Does the US government bond market sell off mark the return of the bond vigilantes?

The bond market was intimidating during the Clinton years, and has started as it means to go on for Trump’s term. As we celebrate this website’s 10th anniversary, it proves fitting that the bond market reminds us why we named the blog as we did.

“I used to think if there was reincarnation, I wanted to come back as the president or the pope or a .400 baseball hitter. But now I want to come back as the bond market. You can intimidate everybody.”- James Carville, Clinton administration advisor, 1993

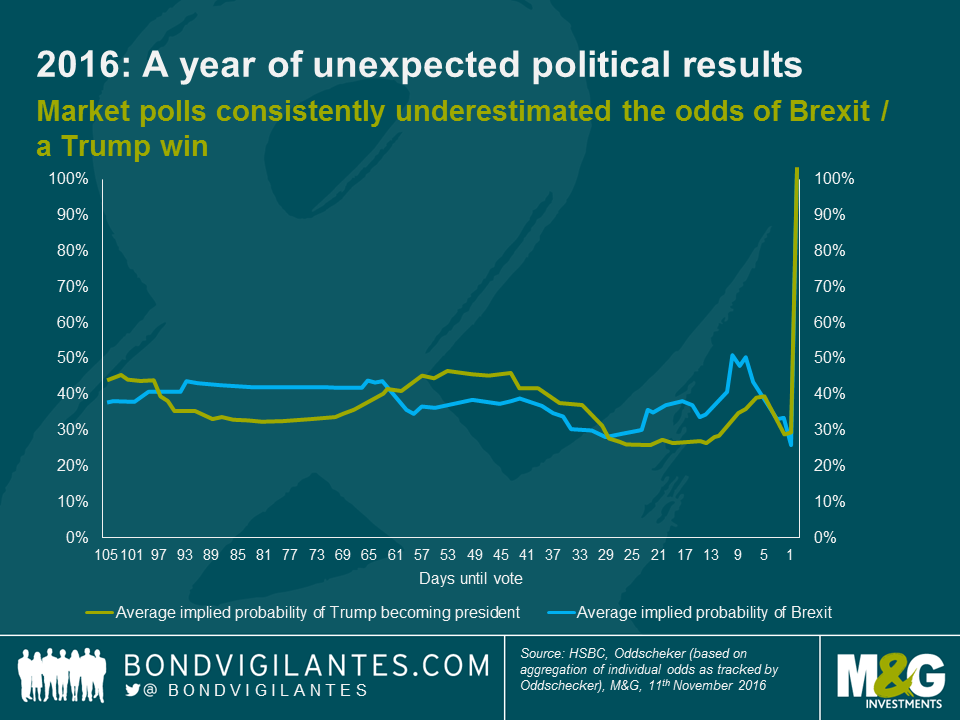

The result of the US election was a surprise given the polls, but the exceptionally short-lived “risk-off” reaction in bond markets has been just as unexpected. When the UK experienced its own political shock in June, there was a textbook flight to quality government bonds globally, with the US 10yr bond price rallying 2% the day after and peaking two weeks later. As a UK centred event, the moves in UK government bonds were even more pronounced; 10yr gilt yields rallied over the next six weeks to historical lows of 0.5% in August, helped of course by the QE announcement.

