The Great British Borrow Off: Baking efficiency into gilt sales

Many governments worldwide face increasing scrutiny over their fiscal affairs, and the UK is no exception. As a result, government cost-saving measures have understandably become a key focus. This blog aims to highlight two notable areas of inefficiency within the gilt market.

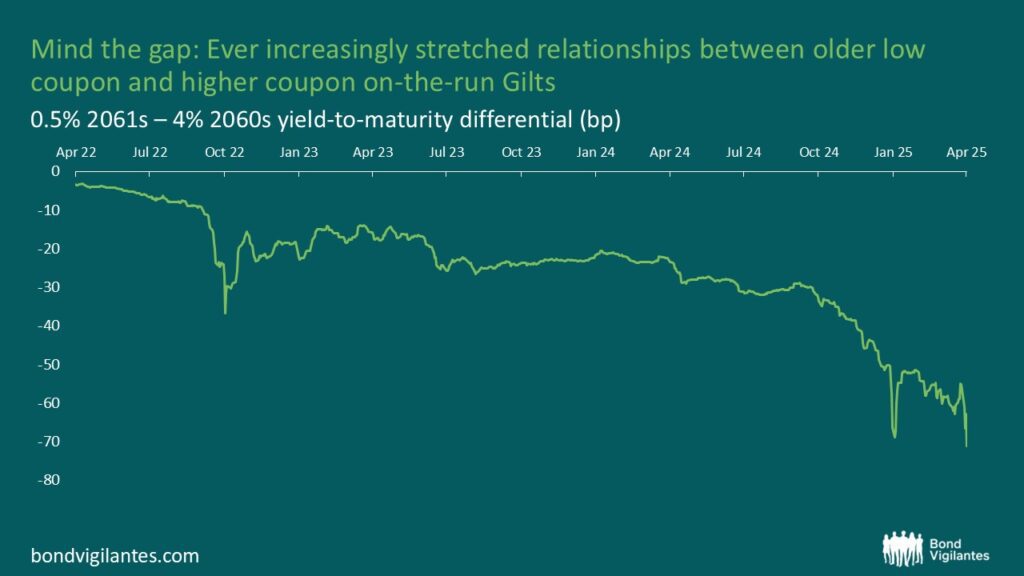

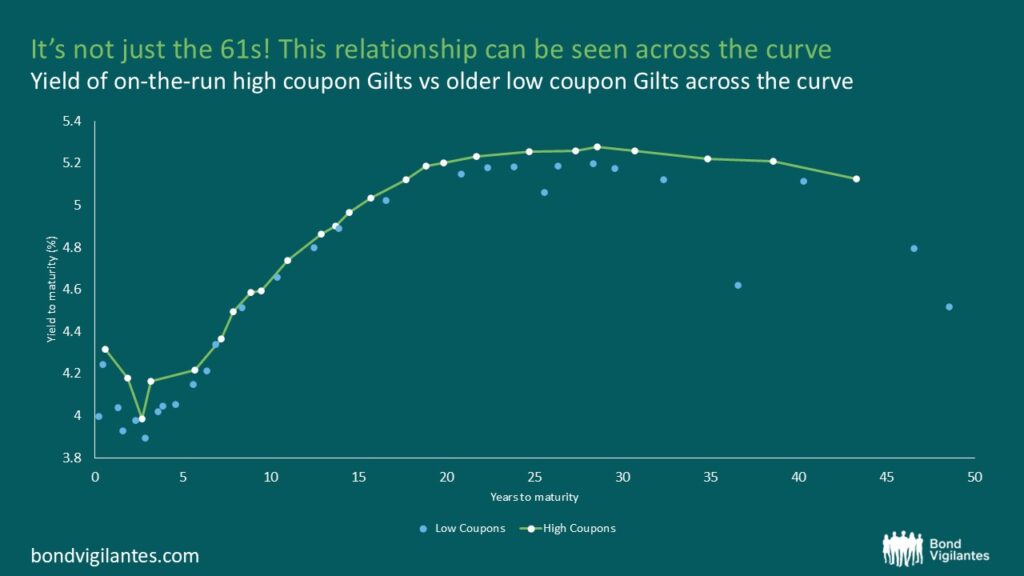

Firstly, there is a clear disconnect between older low coupon gilts and current on-the-run issues. This relationship looks particularly stretched in parts of the curve, with the 61s trading ever richer. Currently, 61s trade at 70bps through the 60s. We touched on this in a previous blog post, outlining what’s driving it, and why it may present an opportunity for investors.

Source: Bloomberg, M&G (31 March 2025)

Source: Bloomberg

With this clear pricing differential, we ask ourselves, why isn’t the government issuing long-dated, low-coupon bonds?

One of the key reasons appears to relate to accounting treatment. The government’s preference is to issue current coupons so that it does not distort the debt arithmetic. If the government were to issue the low coupon 61s with a cash price of 28 pence on the pound, it would have to issue approximately £17.5bn to raise £5bn cash. This is where the accounting comes into play. The government would massively increase the debt stock with 61s issuance as the full £17.5bn is added to the stock of debt, which is unwelcome. However, the year-to-year deficit numbers would be better as a result, given the low annual interest outlay from that particular issue’s 0.5% coupon. Alternatively, by issuing current higher coupon bonds, the year-to-year spending takes the strain from the higher coupon, but debt levels go up more slowly.

It is worth considering whether greater focus should be placed on the yield-to-maturity of one’s financing, rather than how it appears on the balance sheet. If there’s a source of funding that is, say, 70bps cheaper, could this be an opportunity for the government to look beyond the optics and consider whether this pricing inefficiency could be put to good use?

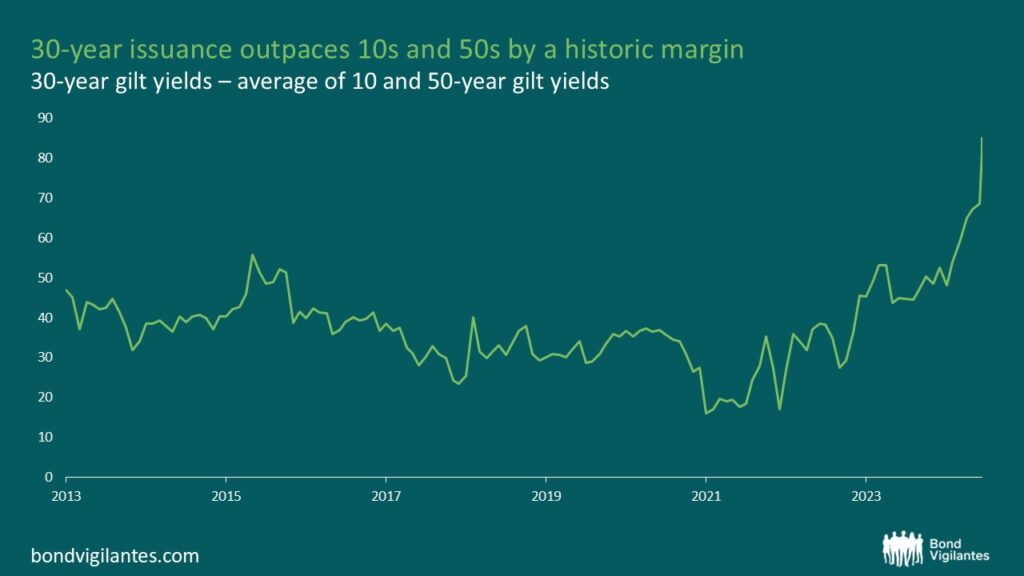

An essential factor to consider beyond the granular details of low coupons versus high coupons is the shape of the yield curve. Given the substantial issuance required by the government in the coming years, one might ask whether the distribution of that issuance is as efficient as it could be. The chart below illustrates the yield relationship between 30-year gilts and bonds maturing in 10 and 50 years. It is evident that 30-year new issuance is occurring at multi-decade highs in yield compared to these other maturities. The simplest way to address this imbalance may be to scale back the issuance of 30-year gilts and focus on other maturity points until this relationship adjusts to more typical levels.

Source: Bloomberg

It would be unjust to suggest that the government is unaware of this issue; indeed, the government has been responsive. We have observed a significant reduction in this year’s allocation to long-dated issuance, which should gradually address this concern. More recently, the Bank of England announced the cancellation of a long-dated quantitative tightening (QT) operation for this month. The cancellation is particularly noteworthy, as it may imply a higher sensitivity to the recent rise in gilt yields, with steps being taken to mitigate any resulting pressure. This development could signify the possibility of a pause in QT, especially as yield levels continue to increase. Such a pause would certainly help alleviate the pressure on rising gilt yields.

If we were to take this analysis a step further, in the event of QT ceasing, one option could be to redirect any reinvestments from maturing quantitative easing (QE) bonds towards the 30-year maturity point to help address the pronounced undervaluation in this sector.

These are practical, measured steps that could support more efficient market functioning and potentially deliver better long-term outcomes for taxpayers.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.