Panoramic Weekly: Japan sneezes, markets get a cold

Speculation that Japan, traditionally a bastion of bond market stability, may shift its ultra-loose monetary policy pushed most developed market government yields higher over the past five trading days: higher rates in Japan may reduce demand for global assets as the billions of yen that fled the country’s negative-yielding monetary policy two years ago may now return home. The central bank’s denial of the speculation didn’t stem the reaction, which pushed the yen 1.6% higher against the US dollar and made US Treasury 30-year bonds the worst-performing asset class among the 34 tracked by Panoramic Weekly.

The ongoing US-China and US-Europe trade tensions also weighed on global bond markets, dragging both the greenback and the yuan lower – the Chinese currency almost touched 6.8 units per dollar, the lowest in more than one year. Despite the general US dollar drop, most Emerging Markets (EM) indices didn’t capitalise on their currency appreciation as EMs continue to suffer from the protracted trade war rhetoric. Exchange Traded Fund (ETF) net flows into Latin America are negative over the past one-month period, while remaining positive in Asia Pacific. Year to date, they are both positive.

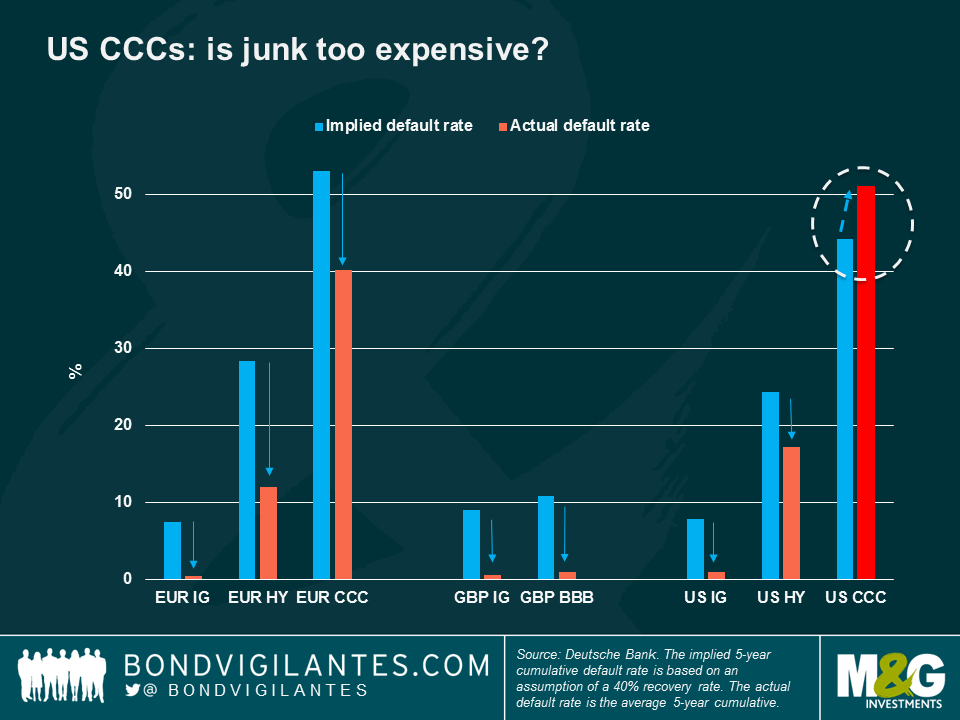

High Yield (HY) was one of the few fixed income asset classes to deliver positive returns over the past five trading days, mainly in the US and Asia. US corporate earnings have come so far mostly above expectations, at the same time that defaults are expected to drop: according to Moody’s Investors Service, the US and European HY default rate fell to 2.9% last quarter and may fall to 2.1% by the end of the year. The positive mood for Asian HY corporates was underpinned by China’s new battery of fiscal policies to support its economy, announced earlier this week.

Heading up:

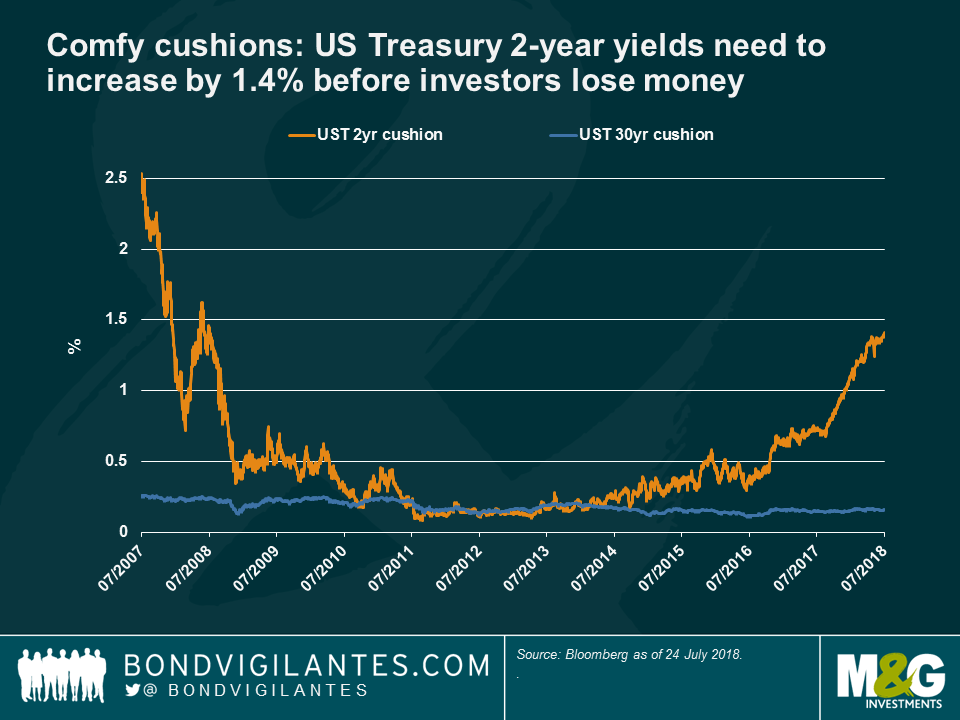

Two-year Treasury yield – Comfy cushions: Strong corporate earnings and a central bank committed to hike rates has pushed 2-year US Treasury yields to 2.649%, the highest in a decade. After taking into account the effect of rate hikes on bond prices, this level means that 2-year yields need to rise by another 1.4% before US investors lose money – giving them a comfortable cushion. As seen in the chart, this is a major change from a few years ago, when bond yields were so low that a small rate hike could wipe out investors’ returns. Holders of US Treasury 30-year bonds cannot say the same: structural challenges to inflation growth, an aging population and strong demand from yield-hungry global investors has kept a lid on long-term Treasury yields, reducing the cushion investors have before losing money. It was no surprise that this week’s 2-year Treasury auction, priced to yield 2.657%, had the highest bid-to-cover ratio since January. The picture, however, might change soon: according to M&G fund manager Richard Woolnough, the US Federal Reserve may favour buying short-term Treasuries, and selling longer-dated ones, in order to reduce duration risk in its own balance sheet. The move would also steepen the yield curve, incentivising banks to lend more – read Richard Woolnough’s “The reversal of Operation Twist and ramifications for the yield curve.”

Brazil: good debt news, at last: The Brazilian real surged 3.3% against the US dollar over the past five trading days, more than any other major currency, helped by reassuring comments about the country’s debt from Treasury Secretary Mansueto Almeida. Despite constant slow growth following the 2015-16 recession, Brazil is on track to avoid, next year, increasing its debt to finance current spending – instead, borrowings will be used to fund investment, Almeida said. The comments provided some relief to investors, whose main concerns include a budget deficit of 7.8% of Gross Domestic Product and the forthcoming October general election. More to come.

Heading down:

Little Britain: Global companies flock to issue in dollars, euros – not pounds: So far this year, global companies have issued 24 bn pounds worth of investment grade (IG) debt – peanuts relative to the 230 bn pounds worth of IG debt issued in euros, or the 543bn pounds issued in US dollars. As seen in the chart, sterling IG issuance relative to its rivals has declined since the 2007-08 Financial Crisis and has not picked up. The creation of the Eurozone and the globalisation of finance have boosted euro and dollar issuance, while the ongoing uncertainty around Brexit makes some companies think twice before issuing pound-debt – lack of a Brexit deal could unsettle the currency, making sterling bonds less attractive to investors. Despite this backdrop, UK IG bonds are offering a one-year gain of 0.4%, below the 0.8% gain delivered by Eurozone IG debt, but better than US IG’s 0.8% loss over the same period. Among other things, this happens because the UK IG index is not necessarily a reflection of the UK economy, as the benchmark is as internationalised as, for instance, the FTSE 100 in Equities, which derives about two thirds of revenues from abroad.

Turkish lira – no delight: Investors generally don’t like surprises – as Turkey knows well. Earlier this week, the country’s central bank unexpectedly held its benchmark one-week repurchase rate at 17.75%, against expectations of a hike, pushing the lira as much as 3% lower against the US dollar. President Recep Tayyip Erdogan, who has increased his grip over the central bank, has for years favoured loose monetary policies in order to fuel growth. With inflation running at an annualised rate of 23%, the highest since 2003, investors have pushed the 10-year sovereign bond yield to a whopping 17% as they demand more compensation.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox