Panoramic Weekly: Stars and Strikes

Global bond markets reacted sharply to Wednesday’s release of US Services data, which struck its best mark in 21 years: US 10-year yields spiked to 3.2%, the highest since 2011, while the dollar reversed a gloomy September to recover its August level. The usually less reactive 30-year Treasury yields surged, leading some investors such as M&G fund manager Richard Woolnough to argue that the market, often compared to a giant anaconda, might be turning – read his blog: US long rates: is the giant anaconda about to turn?

European sovereign bond yields also rose and equity markets rallied. The optimism was further underpinned by comments from Federal Reserve (Fed) chair Jerome Powell, who earlier this week said gradual hikes were appropriate for the US’s robust economy. While a rising dollar initially hurt Emerging Market (EMs) currencies and sovereign bonds, the asset class still posted five-day gains due to previous strong performance. Powell’s cautious approach to rate hikes helps cushion the potential negative effect of the Fed’s moves on EMs, which are still recovering from the Turkish and Argentinean crisis in August.

Almost three out of four of the 100 asset classes tracked by Panoramic Weekly posted gains over the past five trading days, with the losers mostly coming from Europe. Italy’s proposal that its budget deficit will reach 2.4% of GDP over the next three years was received with reluctance in Brussels, whose officials called the plan “out of line.” Italian woes hit other European assets and the euro, which sank 2% against the greenback over the past five trading days. The Mexican peso and the Canadian dollar gained almost 1% against a rising dollar after the US signed a new trading agreement with its two neighbours – one that doesn’t differ that much from the previous North American Free Trade Agreement. Oil surged.

Heading up:

Brazil – Bolsosamba: Brazilian sovereign bonds rallied 1.3% over the past five trading days and the real surged 5% against a rising dollar, the best-performing currency among a group of 16 majors. The real has now recovered about half of the lost ground since early August, when the Turkish and Argentinean crises hit other EMs. Investors are also anticipating a relatively market-friendly outcome in the general election, which is due to start this Sunday. After the vote, a final round on Oct. 28 will decide the winning candidate, with most odds now falling on far-right leader Jair Bolsonaro and Workers’ Party candidate Fernando Haddad. At present, markets see neither candidate as likely to adopt radical fiscal policies, hence the relief. As seen on the right-hand chart below, the real has strengthened as Bolsonaro has improved his poll-implied chances. To learn more about this week’s election, watch M&G Investment Specialists Pilar Arroyo and Robert Secker discuss.

Oil – supply matters: Oil prices rose to $75 per barrel, the highest since late 2014, when the commodity started a precipitous slide, dragged down by rising US shale production. The opposite dynamic seems now in play, as Iran’s exports drop due to US sanctions. The supply consequences of the geopolitical tensions have more than offset recent data showing rising US stockpiles: oil has surged 50% from the c.$50 per barrel level it had barely one year ago. The increase could dent next year’s economic growth, says M&G fund manager Jim Leaviss: Just like 2008? Oil up, ECB tightening – all we’re missing is a credit accident.

Heading down:

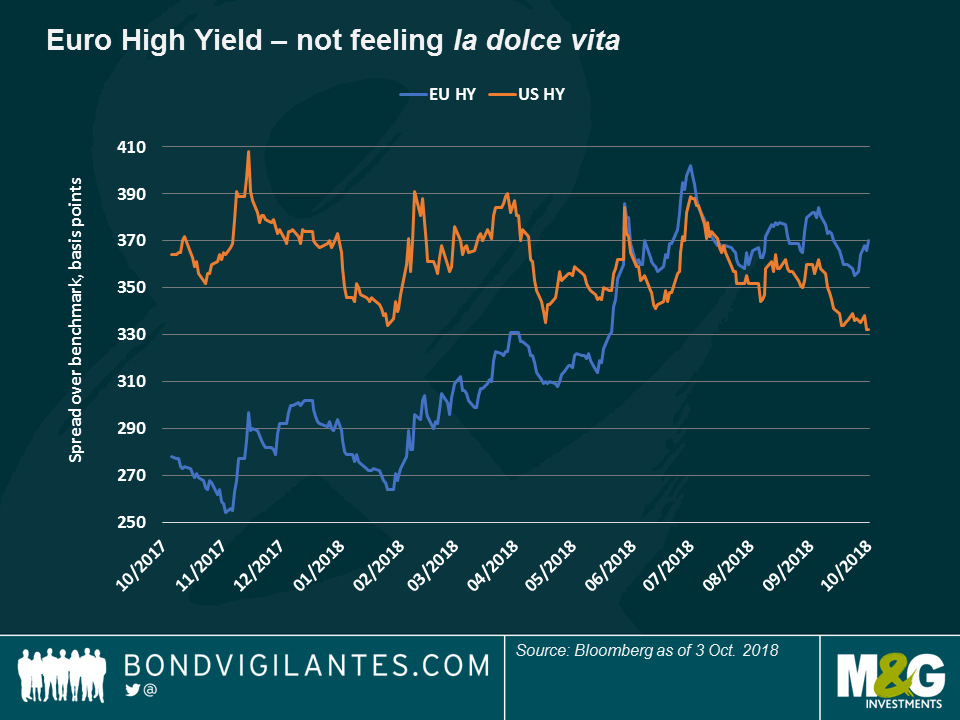

European High Yield – Catenaccio: The defensive football style that Italy is known for seems now to apply to the European High Yield (HY) market, whose index the country dominates. With a 14.7% weighing, the recent poor performance of Italian companies has dragged the index down and raised the premium that investors demand to hold the asset class over its US counterpart. After years trading below the US premium, European spreads overtook the US’s following the Italian election earlier this year. Since then, the asset class has suffered from the uncertainty surrounding the Italian budget, despite having an average higher credit quality than its US rival. European HY also has lower interest risk, with an average duration of 3.8 years, below the US’s 3.97. According to M&G fund manager James Tomlins, the underperformance of Europe’s HY index this year has been mostly concentrated on a list of specific names, including two Italian construction companies.

Swiss franc – less havenly: A traditional safe-haven in times of trouble, the Swiss currency failed to surge this week against the dollar while Italy and Brussels rowed over budget deficits. In fact, the franc has weakened 2.5% against the US currency over the past five trading days, mostly because the country is also having its own tensions with the EU, mainly over trade agreements including the access that EU investors might or might not have to Swiss equities. Swiss policy makers, however, may be pleased as they have complained repeatedly about the currency’s traditional strength.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox