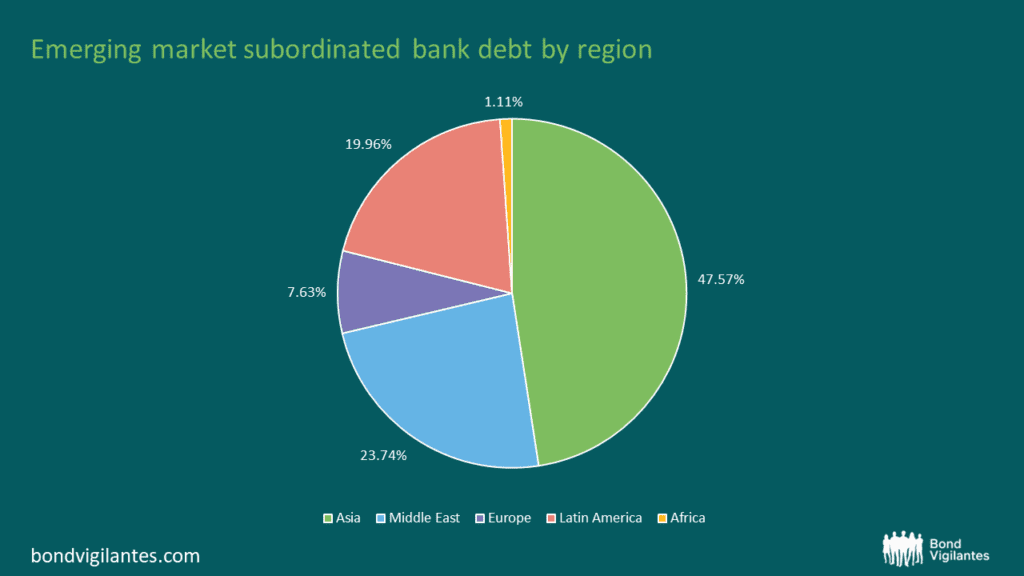

Finally, where might this growth occur? The chart below shows that 70% of EM bank sub debt is issued out of more mature, higher-quality markets in Asia and the Middle East. Banks in these regions are well-known, have strong local investor bases, and hold investment grade ratings. While we expect these markets to continue to grow, we expect higher marginal growth elsewhere. Regulatory developments will see new names approaching the market in LatAm, whereas falling Fed rates could cause issuers with strong local markets, like South Africa, to look abroad again. It could also allow more niche issuers, like those in Nigeria and Georgia, to access the sub debt market. As weaker markets mature and catch up with their Asian counterparts, there’s no reason they shouldn’t follow the same path and develop their sub debt offerings. Whether this takes the form of Tier 2 or AT1 securities is up for debate and will depend on each individual market – some, like Peru, remain heavily focused on common equity. Current trends are fairly split, with sub debt issued this year so far favouring Tier 2 over AT1 by a margin of 55%/45%.

Source: M&G, Bloomberg, August 2024

Whatever form it takes, this market has a bright future. It is attractive to banks as a cheap form of capital and to regulators as a protective instrument of last resort. As investors, we believe that the asset class offers a very appealing risk/reward profile. Moving down the capital structure of strong banks allows us to enhance yield without materially increasing default risk. While volatility in these instruments is greater, our medium-term approach allows us to look beyond short-term price fluctuations to realise the long-term gains offered by these instruments. For these reasons, we are overweight the space, but favour T2 over AT1 paper on current valuations. We welcome the prospect of further issuance, which is likely to provide attractive opportunities to build exposure, particularly if new names – or old ones that have been out of the market for a while – choose to print. We don’t view the looming issuance wave as a negative technical factor, as much of it will be used to refinance calls. Rather, we see it as an opportunity to roll existing exposures to names we like at a premium to existing bonds, or to further diversify our portfolio by adding interesting debut names to our book.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.