M&G Panoramic Outlook: Emerging market corporate bonds – falling default rates and high yields. Too good to be true?

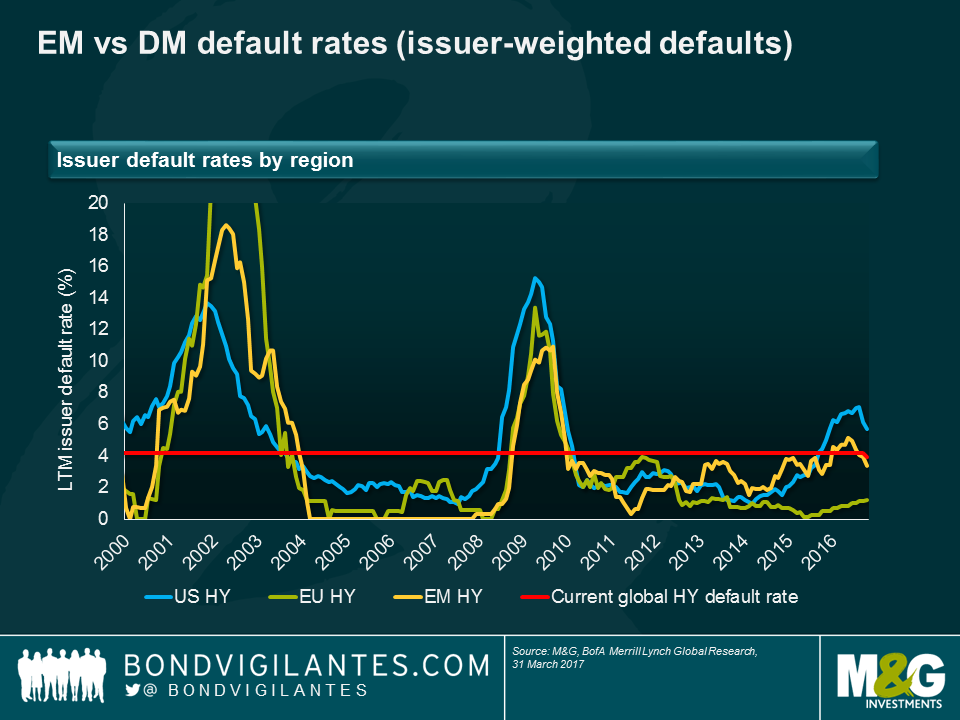

There are a lot of misconceptions about defaults in emerging market (EM) debt. Too often, EM corporates are either considered ‘serial defaulters’ compared with their developed market peers, or seen as a single and homogeneous geography. In reality, default rates follow economic cycles, and having a regional, if not country, approach to default risk remains paramount due to different jurisdictions and various recovery values between regions and countries. Another common misconception is that high yield default risk is higher in EM than in Europe or the US. Looking at the chart below, EM high yield corporate defaults are very much in line with those of European high yield or US high yield. During the last global financial crisis in 2008-09, the EM high yield segment had a lower peak in the default rate than its developed market counterparts.

In this edition of the M&G Panoramic Outlook, Charles De Quinsonas provides an insight into EM corporate default risk within the ever-expanding EM corporate bond universe. In his view, improving EM macroeconomic fundamentals and an expected benign default rate environment continue to offer opportunities to find attractive yields in emerging market debt markets.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox