Demurrage – a tale of gold, cash and mercenaries

Historically I’ve struggled with the concept of gold as an investment. Presumably if you bought gold for this purpose you would want to store it somewhere safe and insure it. However, investors in gold should account for the fact that there is a cost to sleeping well at night. Vaults and insurance don’t come for free, and that cost can be thought of as a negative yield or the demurrage of gold.

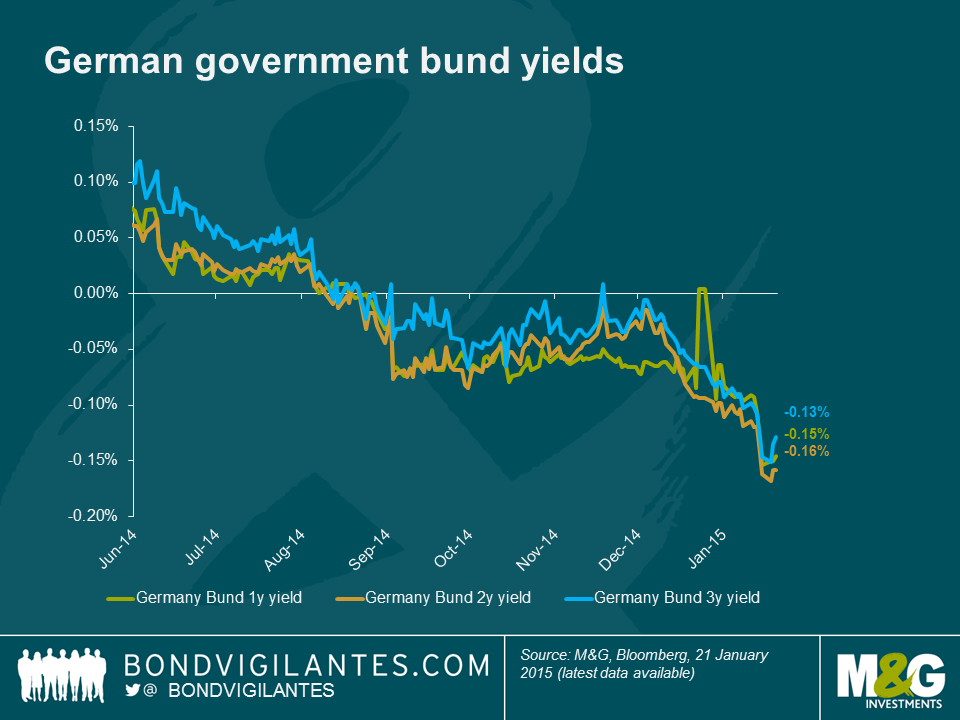

As a bond fund manager a negative yielding investment was something of an anathema. The “was” in that sentence is quite illuminating. Bond investors have been living in a world where some bonds have been paying negative yields for a while now. Investors at the front end of the German bund curve, for example, have effectively been paying for the pleasure of owning those bonds since late summer last year.

This got me thinking, how negative do bond yields need to get before investing in gold is relatively cheap from a yield perspective? With a quick google search I found that for those wishing to store less than 15 bars of gold (over $7.5m worth at today’s prices) the cost of storing and insuring it is about 12 basis points (bps) a year. As you can see from the chart there currently isn’t much in it between gold and short dated bunds.

For traditional bond investors concerned with at least maintaining the nominal value of their investment, gold isn’t the most reliable asset. Perhaps just holding cash is the answer, but with interest rates on bank accounts in Europe also turning negative what is a conservative investor to do?

A bit more googling unearthed how much it costs to rent a safety deposit box at a bank, and how big a pile of dollar bills is. I was then able to calculate how much it costs to own a box full of dollars for a year. The negative yield on cash stored in such a way depends largely on how much of it you have. At the bank whose boxes I was browsing, anything less than about $400,000 dollars costs around 7 bps per year whereas amounts over $3m would cost 3 bps a year.

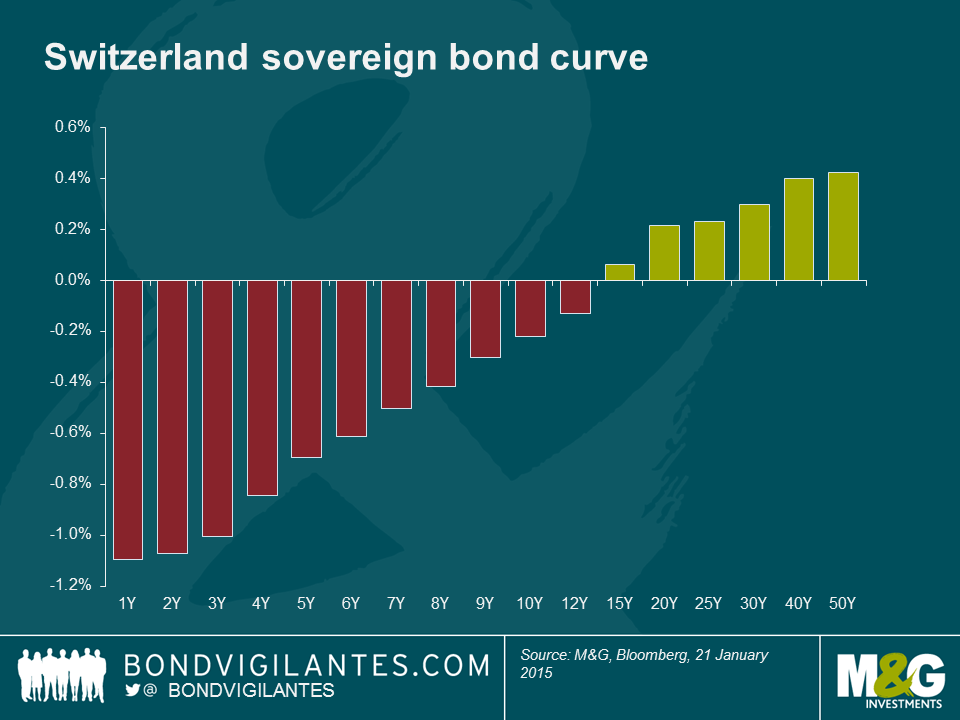

Unsurprisingly I’m not the first person to think of this, as the Swiss National Bank’s website points out, 61% of all bank notes in circulation are made up of CHF 1,000 notes! They go on to state that “The high proportion of large denominations indicates that banknotes are used not only as a means of payment but also – to a considerable degree – as a store of value”. In an economy experiencing deflation, with a large proportion of its government bonds yielding less than zero, a safety deposit box that costs a few basis points a year appears to be a sound investment… until someone decides to steal it that is.

Sadly I haven’t been able to find anyone willing to insure a safety deposit box filled with currency, but if you really wanted to store a large amount of cash you could always build a fortress and hire some mercenaries to protect it. At this point admittedly things start to get rather hypothetical (I hope you’ll forgive me for not looking for quotes whilst at work), but I think it’s safe to assume it would cost more than a few basis points a year. Whatever the cost of such a facility, it would surely put a floor under how negative interest rates could go. Only a full move to electronic money and the end of physical storage could remove this bound (and also end lots of criminal activity and tax evasion too).

Back in reality… If Mario Draghi announces – as is widely expected – full blown quantitative easing later today I think we will see more assets trading with negative yields and more discussion around the relative demurrage between assets. In a world of negative government bond yields, risk aversion and deflation, cash is king.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox