Europe needs a German fiscal stimulus package but won’t get it

The German government can theoretically borrow at negative yields if it were to issue short maturity debt today. Longer maturity debt is also yielding a record low amount. Could the collapse in yields be a blessing for Germany and Europe? Two economists at the International Monetary Fund (IMF) seem to think so. Indeed, the German government’s narrow-minded pursuit of the “black zero” (a balanced budget) could be precisely the wrong thing to do at this point of the economic cycle if the Eurozone is going to continue to move forward with its current membership intact.

In a recent working paper entitled “Das Public capital: How Much Would Higher German Public Investment Help Germany and the Euro Area?” IMF economists Selim Elekdag and Dirk Muir outline the case for a German infrastructure spending boom. They argue that higher German public investment would not only stimulate domestic demand in the near term, but would also raise domestic output over the longer-run and generate beneficial spillovers across the euro area.

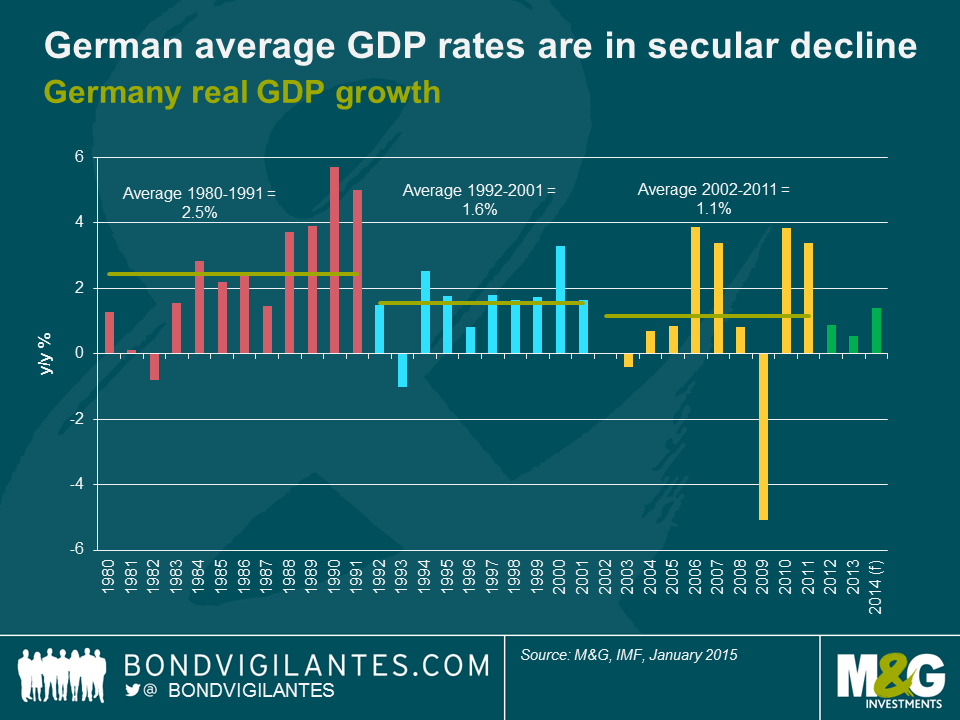

Public investment in Germany is the second lowest in the OECD (1.5% of GDP), while net public investment has been negative since 2003. Years of underinvestment has led to a deterioration of the public capital stock, suggesting that this is a good time to increasingly invest in public infrastructure. And there are areas that a public infrastructure programme would particularly benefit, including aging bridges and roadways. Given that German average GDP rates have been declining since 1980 and has been below trend more recently, the German economy could use a shot in the arm to stimulate economic growth and would benefit greatly from some added stimulus measures. Unlike public consumption – which tends to provide a short-term boost to economic growth if not sustained – an increase in German public investment would raise domestic GDP more durably in both the short and long-term as infrastructure projects become productive public capital.

The IMF economists find that a 4 year, 0.5% of GDP increase in German public investment (which is consistent with Germany’s fiscal rules) would yield a persistent increase in real GDP of 0.75%. Perhaps equally as importantly, the spending programme would also raise growth in the euro area, with peak effects on real GDP in Greece, Ireland, Italy, Portugal, and Spain (considered together) of 0.3%. The spillover effect into the rest of the euro area is transmitted through a couple of key channels. Firstly, positive effects for other euro area nations are caused by Germany demanding more goods from their euro area trading partners. Secondly, the inflation rate would be higher in Germany as demand increases, resulting in a real effective exchange rate depreciation for the rest of the euro area thereby making these nations more competitive. This is vital at a time when Europe is scrambling to generate any growth it can get.

The decline in inflation expectations across Europe, and some stabilisation in the prospects of the peripheral nations, has seen yields collapse not only for Germany but also the rest of the Eurozone. If European politicians could get their act together and exploit the low yields on offer (as ECB President Mario Draghi has implored them to do) and embark upon a coordinated effort to increase public investment across Europe, this would have some significant results on economic output. A coordinated fiscal stimulus (defined as a 2-year, 1% of GDP debt-financed increase in public investment) across the Euro area would generate a sustained 1.2% and 1.1% increase in German GDP and other Euro area countries respectively. If the economics is sound, why won’t the German government act?

The answer lies in the views of the German electorate. There is a fear within Germany that they will end up indefinitely subsidising the whole European periphery (much like the German West has been subsidising the East for the past 25 years with no end in sight). In order to avoid getting into a situation in which the German government has to pick up the bill for European peripheral debt, Germany is trying to enforce austerity on the whole Euro area. The only way Germany can credibly do that is by leading by example, like parents teaching children to eat vegetables. If Germany ramped up public investment and started running deficits now, it would have no (moral) authority whatsoever to make any demands on peripheral countries to keep budgetary discipline.

So at this stage it appears that project “black zero” is all encompassing for the German government and electorate. The type of coordinated effort that Europe needs – a combination of stimulatory fiscal and monetary policy – appears out of reach. Without the coordinated effort of policymakers, it is difficult to see how Europe will generate higher living standards over the longer term for its 330 million inhabitants.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox