The improvement in the US jobs market is quantitatively huge – but qualitatively mediocre

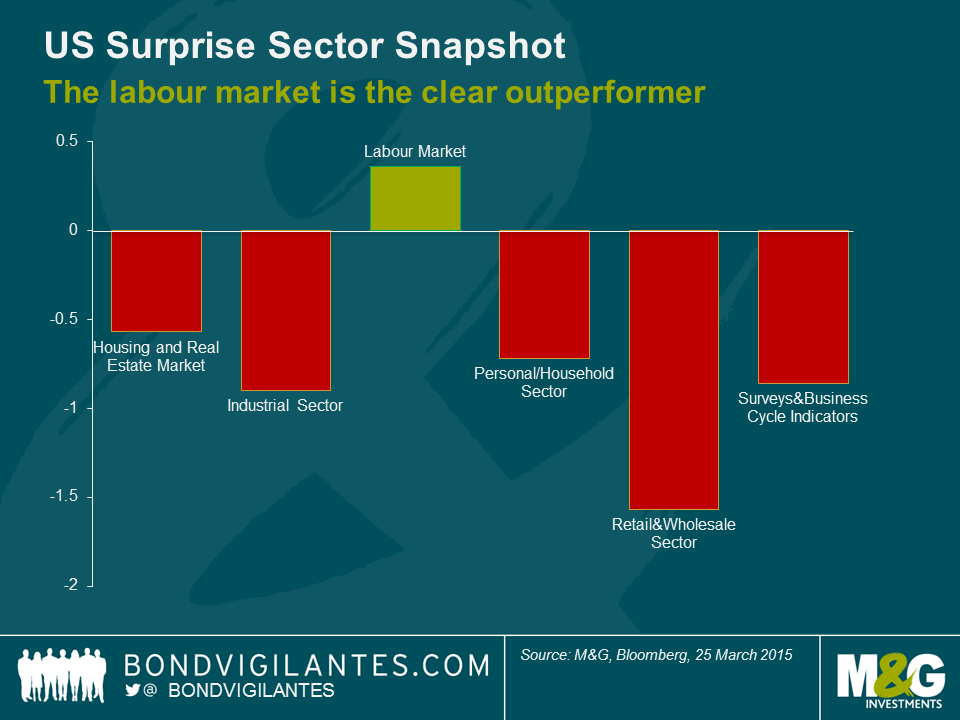

The condition of the US labour market is one of the hot topics in the ongoing “will they / won’t they” Fed rate hiking debate, and as Bloomberg’s Economic Surprises screen shows, this sector is the only area of the economy outperforming expectations of late.

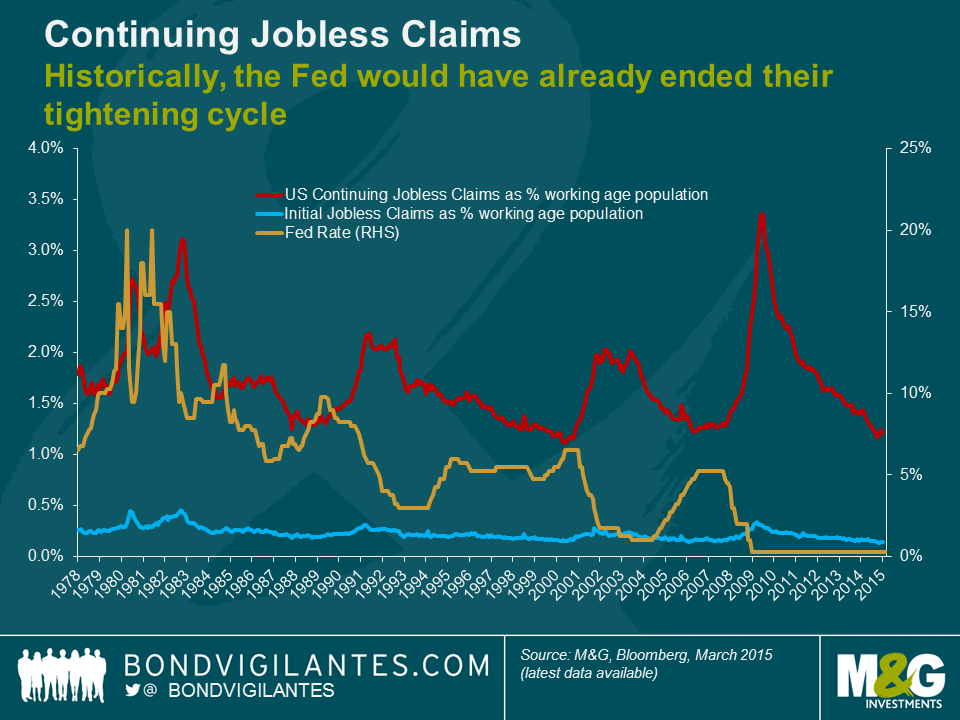

Labour market indicators continue to impress, with employment indicators strong on many measures. Initial Jobless Claims have dropped to 282,000 (market estimate: 290,000), the four-week average declined 7,750 to 297,000 and the number of people filing Continuing Jobless Claims for unemployment benefits fell 6,000 to 2.416m. We blogged last year about the fall in Initial Jobless Claims and noted that the absolute number alone understated the strength of the labour market, since as a percentage of the US labour force population, this statistic had hit multi-decade lows. If we consider Initial Jobless Claims to be a proxy for the flow of labour, then what has happened to the stock – i.e. the Continuing Claims – of labour?

The graph below shows both the flow and stock of labour as a percentage of the working age population aged 15-64. While Initial Jobless Claims has fluctuated within the 0-0.5% band over the last forty years, Continuing Claims move unsurprisingly within a much wider range. What is surprising however is that Continuing Claims as a proportion of the labour force hasn’t been any lower (1.22% at the beginning of this year) since the boom years at the turn of the century.

Historically, Continuing Claim cycles have bottomed out when the Fed has reached the top of its monetary tightening cycles (see the late 1980’s, early 2000 and in 2007). In recent years however we have seen a break from trend; an improvement in the labour market, without the corresponding policy tightening. It appears that by historical standards, the Fed are behind the curve. The new conundrum however, is that average hourly wage growth was 3.8% in the first quarter of 2000, compared to just 1.6% today. This weak wage growth, and the still elevated level of U6 unemployment (which includes discouraged workers and those working less than they’d like to) relative to the headline unemployment level, implies that the lack of a Fed rate hike is due to a preoccupation in the quality of jobs rather than just the quantity.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox