Panoramic Weekly – Trump’s dollar: making European bonds great again

Most global Fixed Income asset classes rose over the past five trading days, led by recently-battered Southern European government bonds, which rallied on the back of gloomy news: the Eurozone’s trade surplus fell in June to its lowest level in 18 months as export growth didn’t keep up with rising imports. European sales abroad suffered from a rising euro, or a low US dollar – a position favoured by US President Trump as he aims to keep financial conditions loose and to give a helping hand to US exporters. Presidential links continued to push the greenback lower this week, although this time probably not intentionally: Trump’s former personal lawyer admitted illegal election campaign contributions, while a jury found the President’s former campaign chairman guilty of fraud charges. The world benchmark US 10-year Treasury yield fell to 2.81%, the lowest since May, also dragged down by lower-than-expected Housing Starts in July and Consumer Sentiment in August. The widely followed Philadelphia Manufacturing index hit a 21-month low. US inflation expectations dropped.

Emerging Markets (EM) and their currencies rallied on the back of a falling dollar – except the countries facing specific challenges: the Brazilian real plunged 4% over the past five trading days, after the latest October election polls showed that market-friendly candidates are lagging. The polls showed support for former – and now jailed – President Lula da Silva. The Turkish lira continued to suffer from the country’s ongoing crisis, Friday’s sovereign downgrade and the central bank’s decision not to raise rates – a move favoured by investors. The Russian ruble touched a two-year low against a falling dollar on concerns about potential new US sanctions. Don’t miss M&G fund manager Claudia Calich’s “Can Russia stomach new US sanctions?”

Heading up:

European bonds: Va, Va Gloom: Southern European sovereign debt soared over the past 5 trading days, with Italian bonds rallying 1.9%, Spain’s, 1.8%, and Portugal’s, 1.7%. The gains – still not enough to bring their 1-month returns to positive levels – came as Europe’s growth hopes took a new setback: this time, the region’s trade balance fell to 16.7 billion euros, below expectations and the lowest level since January last year. The figure matters because exports have been one of the leading growth engines over the past few years. As seen on the chart, the Eurozone has been running a trade surplus since 2011, when Europe’s sovereign debt crisis was dragging the euro lower. The surplus, which reached a high in 2016 as its currency sank against the dollar, stopped rising in early 2017, when European growth picked up and the dollar started weakening again (circled area). While European exporters might be losing sleep over this week’s euro 2.2% rally, the region’s peripheral bond holders are finally smiling, for now.

Rwanda’s bonds – tea time: Often overlooked by investors as its dollar-bonds are too small to be included in major bond indices, Rwanda’s leading international bond has seen its yield fall to 6.56%, from 6.7% on Aug. 13, according to Bloomberg data. The East African economy is expected to grow by 7% this year, the highest since 2014 and above last year’s 5.3%. Inflation is expected to drop to 2.9%, from 5.1% last year, while the Current Account deficit is forecasted to widen to 8.5% of GDP, up from 6.8% last year – the Rwandan franc has weakened 2.9% against the US dollar so far this year. The country largely earns its foreign exchange reserves through tea and coffee exports, as well as tourism and mining.

Heading down:

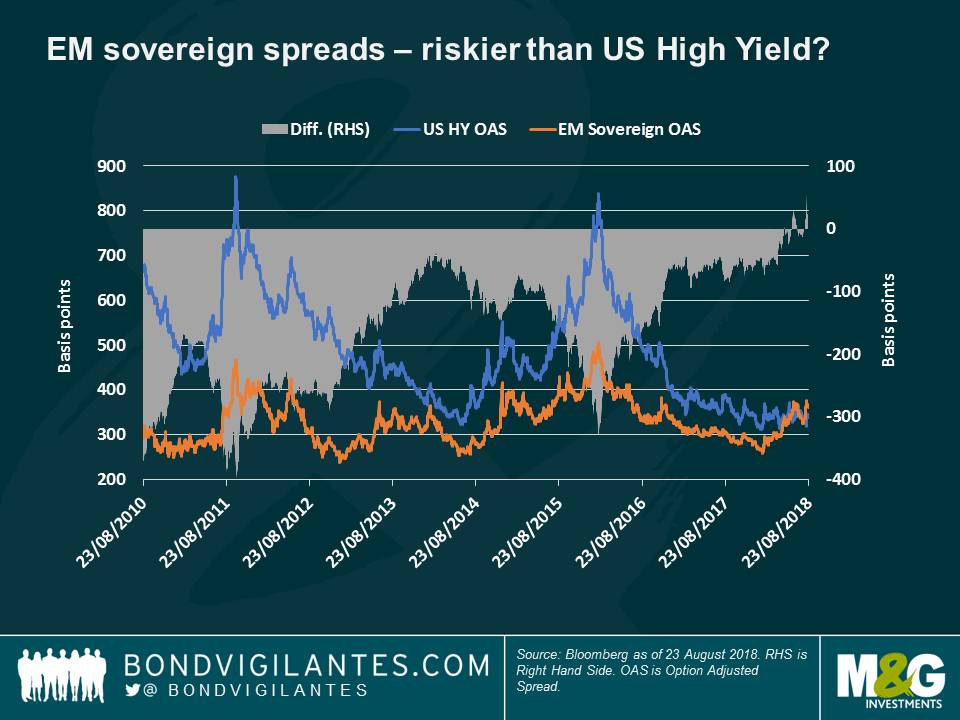

EM sovereigns – index biggies drive EM spreads higher: After a decade of being perceived as less risky than US High Yield (HY) bonds, EM sovereign spreads rose higher than those of US junk-rated companies in March. The gap between the two, as seen on the chart, reached 56 basis points (bps) last week, at least a decade-high. US-dollar denominated sovereign debt has lost 3.8% for investors so far this year, partially dragged down by index heavy-weights, whose spreads have risen on the back of domestic troubles: Turkey, for instance, represents 3.3% of the widely followed JP Morgan EM Bond Index (EMBI) Global Diversified, the fifth-largest weight in a list of 67 countries. Its spread over US Treasuries has more than doubled to 511 basis points (bps) over the past six months, when the trend between EM and US HY spreads reversed in favour of the HY gauge. Argentina, the 11th largest weight in the JPM EMBI index, has seen its sovereign spread also more than double to 689 bps over the same period. However, some investors also say that the difference between the two is also due to the recent rally in US HY – to learn more, read M&G fund manager Stefan Isaacs’ “HY spreads: the story behind the story.”

Central Bank’s perceived independence: Jackson’s toll? US economist and textbook author Paul Samuelson said that the US Federal Reserve (Fed) is a prisoner of its own independence, since it is a creature of Congress, which created it in 1913. Some investors think that such a link is the toll that the Fed pays for its independence – this week challenged by President Trump just ahead of the central bank’s annual meeting in Jacksons’ Hole. Trump’s criticism of the Fed’s rate rising policy is so rare from a President that it sent both US Treasury yields and the dollar lower. While some expect an answer from Wyoming, others believe that it would be un-Fedlike to respond.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox