Electronic Arts: How to madden bondholders

The record breaking $55bn leveraged buyout (LBO) of Electronic Arts (EA) is expected to close this year. But in a twist that could madden bondholders, EA is tendering for its bonds well below par instead of honouring the 101 Change of Control provision, saving itself over $250m at bondholders’ expense.

Many bonds include a Change of Control clause that requires the issuer to offer to repurchase at 101 in the event of a takeover. The idea is to protect bondholders from a deterioration in credit quality if a weaker owner takes charge.

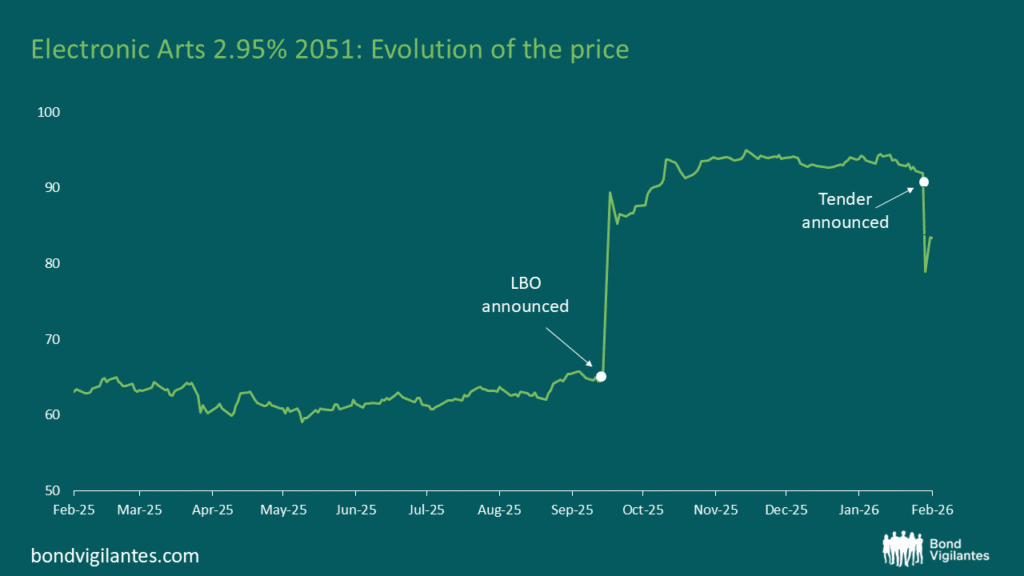

EA had two bonds outstanding when the LBO was announced last year. Before the announcement, the bonds were Investment grade rated and traded around 100bps over Treasuries. Because they were issued in the low‑rate environment of 2021, coupons were just 1.85% (2031s) and 2.95% (2051s). In the higher‑rate environment of 2025, a 100 bps spread translated to a price near 65 for the 2051s. On hopes of a 101 payout, those bonds jumped almost 50% to around 90.

EA is now gaming bondholders by offering to buy the bonds at a flat spread to Treasuries (plus a 50bps early consent fee), which currently equates to c. 74 for the 2051s.

Is it game over for bondholders? Practically speaking, they have little choice but to accept. EA will use defeasance, an archaic but legitimate mechanism, to place the remaining bonds in trust. By backing the bonds with Treasuries (or cash), EA is relieved of ongoing covenant obligations, including the Change of Control. Holders who refuse the tender will be left with an instrument that has the payment certainty of US Treasuries but dreadful liquidity.

The savings for EA are material in absolute terms: over $250m versus the higher 101 payout. Even if bondholders don’t tender, EA can defease with long Treasuries that have fallen far as yields have risen. For example, the US Treasury 1.875% 2051 trades in the mid‑50s.

Bondholders will argue that $250m is small in relative terms of a $55bn transaction, and perhaps that EA will find it harder to place the $20bn of LBO debt should it alienate the market. Current secondary pricing above the tender level suggests there is a chance EA relents. Even so, the recent fall in software valuations may encourage the sponsors to squeeze every part of the structure to make the deal work.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.