The US Economic Outlook: Labour Market Puzzle – “You’re Hired or You’re Fired”

The US, and consequently the global bond markets, were rightly focused on the November US election. With the election concluded, it is time to shift our attention from the 50 states to the state of the US economy, particularly the labour market, which is a key economic indicator for policy decisions.

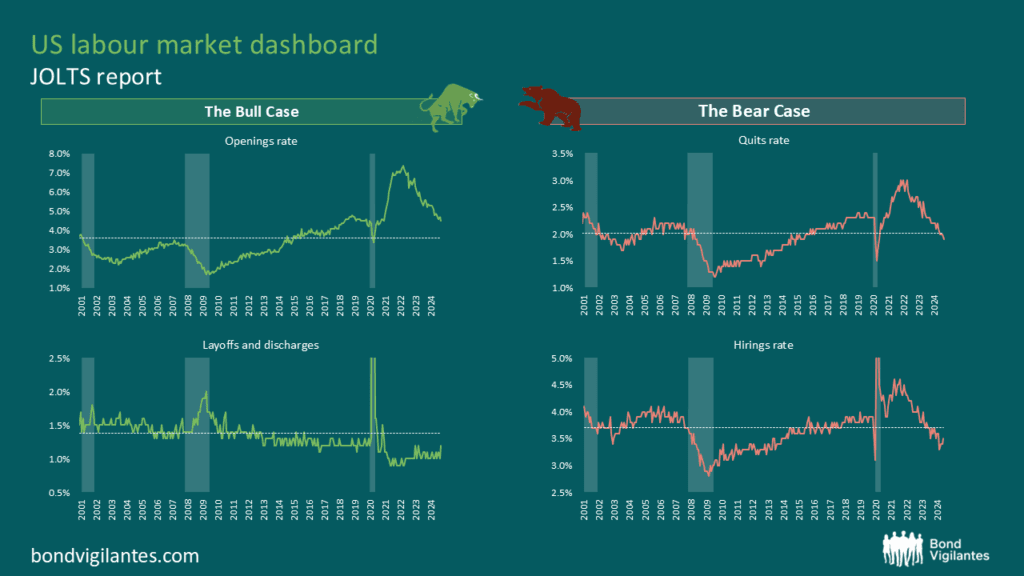

Unlike in the past, not all jobs statistics are moving in the same direction and as a result, we are receiving mixed signal from the labour market. Take for example the JOLTS (Job Openings and Labour Turnover Survey) report, which is a monthly publication by the US Bureau of Labor Statistics that provides detailed insights into the US labour market. Depending on which indicators you decide to focus on, you can create a bull case or a bear case for the current state of the labour market.

Below is a slide representing the key indicators published in the JOLTS report. The charts on the left support the bull case for a robust economy. Job offers remain historically high, and layoffs are low, indicating a strong labour market. Conversely, the charts on the right illustrate the bear case. Both the quits rate and the hirings rate are low and at levels consistent with a recession.

Source: M&G, Bloomberg, 30 September 2024 (latest available data)

The market’s interpretation of economic data swings between these two perspectives. Strong economic data supports the bullish view, while weak data supports the bearish view. This dichotomy contributes to the volatility in interest rates as the economic outlook remains uncertain. The key question is whether the labour market is strong, weak, or perfectly balanced.

When considering all four charts together, one could argue that we have a neutral outlook for the labour market and, by extension, the overall economy. However, the divergence between the bullish and bearish indicators warrants further examination.

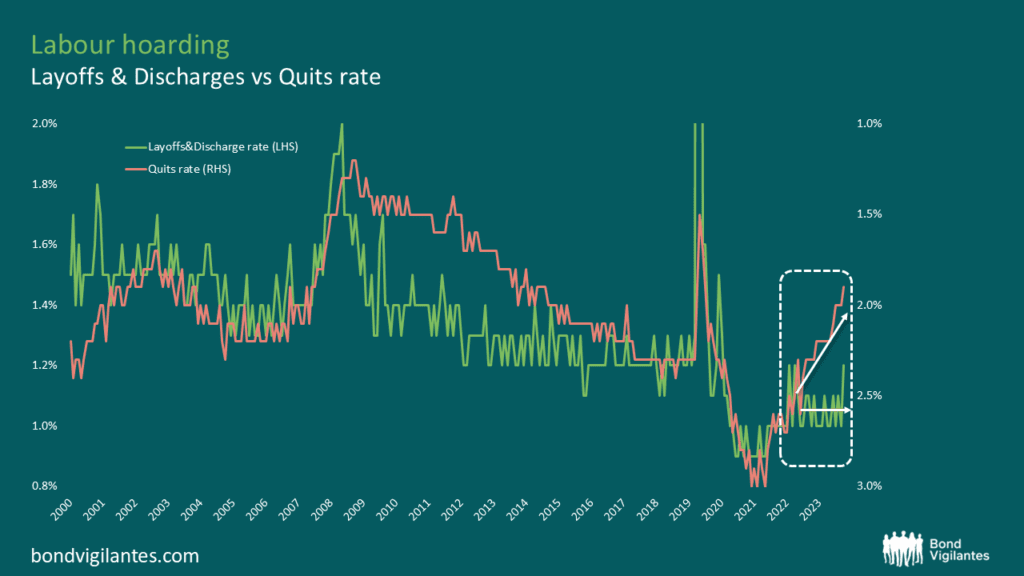

The chart below plots the quits rate against layoffs and discharges. The quits rate is driven by workers and reflects their confidence in the job market. When more employees voluntarily leave their jobs, it indicates that they are confident in their ability to find new, likely better, employment opportunities. This confidence usually stems from a robust job market with ample opportunities. Conversely, layoffs and discharges are decisions made by companies and generally reflect the underlying health of a company. The chart below shows an unusual divergence between these two lines. Workers seem hesitant to leave their jobs, suggesting weak labour market dynamics, while companies are behaving differently.

This relationship has significantly changed since the beginning of this decade, likely due to the unprecedented economic impact of the COVID-19 lockdowns. The T shaped recession has understandably affected how management approaches hiring and firing. Companies laid off employees quickly in 2020 and then struggled to rehire. This experience has changed their behaviour, leading to a tendency to hoard labour. This behavioural shift likely explains the current labour market puzzle: companies are not firing employees and are continuously looking for new hires. Consequently, redundancies are low, and theoretical job offers are plentiful. This labour hoarding behaviour could account for the divergence between corporate and worker behaviour.

Source: M&G, Bloomberg, 30 September 2024 (latest available data)

The logical conclusion from the above chart is that while companies’ behaviour has changed, workers’ behaviour remains unaltered. The critical question is: how long companies will continue to hoard labour? The longer this behaviour persists, the stronger the economy will be.

If companies revert to a more traditional approach, moving away from labour hoarding, we would see a convergence in the data. Firings would increase, and job offers would decline. However, if companies decide to maintain their current approach, the economic outlook would involve less risk.

President-elect Trump is well known for his “You’re Fired” catchphrase. His appointments in his new administration suggest a downsizing of employment in the public sector. If this drive for efficiency is mirrored in the private sector, labour hoarding is likely to decrease rather than increase.

In conclusion, the US labour market presents a complex puzzle with indicators pointing in different directions. Understanding the underlying behavioural changes in corporate hiring and firing practices is crucial to interpreting these mixed signals and predicting future economic trends. If the corporate mood mimics the recent change in political culture then “You’re Fired” becomes a more likely corporate mantra.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.