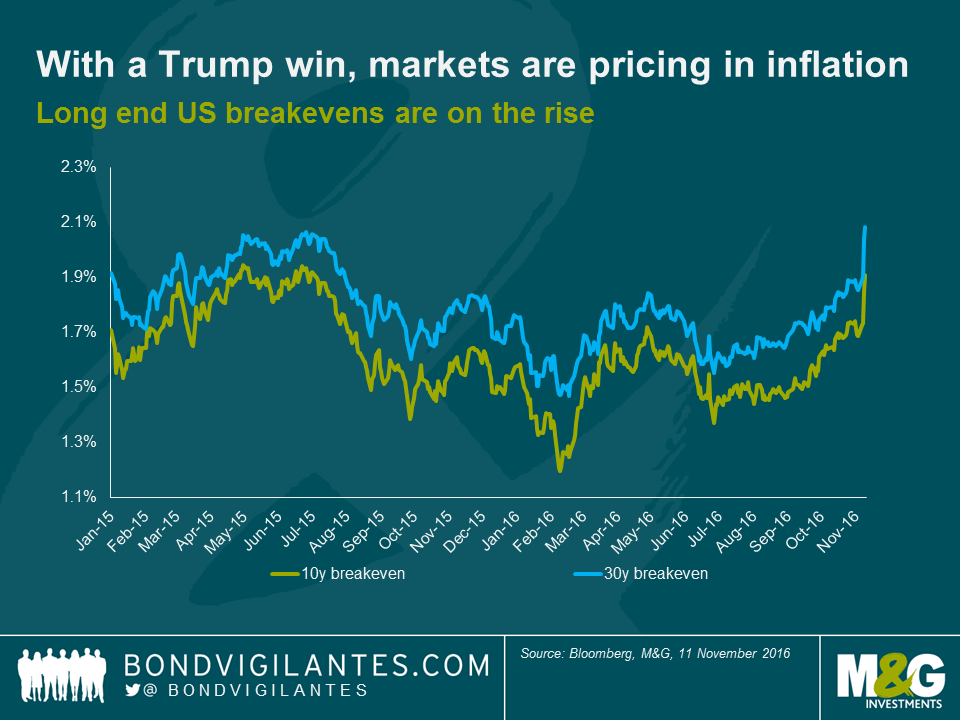

The US has just arguably delivered the biggest shock in modern political history, yet the flight-to-quality effect lasted just hours. Since then, the government bond market sell-off has been marked across the curve. In just two days the US 10yr saw a 30bp yield sell off, closing the US session at 2.15% up from the polling day close of 1.85%. In the longer end of the curve, US 30yr yields climbed 33bp. US breakevens now reflect increased inflation expectations, with inflation-protected TIPS outperforming strongly.

Whilst Trump promised much in the run up to the 2016 US election, the detail has been sparse and it is still too soon to know what his administration will focus its efforts on. Having won Congress as well as the presidency, Trump and the GOP have the ability to enact the promised pro-growth policies such as fiscal stimulus via tax reform, and infrastructure and defence spending. Though there remains some uncertainty about the willingness of Tea Party Republicans to back the higher spending part of these promises, one thing is certain: the bond market has already moved aggressively.

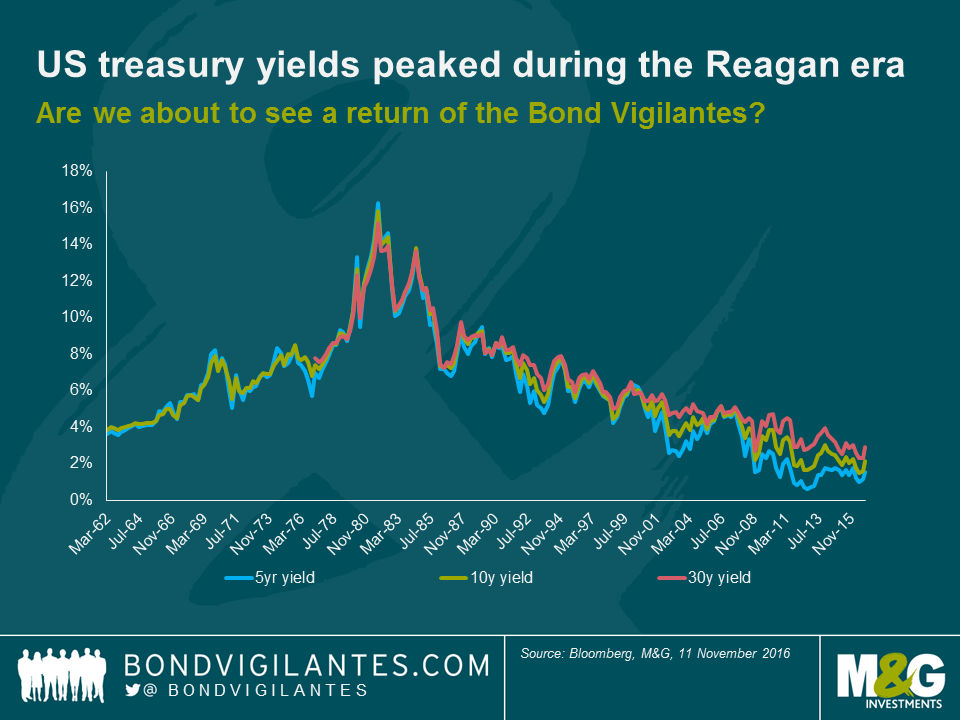

The term bond vigilante alludes to the ability of the bond market to serve as a restraint on the government’s ability to over spend or borrow. As a protest to monetary or fiscal policy, market investors may sell bonds, causing yields to rise. Although the name implies something rather more sinister and deliberate, it’s simply a term to describe the uncoordinated actions of a large number of rational economic agents. It was coined by Edward Yardeni in response to the Reagan era where expansionary fiscal policy in the early 1980s drove bond market investors to demand a much greater return from government bonds. When Reagan took office, he inherited a sluggish economy and inflation near a staggering 15%. He proposed the Economic Tax and Recovery Act; a bill to cut taxes while reducing government welfare spending. Yields climbed to all-time highs. The 5yr yield rose to 16.3%; higher than both the 15.8% yield demanded on the 10yr and 15.2% yield for 30 year lending – near term default risk was being priced as a legitimate concern, even though debt to GDP was just 30% vs 90% now – Reagan had much more fiscal headroom than Trump does today. It’s time to re-read our Reinhart and Rogoff.

One week of falling Treasury prices does not a bear market make. But if Donald Trump intends to flex the fiscal lever, bond market vigilantes could return with a vengeance, making it increasingly expensive for him to do so. And we didn’t even get round to discussing the next POTUS’s famous pre-election quote about voluntarily defaulting on Treasuries…

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox