Caveat emptor – new deals in the high yield market

The volume of new bond deals in the European high yield market has been very strong this year. One (unscientific) measure of this has been the growing pile of bond prospectuses on the desk; already the 2013 pile is more than halfway up the 2012 pile after just three months.

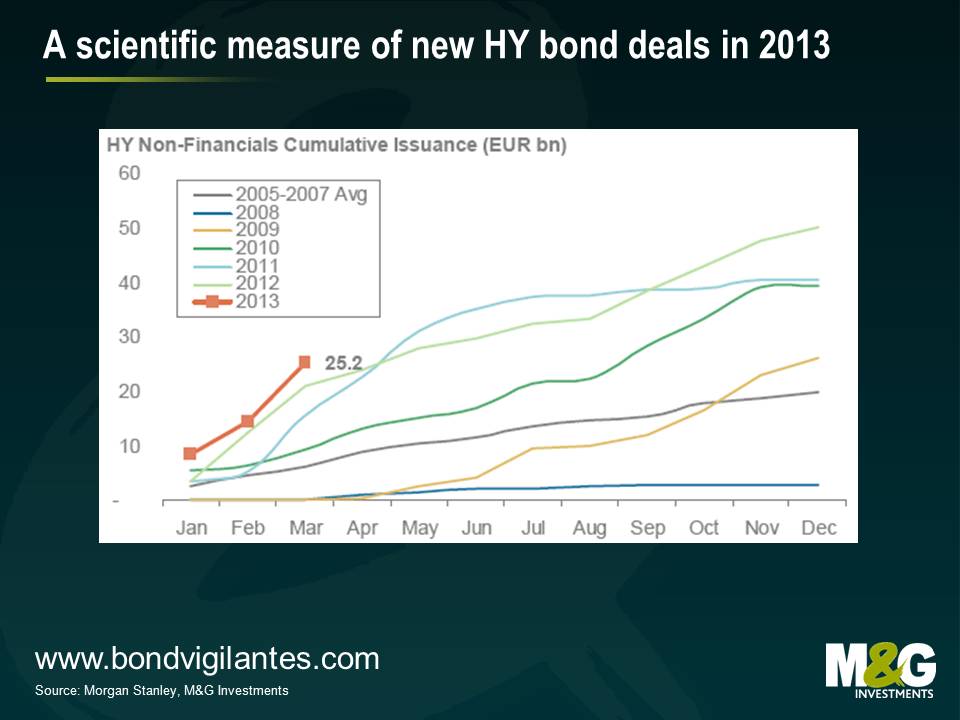

A marginally more robust measure is the data below published by Morgan Stanley. The year to date number of €25.2 bn is running well ahead of last year as more and more companies take advantage of lower yields and looser financing conditions in the wider credit markets to term out their debt and reduce interest costs.

Whilst this is generally good for the long term development of the high yield market in terms of depth and diversification, at this point in the cycle there are a few factors that are beginning to cause us to pause for thought.

In brief they are:

- Capital structure – in recent months we have seen the re-appearance of more equity like instruments being issued. This can take the form of deeply subordinated debt, or bonds that pay interest in the form of more bonds rather than cash (aka payment in kind notes). These instruments are typically used to fund dividends to the owners of businesses and can expose bond investors to equity like downside.

- Covenants – less of an issue for the bond market, but several leveraged loans in recent months have been issued on so called “cov-lite” terms (i.e. with significantly looser legal restrictions)

- Quality of issuer – looser conditions in the credit markets make it easier for riskier issuers to refinance their debt. In early 2012, the market was largely closed to cyclical or more challenged southern European issuers. This is no longer the case.

- Pricing – all the factors above are acceptable as long as buyers of the bonds are being compensated for the inherent risks. However, given that these deals are being priced in a market with an average yield of 5.6%*, the general prospects for attractive returns are more limited.

We believe that on a case by case basis there are still some attractive opportunities. Nevertheless this is very much a seller’s market. The terms are arguably more attractive for the issuers of bonds rather than the buyers. Accordingly, when looking at new deals, now is the time for a healthy dose of cautious discrimination – caveat emptor.

*B of A Merrill Lynch Euro High Yield Index yield to maturity 02/04/13

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox