Brazil: caught in a destructive trap between politics and economics

Part of the ABC of Latin American debt series

Brazil currently finds itself caught in a destructive trap between politics and economics.

On the political front, it is impossible to trade the daily noise and headline risk. The possible impeachment (45% probability as a guesstimate) of Rouseff would still be subject to various steps and legal challenges and could take a minimum of 6-9 months. Three hundred and forty two votes are needed and the opposition only has about 280 votes at the moment. In the meantime, Congress would be fully distracted and the economy would continue to struggle until the uncertainties over who is in command are cleared. The ultimate goal of the opposition is to weaken the PT (Workers Party) as much as possible ahead of the 2016 midterm and 2018 presidential elections.

At the same time, local economists think that the economy is still three quarters away from bottoming out. Consumption is pressured by falling real wages and rising unemployment and investment is frozen until there is clarity on the political direction of the country. Net trade can make a small contribution, but not enough to turn things around as Brazil is a closed economy. In the meantime, the fiscal deterioration has been severe as revenues have an elasticity higher than one and more than 90% of expenditures are non-discretionary items that cannot be easily cut without congressional approval. Even a new administration, if weak, may not have enough support to de-index pensions and benefits from past inflation, which could allow Brazil to deflate itself out of a fiscal crisis. There is no chance of this happening under the current political environment. Other structural reforms, even if passed (e.g. public sector social security and pensions) would be a positive signal, but would only produce benefits in the long term. Additional tax increases to reduce the fiscal gap prompted an inconclusive but lively discussion of whether Brazil had already reached the optimal point on the Laffer curve –ie where further tax raises become counter-productive. The CPMF bank tax, which in theory can collect near 1% of GDP is unlikely to be passed (despite the carrot of sharing part of it with cash strapped local governments) as the opposition is conditioning this on spending cuts on politically sensitive areas (such as pensions), which the government is unwilling to tackle due to its low popularity and voter backlash. Brazil, like many other countries in the region, desperately needs growth to shore up its fiscal accounts.

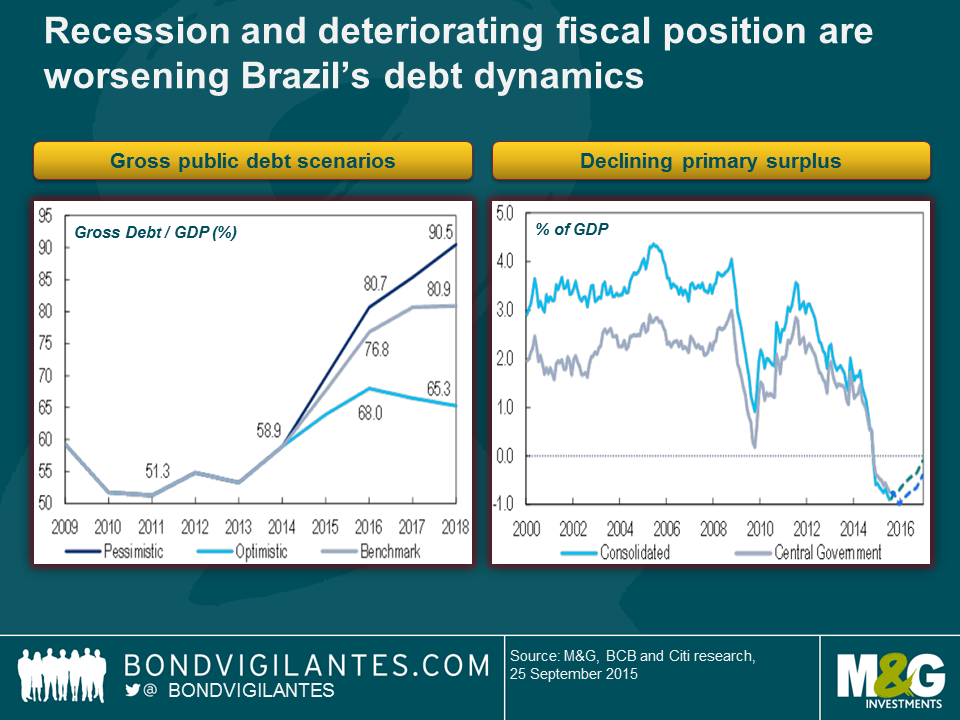

Debt, as a result, will continue rising to 70-80% of GDP under the current path of primary deficits, negative growth and one of the world’s highest real rates.

Roll-overs, however, are not under threat at the moment, but the domestic debt could shorten further (in the 1980s, most of it was rolled overnight). A few state governments are also facing difficulties in servicing their debt, not to mention the Petrobras scandal (see Charles’ EM quasi-sovereign blog here).

The Central Bank is in an unviable position of facing near double digit inertial inflation (some of the proposed tax increases to reduce the fiscal deficit would push it even higher) in a recession and their reaction function appears to be tolerating higher near term inflation until there is greater clarity on the political and fiscal situation. I sense rates will be on hold for a while, despite inflation being way above the 4.5% target and 6.5% upper limit. The pressures to ease will intensify should inflation start declining.

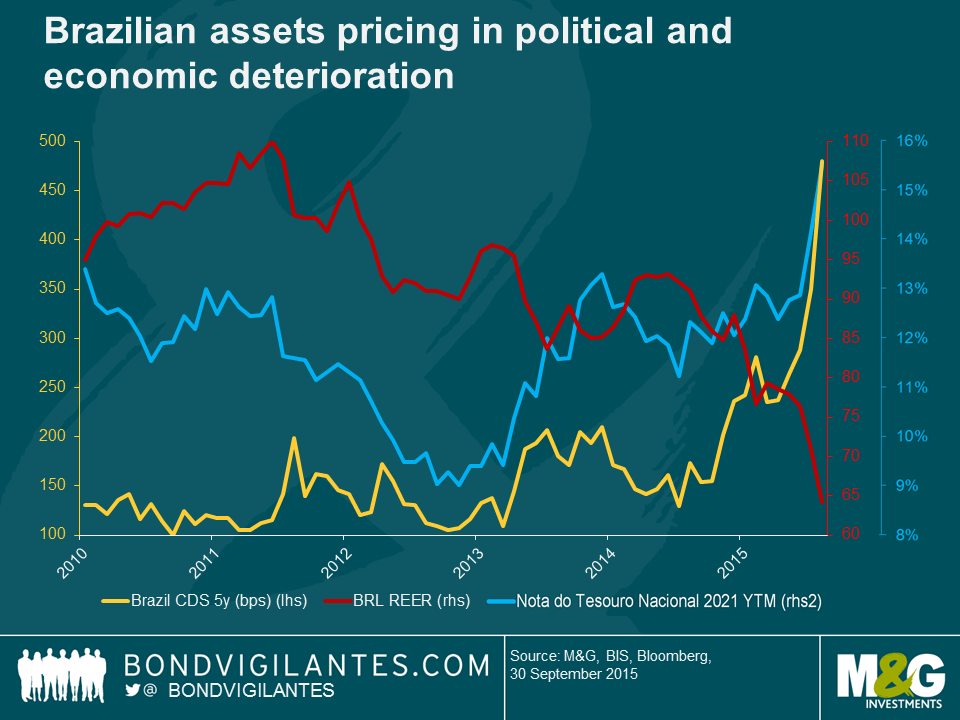

On the positive side, Brazil’s current account will likely continue improving as the tourism deficit declines (see my earlier blog) and imports compress further. The Real has seen a large adjustment and is no longer overvalued, though I think it could weaken still further should Finance Minister Levy leave and there is further weakening in the fiscal accounts or pressure on the Central Bank to start easing prematurely. Despite ongoing currency interventions, Brazil’s gross reserves ($370 billion) remain above IMF recommended levels, under normal conditions. Capital flight has been manageable thus far. However, should that accelerate or should conditions worsen to the extent that the market starts demanding dollar spot as a hedge and not the counterparty risk of the Central Bank swaps ($110 billion notional), the reserve buffer can quickly dwindle.

Asset price levels as of late September (spreads, local rates and the currency) seemed to have priced a lot of the near term bad news. The pain trade was for positive news as the market was very defensively positioned. We have seen since then some short covering and a partial recovery of asset prices.

The consensus is that an impeachment of President Dilma would produce a market rally. If that happens, it could make sense to fade the rally as post-impeachment governability would still be difficult under a new (and possibly unelected) government, and many of the challenges will require deep structural reforms, particularly on the fiscal side. My take away is that things will get still worse before they get better.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox