The US election result impact on emerging markets

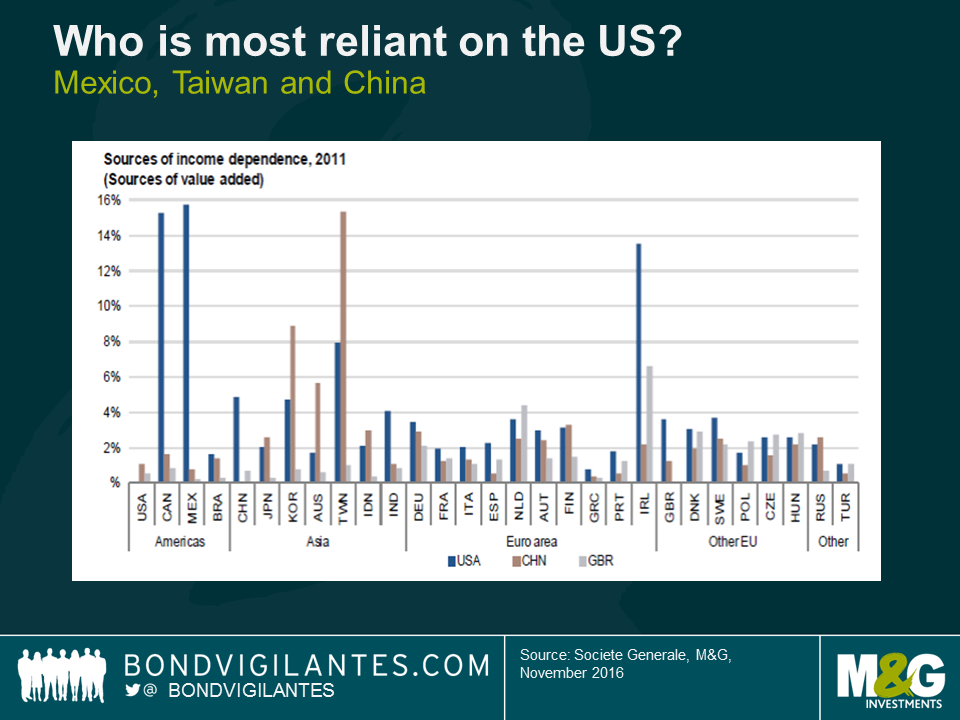

Today’s US election result has several implications for emerging markets. At a first glance, the outcome is clearly negative, given the potential downside risks from increased trade protectionism, anti-immigration measures, large fiscal expansion and steepening of the US yield curve and uncertainty in terms of foreign policy.

These risks are already being reflected in asset prices. Since the result, Mexico is one of the largest underperformers due to its deep trade and economic ties to the US. Another region which could suffer is Central America. If Trump goes ahead with all of his proposals during the campaign and manages to overcome the logistical nightmare of having all illegal immigrants deported, remittances from these immigrants will come to an end and that will certainly have an impact on their home countries’ economies. In Central America, countries seeing the largest impact would be the smaller ones, such as Guatemala, El Salvador and Honduras, where unauthorised remittances from the US could account for as much as 5.6%, 8% and 13.2% of their respective GDPs, according to our estimations. These countries have a much higher share of remittances vs. GDP and current account receipts because their share of illegal immigrants is higher in comparison to the size of their economies and population (see my previous blog on this topic here).

However, as is always the case, volatility creates opportunities. There are several countries that are relatively closed economically, such as India and Brazil, that have relatively low trade or immigration ties with the US. Countries within Eastern Europe are much more dependent on Europe than the US for their exports or financial channels. In this respect, they will be much more impacted by the upcoming Italian, French and German political events than the US election. Russia may benefit from today’s result should the US start easing financial sanctions. Finally, commodity credits such as Sub-Saharan African issuers are much more dependent on China as a driver for commodity demand or for financing than the US. In terms of relations with China, imposition of trade tariffs and whether the US Treasury will name China as a currency manipulator will be the key events to watch.

We will look to selectively increase exposure to countries that have relatively looser ties with the US and whose asset prices have been unduly punished or for assets that have severely underperformed, such as the Mexican Peso, which is finally pricing in a lot of negative news after a 50% depreciation in the last two years.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox