Caribbean bonds: forecasting the weather, tail risks and spreads

First of all, our thoughts are with those impacted by Hurricane Irma and other recent weather-related disasters.

Beyond the human tragedy and economic costs, these are typically low-probability, but potentially high-impact, events that can ultimately impact an issuer’s ability to service its debt obligations. As bond investors, we aim to assess the various risk factors related to the companies we invest in and, ultimately, decide whether we are being well enough compensated for taking those risks.

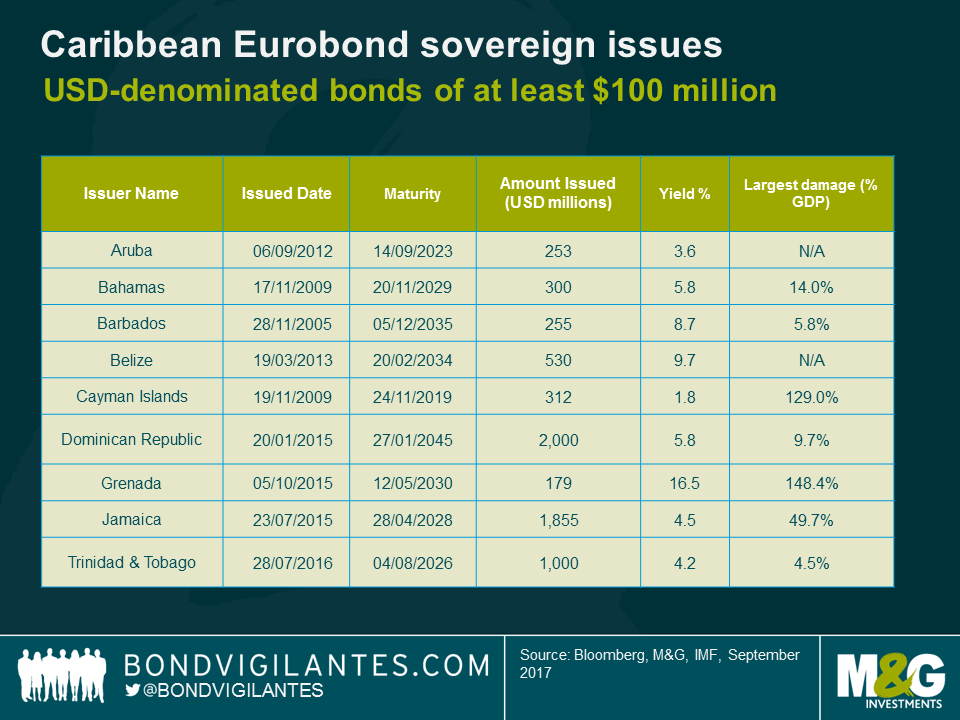

The chart above lists a sample of USD-denominated bonds of at least USD 100 million issued by various Caribbean countries, where Grenada provides one interesting case study. Grenada, a small and largely tourism-based economy, was hit by Hurricane Ivan in 2004, only two years after its international bond market debut with a sovereign issue maturing in 2012. The damage was widespread, estimated at almost 150% of GDP, impacting physical infrastructure, housing (where only a small portion of the housing stock was insured), agriculture and tourism. The country ended up defaulting and restructuring its bonds with a haircut of approximately 40%.

Delving into the detail of Grenada’s prospectus for that particular bond, we find that it did state that ‘Grenada lies south of the usual track of hurricanes, but when storms do occur, as in 1955, 1979 and 1980, they often cause extensive damage. A major hurricane or other climatic or geological occurrence could have a material adverse effect on Grenada and, as a result, the Government’s financial condition and its ability to meet its debt service and other obligations, including with respect to the note’. For a prospectus that was 94 pages long, with an extensive assessment of Grenada’s economic, geographic and environmental conditions, one may be surprised to see the word ‘hurricane’ appear only twice and the broader word ‘disaster’ just get 15 mentions.

The IMF has recently published a very comprehensive study around the associated costs of hurricane impacts in the Caribbean region. Surprisingly it states that economic damages could be underestimated by material amounts, with the average damage per island potentially being as large as 82% of GDP .

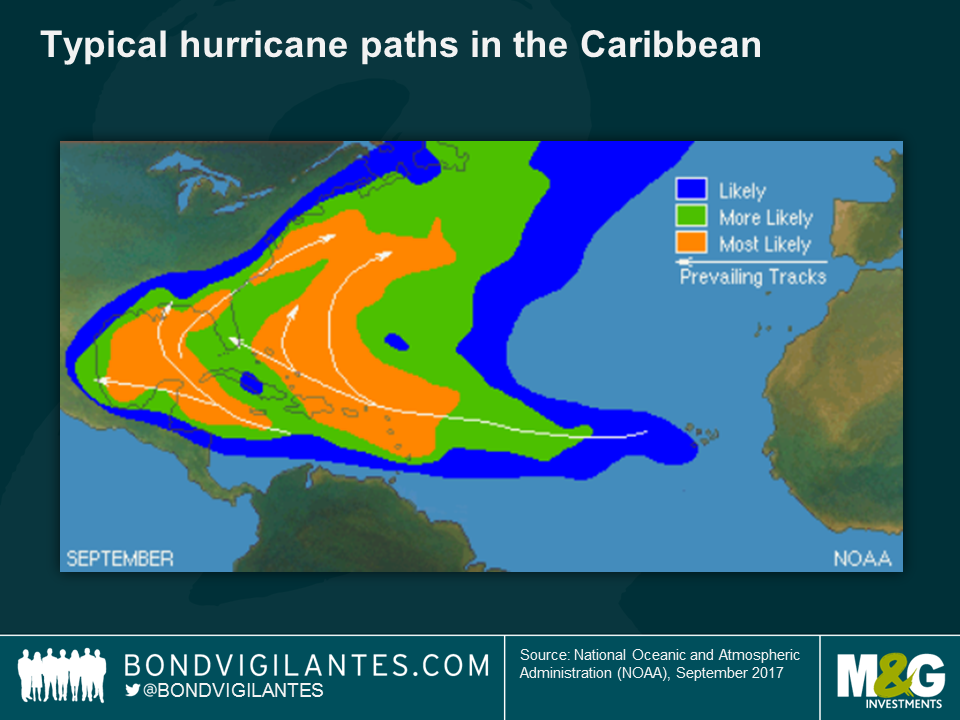

Furthermore, this map comes to show how hurricanes can indeed affect most Caribbean countries, with only very few (i.e. Aruba or Belize) falling outside the main hurricane belt. With this in mind, I would argue that prevailing sovereign bond yields for many of these economies are currently not pricing in a worst-case scenario of being hit by a large-scale weather-related disaster. As in the case of any fat-tail event, caveat emptor.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox