Volatility for U.S. hospital bonds ahead

As the rhetoric of the U.S. presidential race heats up over the summer campaigning months, one topic we are likely to hear much on is health care. Health care in the U.S. is always a highly charged political subject, and now even more so with extra scrutiny on prescription drug prices and continued debates over the Affordable Care Act (ACA) or Obamacare. Obamacare is deeply unpopular with the Republican Party and Republican Party candidate Trump has called for its repeal if he is elected. We don’t want to discuss the politics of Obamacare, but could it fall over on its own?

Last week Humana (HUM), a large U.S. health insurance company, announced that it was exiting individual ACA insurance plans it was offering in eight states citing unprofitability. This follows United Health Group (UNH), another large health insurer, who announced in April they were exiting ACA plans in most states it operates in for similar reasons.

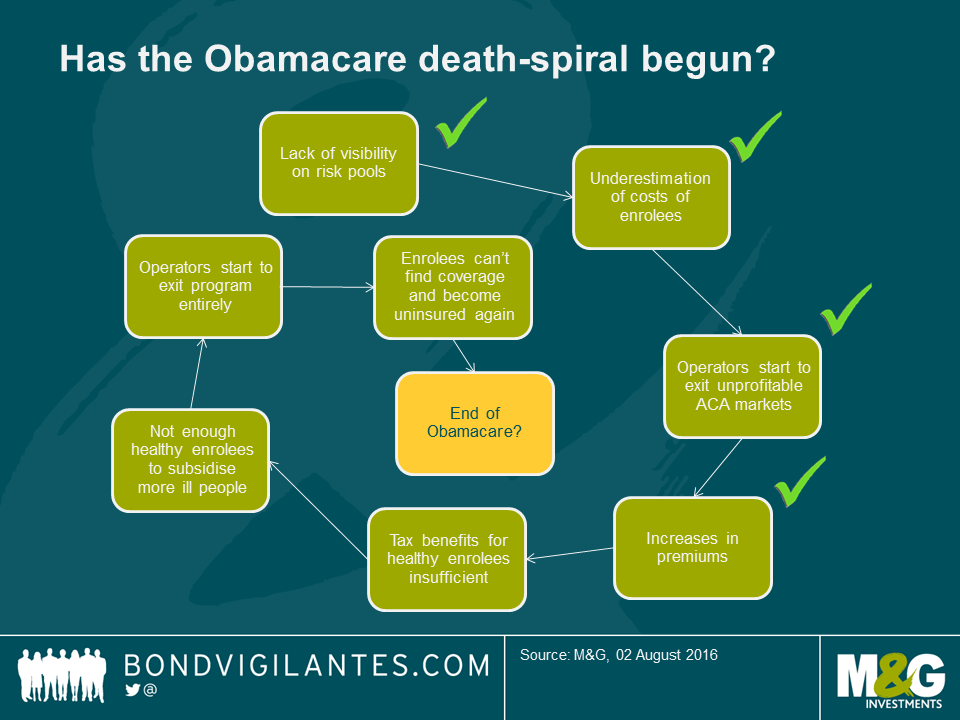

These ACA plans were one of the key mechanisms by which Obamacare sought to extend health coverage to the uninsured. Under the ACA, private health insurance companies like HUM and UNH offered coverage to the uninsured who would face tax penalties if they did not enrol (although in most cases they received tax credits to offset the cost of their premiums). However, the legislation mandated that insurance companies could not ask enrollees any medical history questions and they had to accept all enrollees, including those with pre-existing conditions. As such, the program was criticised on the basis that without knowing how sick the people enrolling in the plans were, it would lead to an insurance death spiral, i.e., not enough healthy enrollees subsidising the care of those actually filing claims.

A couple of large insurers exiting the program does not portend that a death spiral is imminent, or even likely, but it is a worrying sign and recently many companies have announced meaningful premium increases in their ACA plans. Politico’s Blog, The Agenda, sums up the issues facing the program nicely.

Death spiral or not, if more and more companies exit ACA plans or if enrollees drop coverage on their own due to rising premiums (and just pay the tax penalty), it’s possible that there would be a spike in the uninsured population at least in the near-term. The knock-on effect could impact U.S. for-profit hospital operators who were significant beneficiaries of ACA enrolment. With more patients having health insurance than previously, this reduced hospitals’ bad debt burdens and aided their profitability. Should that trend reverse these operators could face earnings headwinds.

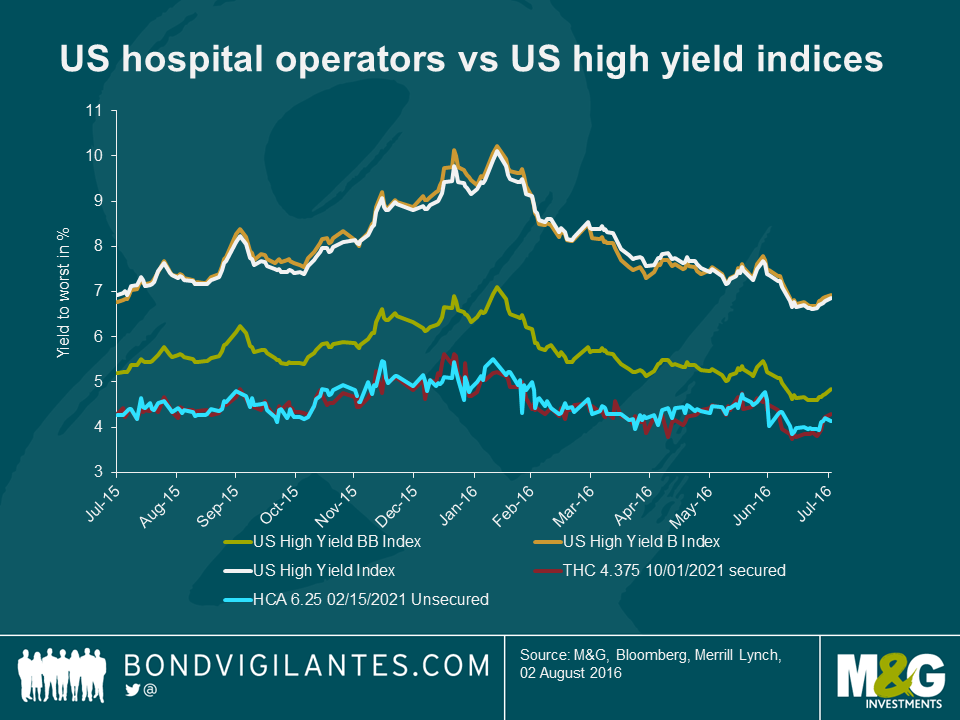

This matters to high yield bond investors as health facility companies’ bonds represent a meaningful 5% portion of the Merrill Lynch Bank of America U.S. High Yield Index. And with over $43 billion in bonds outstanding, the bonds of just the top three hospital operators HCA Inc., Community Health Services (CYH), and Tenet Healthcare (THC) are the 2nd, 10th and 23rd largest issuers in the index, representing over 3% of the Index, meaning that they are likely widely held among investors.

These companies’ bonds have always been considered reasonably safe heavens as investors liked the defensive characteristics associated with health care companies in general. As such, these bonds typically trade inside the broader indices.

If investors start growing concerned about the earnings headwinds these companies could be potentially facing, they also need to weigh up if they are being adequately compensated at these levels. Now add to the mix the political rhetoric of the campaign and the impact on bond volatility. Surely if Trump surges in the polls, uncertainty surrounding the future of Obamacare will intensify regardless of what is happening with the ACA plans, and this could lead to volatility in not only hospital company bonds but many related health care companies as well such as insurers and pharmaceutical companies.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox